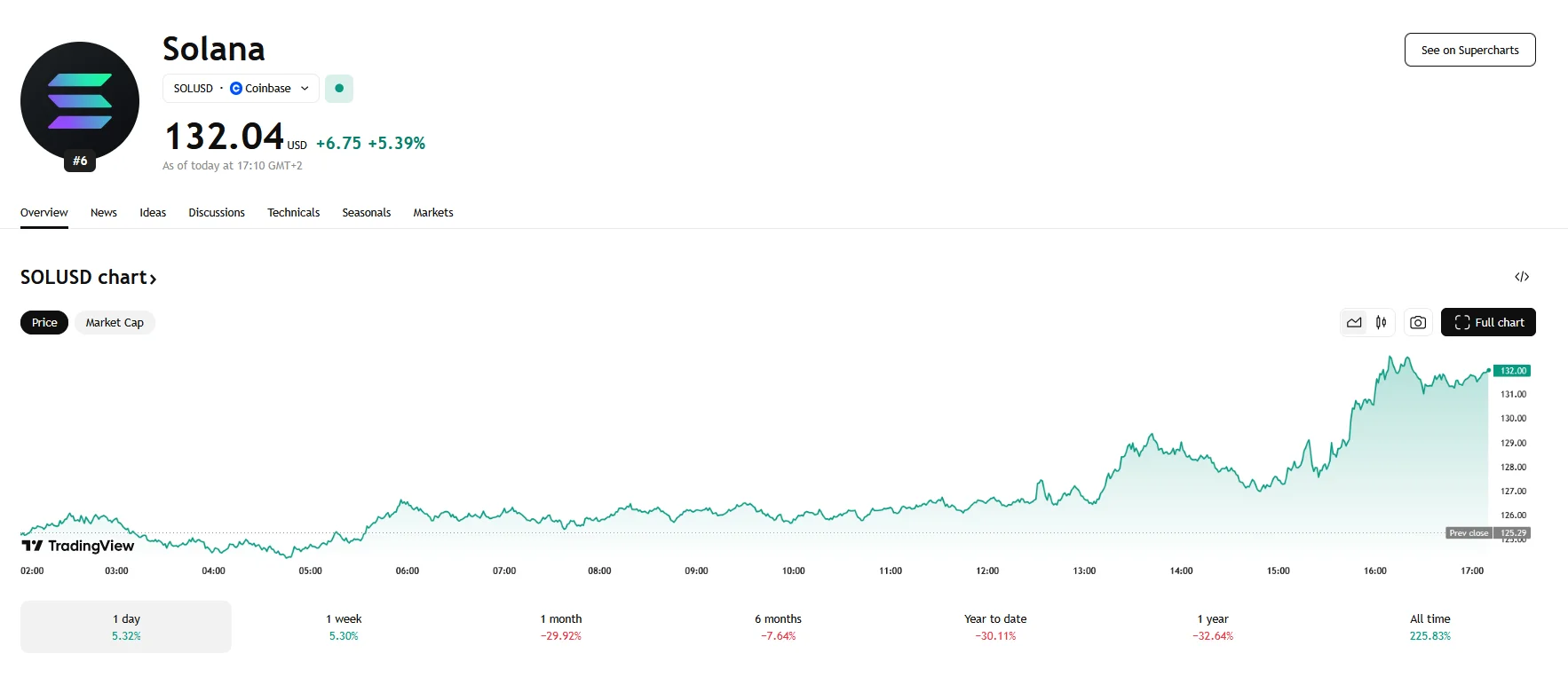

Key moments

- Wednesday saw Solana’s price surge 5.4% to $132.04.

- Crypto platform STARDEER has announced a $10 million fund that is set to support Solana’s ecosystem.

- The fund will strengthen Solana by providing seed funding, liquidity incentives, developer rewards, and free platform listings.

Solana Enjoys Price Jump to $132

Solana’s market value experienced a significant uptick on Wednesday, jumping 5.39% to $132.04. The price climb was triggered by renewed investor enthusiasm that followed the announcement of a substantial funding initiative.

The catalyst in question was the unveiling of a $10 million fund by STARDEER, a crypto trading platform. This fund is specifically designed to bolster the Solana ecosystem by providing crucial support to emerging projects. STARDEER’s initiative aims to address a critical challenge faced by many promising ventures: securing early-stage funding and gaining sufficient market exposure.

To reinforce and broaden the Solana network, STARDEER’s $10 million will focus on a number of critical areas. Firstly, it will offer seed funding to fledgling projects, providing the necessary capital for development and growth. Secondly, it will introduce liquidity incentives to stimulate market activity and attract a broader user base. In addition, developers will be incentivized to create innovative decentralized applications and financial tools, enriching the platform’s functionality. Last but not least, projects will be listed on STARDEER’s platform without fees, which will reduce the financial burden on new projects seeking visibility.

The CEO of STARDEER emphasized the innovative potential within the Solana ecosystem, stating that the fund’s primary goal is to support the development of high-caliber projects and connect global investors with valuable opportunities.

In addition to the funding initiative, STARDEER has launched a dedicated Solana trading section, accompanied by a temporary 50% reduction in trading fees. This move is designed to enhance liquidity and accessibility for traders, particularly those dealing with popular Solana-based tokens like Jupiter and Raydium. As Solana continues to evolve, initiatives like STARDEER’s fund will play a crucial role in shaping its future.