Key moments

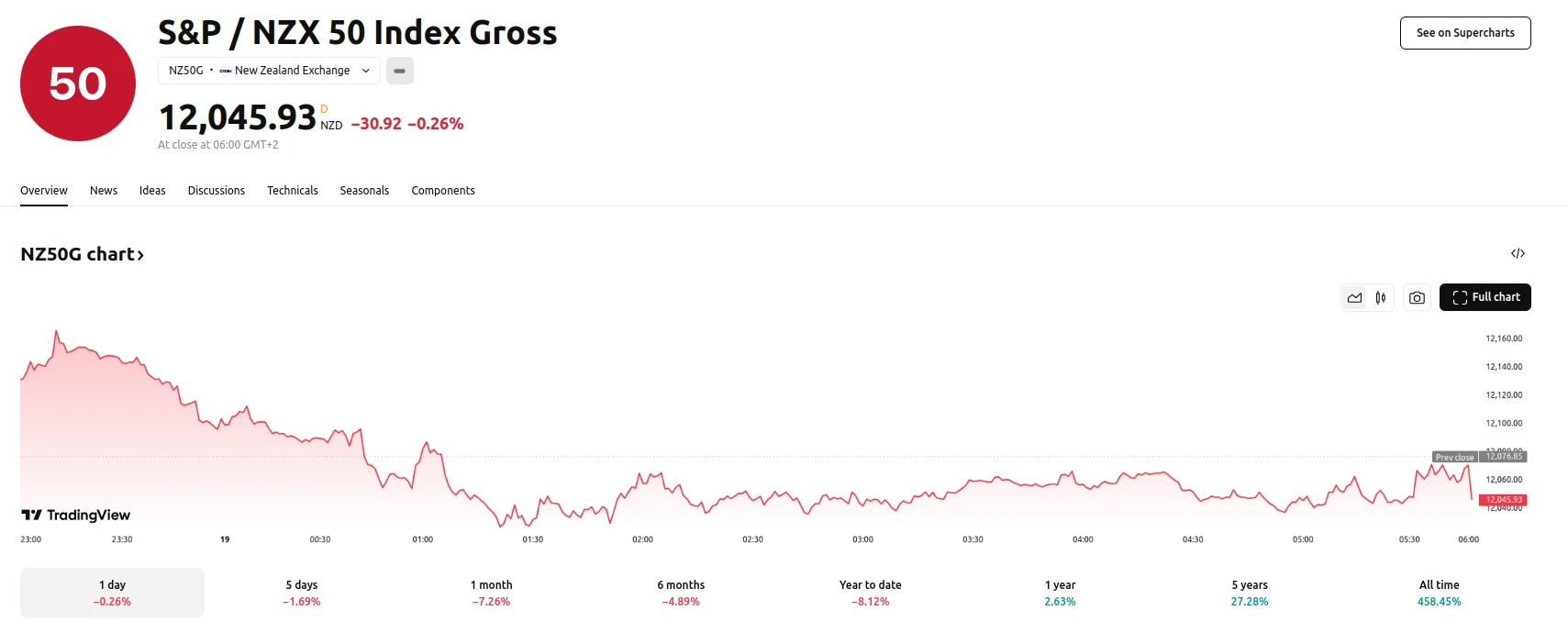

- NZX 50 index concludes a third consecutive day of decline, reaching a seven-month low. As of March 19, the index experienced a 0.3% decline, closing at 12.046.

- Domestic consumer confidence weakens amidst cost-of-living pressures and trade war apprehensions.

- Investor focus shifts to upcoming GDP data release, anticipating quarterly growth amidst annual contraction, while specific stock performance varies.

NZX 50 Index Declines Amid Economic Uncertainty and Shifting Investor Focus

The New Zealand stock market, as represented by the S&P/NZX 50 index, experienced a 0.3% decrease, closing at 12,046 on Wednesday. This decline marks the index’s third consecutive day of losses, pushing it to its lowest point in seven months. The market’s downward trend reflects broader concerns stemming from global economic uncertainties, particularly those influenced by US trade policies and the anticipation of the Federal Reserve’s policy decisions. These external factors have contributed to a cautious investor sentiment within the New Zealand market.

Domestically, a notable decline in consumer confidence during the first quarter has further impacted market dynamics. Persistent cost-of-living pressures, coupled with anxieties surrounding potential global trade conflicts, have contributed to this weakened confidence. This shift in consumer sentiment has placed additional scrutiny on the nation’s economic outlook, prompting investors to closely monitor upcoming economic data releases.

The immediate focus for investors is the release of the fourth-quarter GDP data, scheduled for Thursday. Analysts project a 0.4% quarter-on-quarter growth while anticipating a 1.4% year-on-year contraction. This divergence highlights the complexities of the current economic environment, where short-term growth faces challenges from longer-term economic pressures.

Sector-specific performance within the NZX 50 reflected these broader trends. Utility providers Meridian Energy, Mercury NZ, and Contact Energy saw declines of 0.65%, 0.90%, and 1.27%, respectively. Aged-care stocks also experienced downturns, with Ryman falling 2.14%, Oceania dropping 1.56%, and Summerset decreasing by 1.63%. HALLENSTEIN GLASSONS was the one declining the most – 3.46%. Conversely, KMD BRANDS LTD NVP, HEARTLAND GROUP, and TOURISM HLDGS ORD NPV recorded gains between 1.19% and 1.20%. These percentage changes are crucial constituents of the index’s overall movement.