Key moments

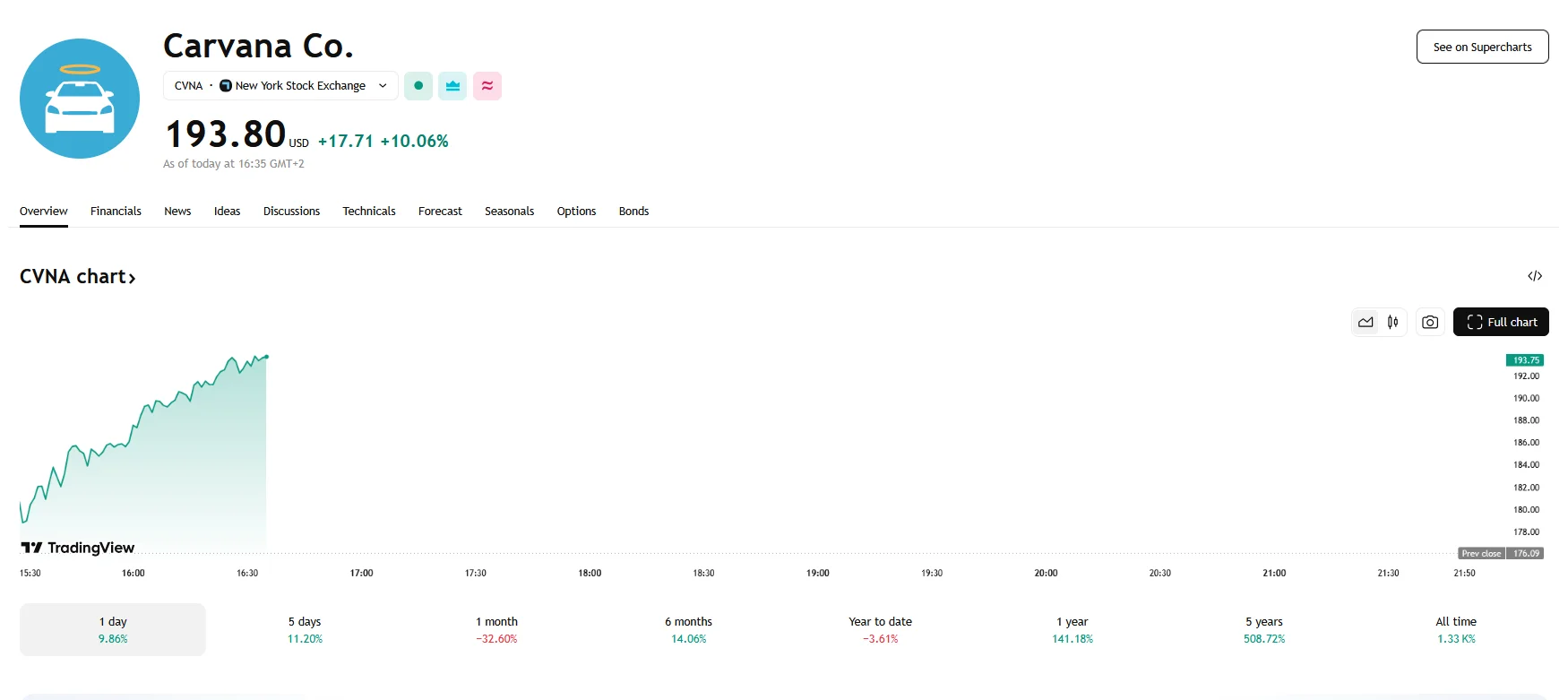

- Carvana’s stock jumped a notable 10% to $193.80 on Thursday.

- The surge followed stock rate upgrades by analysts working for financial services providers like Piper Sandler and RBC Capital Markets.

- Carvana’s revenue increased by 26.94% to $13.67 billion in the past year. This, along with other promising figures, fueled confidence in the stock.

Market Optimism and Price Target Boosts Drive Carvana Stock Surge

The stock of used car retailer Carvana Co. (NYSE:CVNA) experienced a significant surge on Thursday, climbing around 10% to $193.80 as investors reacted positively to recent analyst upgrades and company performance updates. A key driver of this surge was Piper Sandler analysts’ decision to upgrade Carvana’s rating from a “Neutral” to an “Overweight” rating. According to analyst Alexander Potter, Piper Sandler’s price target of $225.00 is rooted in optimism about Carvana’s potential to capitalize on the fragmented and relatively static used car industry. He highlighted the company’s capacity to significantly increase its market share.

Analysts at other firms have also adjusted their outlooks on Carvana. Bank of America Securities adjusted its price target for Carvana, lowering it to $220 while maintaining a “Buy” rating. RBC Capital Markets raised its price target to $320, citing strong retail unit growth and better-than-expected EBITDA.

Carvana’s recent financial performance and its growing presence in the U.S. are behind this surge in confidence. By effectively utilizing its online platform and streamlined, end-to-end operational structure, Carvana has carved out a substantial portion of the American pre-owned vehicle market. Over the past twelve months, Carvana’s revenue has increased by 26.94%, reaching $13.67 billion, and Potter anticipates earnings growth will hasten. He also expects that the multi-year compound annual growth rate (CAGR) will exceed 20% in revenue.

In addition to the analyst upgrades, Carvana has shown significant improvement in its financial health. S&P Global Ratings recently upgraded the company’s credit rating from ‘B-‘ to ‘B’, citing enhanced EBITDA margins and increased revenue. Carvana’s EBITDA margins rose from 3.9% in 2023 to 10.6% in 2024, and revenue grew from $10.8 billion to $13.7 billion during the same period. Moreover, with an estimated market share of 1-2%, the company’s continued growth highlights its increasing dominance within the digital automotive retail landscape.