Key moments

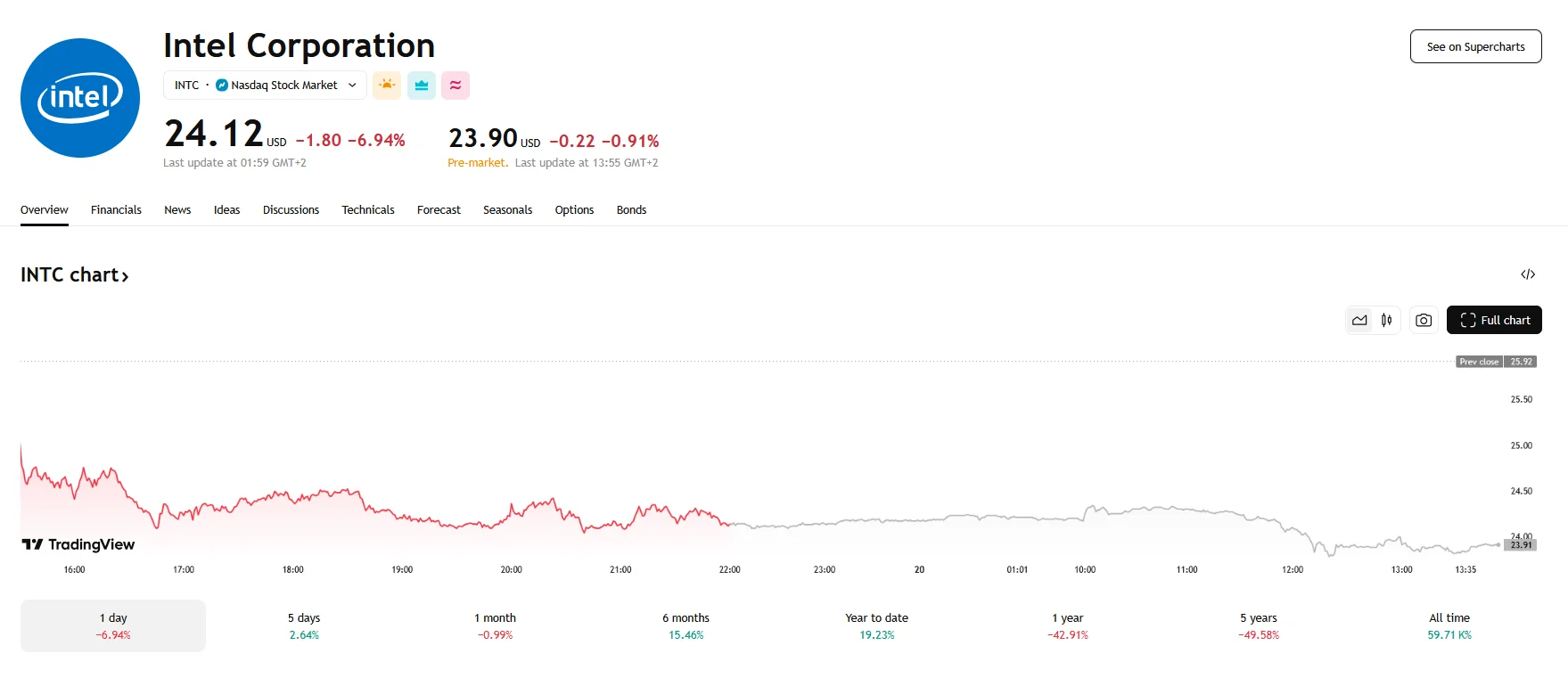

- Intel’s stock fell roughly 7% to $24 on Wednesday.

- Figures observed during Thursday’s pre-market hours indicate further downturns.

- A likely factor behind the price drop was the dismissal of rumors suggesting that TSMC would acquire Intel’s struggling foundry business.

Intel Stock Drops Amid Foundry Division Uncertainty

Intel Corporation (NASDAQ: INTC) experienced a significant downturn in its stock value, with shares plummeting by approximately 7% to close at around $24 during Wednesday’s trading session. Pre-market trading indicates further downward pressure on Intel’s stock, with Thursday’s prices dipping below the $24 mark. This decline reversed a recent period of promising stock performance, which had been buoyed by the appointment of Lip-Bu Tan as the company’s new CEO.

Lip-Bu Tan’s appointment had initially sparked a five-day winning streak for Intel’s stock, and investors were also interested in recent rumors suggesting that a potential acquisition deal between Taiwan Semiconductor Manufacturing (TSMC) and Intel Corporation was in the works. Had reports proven true, Intel’s foundry business would have been purchased by TSMC. However, market sentiment turned pessimistic following a statement made by TSMC board member Paul Liu, who categorically denied any discussions regarding an acquisition or partnership involving the foundry division of Intel.

Intel Foundry, which manufactures chips for both internal and external clients, has faced significant challenges, including substantial losses and difficulties in achieving technological milestones. The speculation of a TSMC partnership had offered a potential lifeline for this struggling division, raising expectations of a much-needed strategic restructuring.

The uncertainty surrounding Intel’s foundry business has raised questions about the company’s future strategic direction. Investors are now keenly awaiting Lip-Bu Tan’s response to these developments and his plans for revitalizing the foundry division. The decision regarding the foundry’s future, whether it involves a sale or a joint venture, will significantly impact Intel’s overall structure and competitiveness.