Key moments

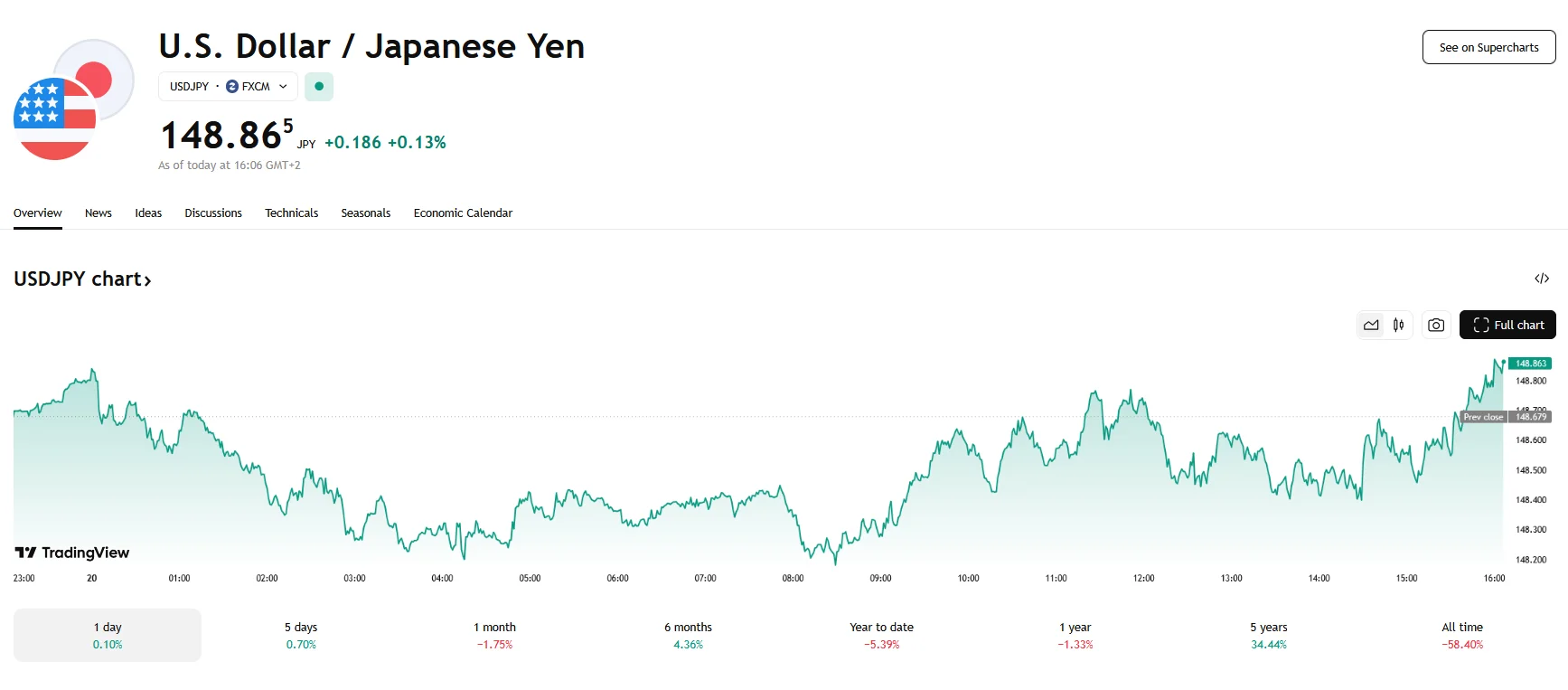

- The USD/JPY is trading below the 149.00 mark.

- The pair managed to climb past 150.00 on Wednesday, but it sank to around 148 the following day.

- Global uncertainties, including trade policy and geopolitical tensions, have driven investors towards the yen, pressuring the USD/JPY pair downwards.

USD/JPY Under Pressure, Pair Fails to Break 149.00

The USD/JPY currency pair’s exchange rate has been trading below the 149.00 threshold, staying below Wednesday’s hike of above 150. These movements are largely driven by differing perspectives on monetary policy between the Bank of Japan (BoJ) and the Federal Reserve (Fed), alongside geopolitical uncertainties and economic data.

This Wednesday saw the BoJ maintain key interest rates, which exerted downward pressure on the yen and propelled the USD/JPY pair. However, this momentum did not last through Thursday, as the Japanese yen has found support from market speculation that the BoJ will continue its gradual interest rate hikes. This expectation stems from projections of strong wage growth, which are anticipated to boost consumer spending and contribute to rising inflation. Such conditions would provide the BoJ with the flexibility to tighten its monetary policy further. BoJ Governor Kazuo Ueda’s emphasis on the importance of achieving the central bank’s 2% inflation target underscores the potential for further policy adjustments.

The resulting narrowing of the interest rate differential between Japan and other major economies enhances the yen’s appeal, exerting downward pressure on the USD/JPY pair. Adding to the yen’s strength is its status as a safe-haven currency. Global uncertainties, including trade policy concerns stemming from US political developments and escalating geopolitical tensions, have prompted investors to seek refuge in the yen.

Conversely, the U.S. dollar’s performance is being weighed down by market expectations that the Fed will implement multiple interest rate cuts throughout the year after this week’s decision to keep rates steady. This anticipated easing of monetary policy reduced the dollar’s attractiveness. The Fed’s revised economic forecasts, which include downward adjustments to growth projections and upward revisions to inflation expectations, have added to the uncertainty.