Key moments

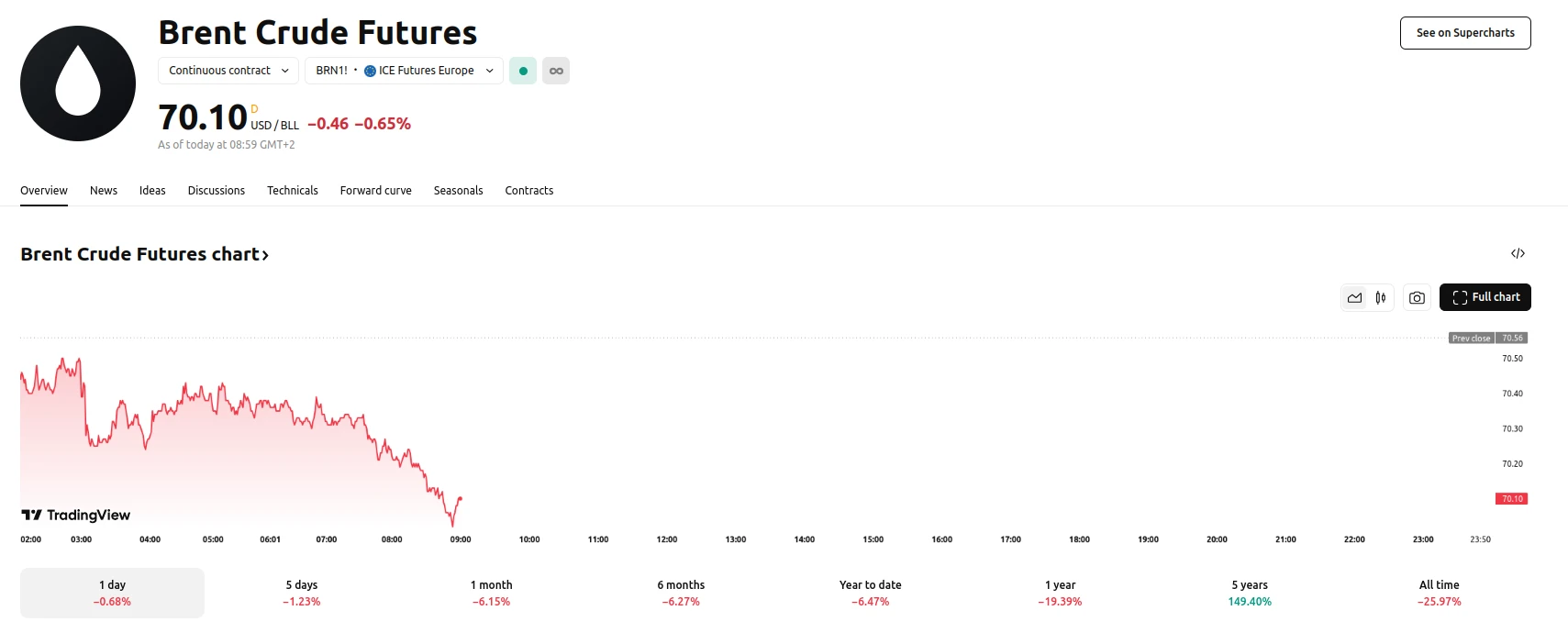

- US crude inventories experience an unexpected rise, as reported by industry data. Brent nears $70, whereas West Texas Intermediate hovers around $66.

- Ongoing trade disputes contribute to a risk-off sentiment in financial markets.

- Geopolitical tensions persist, with US and Russian stances diverging on regional conflicts.

Fluctuations in Oil Prices Reflect Market Uncertainties

Oil prices have registered a consecutive decline, primarily influenced by a reported increase in US crude oil stockpiles. Data released by the American Petroleum Institute indicated a rise of 4.6 million barrels in nationwide inventories over the past week. This development has introduced an element of unpredictability into the market, despite a reported decrease in storage at the Cushing, Oklahoma hub. The forthcoming official data release is anticipated to provide further clarity on the current supply situation.

The sustained downward pressure on oil prices is also attributed to prevailing trade tensions. The Trump administration’s continued pursuit of its economic agenda has fostered concerns among investors regarding potential disruptions to global trade flows. The broader market has adopted a risk-averse posture, evidenced by recent equity sell-offs, reflecting anxieties about a potential economic slowdown. The Federal Reserve’s interest-rate decision and subsequent commentary from Chair Jerome Powell are being closely monitored for indications of future economic policy and its potential impact on market stability.

Geopolitical factors continue to play a significant role in shaping oil market dynamics. The US administration’s engagement with Iran and its involvement in regional conflicts, particularly concerning the Houthi militant group in Yemen, remains a focal point. Concurrently, discussions between the US and Russia regarding the conflict in Ukraine have yielded limited consensus, with Russia declining a proposed ceasefire and instead agreeing to limit attacks on energy infrastructure. These ongoing geopolitical uncertainties contribute to the volatility observed in the oil market, as investors assess the potential implications for supply and demand.