Key moments

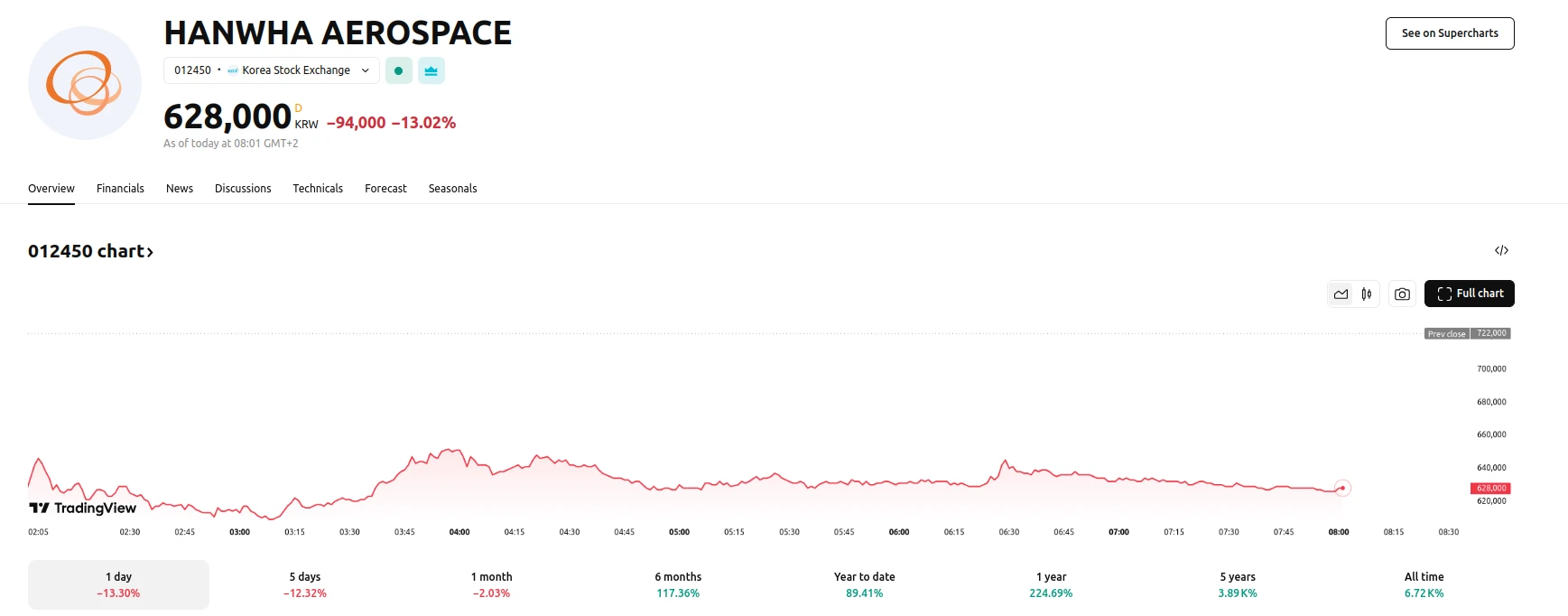

- Hanwha Aerospace announces a substantial share sale plan to raise 3.6 trillion won ($2.5 billion), triggering a significant stock price decline.

- The company outlines plans for extensive overseas investments, including plant construction and strategic stake acquisitions, with a target revenue of 70 trillion won by 2035.

- Financial analysts and regulators express concerns regarding the scale and necessity of the share sale, leading to revised price targets and regulatory scrutiny.

Impact of Major Capital Raise on Hanwha Aerospace’s Market Valuation and Strategic Direction

Hanwha Aerospace Co. experienced a sharp decline in its stock value following the disclosure of a 3.6 trillion won share sale plan, the largest in South Korea in over three years. The company’s shares plummeted by as much as 16% in Seoul, reflecting investor apprehension regarding equity dilution. This significant capital raise is intended to fund ambitious expansion plans, primarily focused on overseas investments. The company aims to allocate approximately 1.6 trillion won to establish overseas manufacturing facilities and acquire stakes in foreign partners, aligning with its goal of achieving 70 trillion won in revenue by 2035. Following the company’s announcement, shares have dropped by more than 13% within the last trading day. However, the stock is up more than 90% this year.

The proposed share sale has drawn scrutiny from financial analysts and regulatory bodies. Several brokerage firms have subsequently lowered their price targets for Hanwha Aerospace, citing concerns about the necessity of raising capital through equity markets, given the company’s existing profitability. The South Korean financial regulator has also indicated that it will review the plan, highlighting the scale of the offering. The company’s strategic moves, including its recent acquisition of a stake in Australian shipbuilder Austal Ltd., have prompted varied responses. Analysts have raised questions about the strategic alignment of the shipyard investment compared to the more straightforward expansion of defense manufacturing capacity.

Despite the recent market correction, Hanwha Aerospace remains a strong performer within the regional market, driven by increased global defense spending. The company’s focus on ground weapons, such as the K9 self-propelled howitzer, positions it to capitalize on rising geopolitical tensions and the resulting increase in national defense budgets. Hanwha Aerospace intends to respond to potential customer demands from Europe and the Middle East. The significant infusion of capital is designed to enable the company to aggressively pursue its expansion strategy, aiming to solidify its position in the global defense sector.