Key moments

- Federal Reserve maintains current interest rate range, affirming projection of two rate cuts for 2025.

- Major U.S. stock indices, including the Dow, S&P 500, and Nasdaq, experience significant gains following the Fed’s announcement.

- Federal Reserve Chair Jerome Powell emphasizes the strength of the economy and progress towards inflation targets while acknowledging ongoing economic uncertainties.

Market Response to Federal Reserve’s Interest Rate Outlook and Economic Assessment

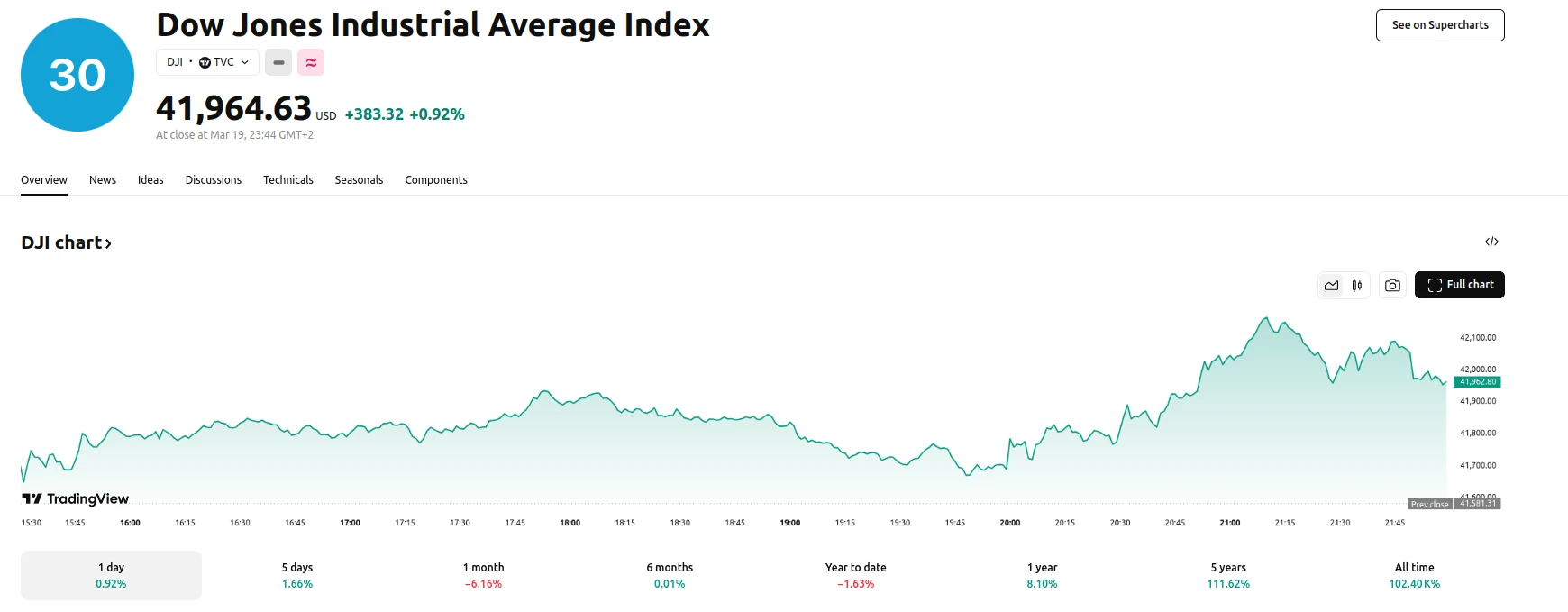

The U.S. stock market responded positively to the Federal Reserve’s decision to maintain the federal funds rate within the 4.25% to 4.5% range, and its continued projection of two rate cuts in 2025. The Dow Jones Industrial Average surged by 383.32 points, representing a 0.92% increase, closing at 41,964.63. Similarly, the S&P 500 and Nasdaq Composite indices saw gains of 1.08% and 1.41%, respectively, settling at 5,675.29 and 17,750.79. This market upswing reflects investor confidence in the Fed’s economic outlook and its commitment to potential future rate reductions.

Federal Reserve Chair Jerome Powell, in a subsequent press conference, highlighted the overall strength of the U.S. economy, citing solid labor market conditions and progress in lowering inflation towards the 2% target. However, he also acknowledged the presence of increased uncertainty surrounding the economic outlook. Powell addressed the potential impact of recent tariff implementations, suggesting that any inflationary effects are likely to be short-term. The Fed’s decision to maintain its rate cut projections, despite these uncertainties, appears to have reassured investors, contributing to the market’s positive performance.

The market’s response appears to be closely linked to the Federal Reserve’s actions meeting established expectations. Observers have pointed out that the released information was largely in line with prevailing market forecasts. This alignment played a role in reducing investor apprehension and fostering a sense of stability. This positive market reaction stands in contrast to the previous day’s sell-off, where major indices experienced considerable losses. The subsequent rebound indicates a level of investor resilience and a focus on the Federal Reserve’s broader economic strategy.