Key moments

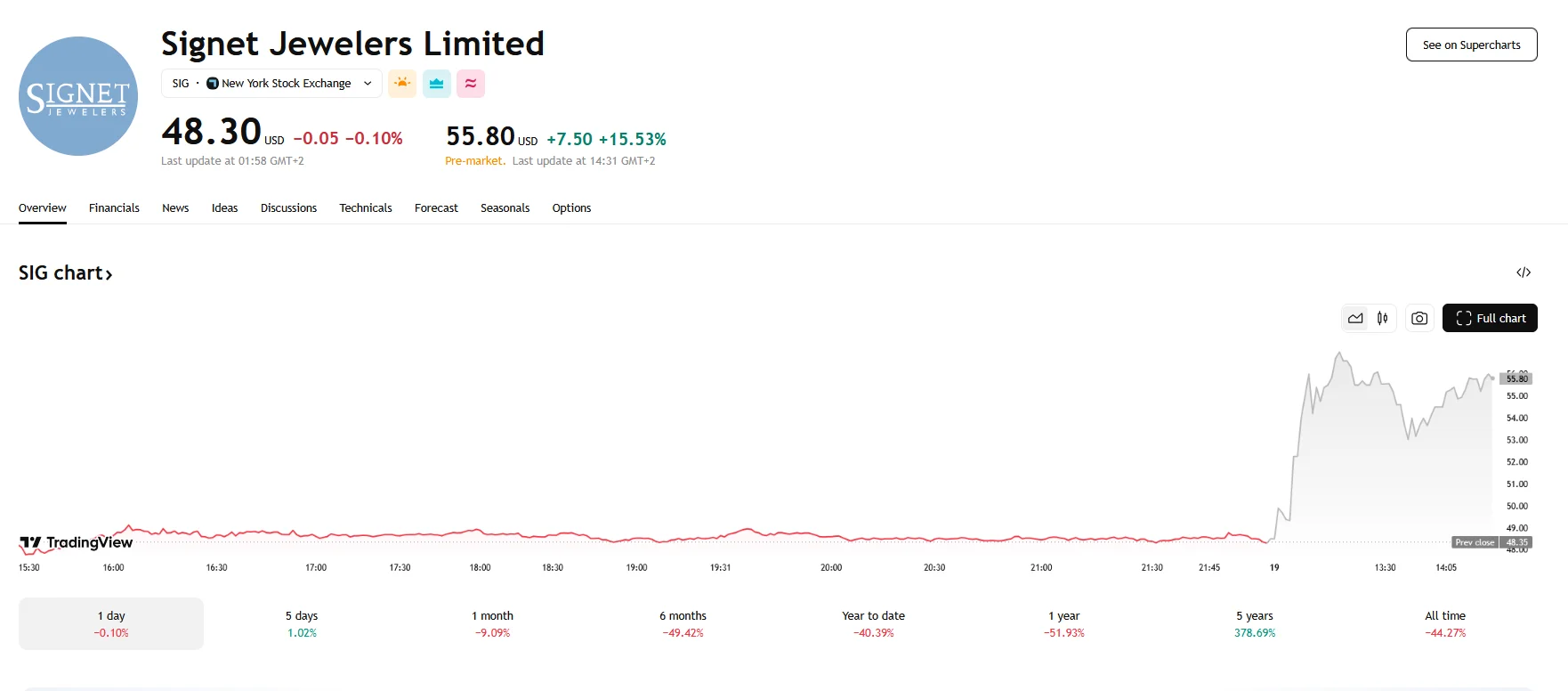

- Signet Jewelers’ stock achieved a substantial 15.53% gain to $55.80 during Wednesday’s pre-market hours.

- Signet Jewelers delivered adjusted earnings per share of $6.62 and sales of $2.4 billion, higher than market participants were expecting.

- The substantial uptick in share value reflects a positive market response to both the retailer’s financial performance and its strategic plans for future growth.

The World’s Largest Diamond Retailer Sees Its Shares Skyrocket Amid Investor Enthusiasm

Signet Jewelers witnessed its pre-market stock price figures surge by a remarkable 15.53% to $55.80 on Wednesday. Investor enthusiasm was triggered by the company’s release of its fourth-quarter fiscal report.

The company, which boasts a portfolio of well-known brands, including Kay Jewelers, Jared, and online platform Blue Nile, delivered adjusted earnings per share of $6.62, surpassing analyst predictions of $6.25. Similarly, sales figures reached $2.4 billion, exceeding the anticipated $2.3 billion. These results indicate a robust performance in the quarter ending February 1, 2025, providing a solid foundation for the company’s optimistic forecast.

Signet’s projections for the current quarter indicate a potential growth of up to 2% in same-store sales, which surpasses the 0.9% growth analysts anticipated. For the first fiscal quarter, the company forecasts a total sales range from $1.50 billion to $1.53 billion, closely mirroring market analysts’ predictions.

Beyond the strong financial figures, investors responded favorably to Signet’s strategic reorganization plan. The company announced its intention to optimize its real estate portfolio by transitioning over 10% of its mall locations to off-mall formats and expanding its e-commerce presence over the next three years. This initiative serves as a strategic shift away from a predominantly mall-centric model, aligning with evolving consumer preferences and the growing importance of online retail.

The company’s fourth-quarter report also drew attention to several key financial metrics. While overall sales experienced a slight decline compared to the previous year, the average unit retail price increased by about 7%, indicating a focus on higher-value merchandise. Adjusted operating income was reported at $355.5 million, reflecting a solid performance despite some digital brands’ non-cash impairment charges ($200.7 million).

Furthermore, Signet’s leadership expressed confidence in the company’s trajectory. CEO J.K. Symancyk highlighted the positive comparable sales growth in January, which has continued into the first quarter, noting growth across all product categories. CFO Joan Hilson emphasized the company’s strong cash flow generation, with over $400 million in free cash flow, enabling a significant reduction in diluted share count and the return of approximately $1 billion to shareholders. To underscore its commitment to delivering shareholder value, Signet raised its quarterly dividend by 10% to $0.32 per share.