Key moments

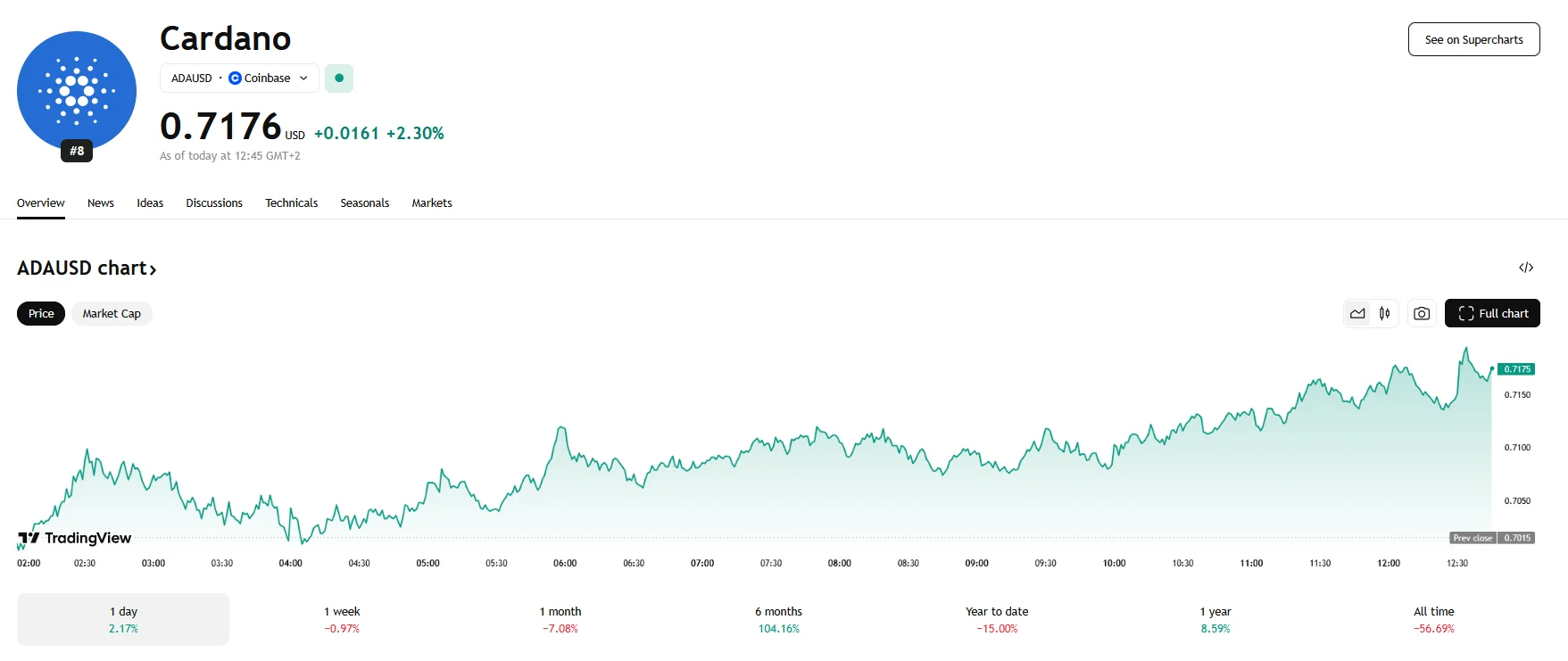

- Cardano’s ADA price surged 2.30% to surpass $0.71 on Wednesday, backed by a $25.16 billion market cap.

- Speculation about Cardano’s potential integration into U.S. government blockchain projects is fueling ADA’s surge.

- Data provided by Santiment reveals a notable rise in positive public opinion, reversing past skepticism.

Cardano Sees Boost as Confidence in ADA Grows

Cardano (ADA) has experienced a notable upswing in its market value, with its price climbing 2.30% to breach $0.71 on Wednesday. This positive movement is accompanied by a robust market capitalization of $25.16 billion, and the surge in valuation occurs as social sentiment surrounding Cardano undergoes a significant transformation, shifting from skepticism to palpable optimism.

The catalyst for this shift appears to stem from talks about Cardano’s potential integration into U.S. government blockchain initiatives. The crypto community has been speculating that regulatory bodies might be considering Cardano’s technology for use in official services. These rumors, while still unconfirmed, have ignited a surge of positive commentary and discussion across social media platforms.

Traditionally, Cardano has faced considerable criticism and doubt within the cryptocurrency space. However, a significant upturn in public sentiment is evident, as shown by information gathered from Santiment, a market analysis tool. The platform’s data reveals approximately 3.5 favorable comments for every critical one, a ratio not seen in four months. This change signifies a clear move away from the long-standing skepticism that surrounded the project, and this altered perception is a major contributor to the recent price increase. What is more, the surge in positive sentiment could provide the momentum needed for additional gains.

While the immediate price increase is a positive sign, the long-term sustainability of this upward trend hinges on whether the increased social sentiment translates into actual demand for the ADA token. If the positive commentary leads to increased trading volume and investor activity, Cardano could potentially break through key resistance levels and aim for higher price targets.