Key moments

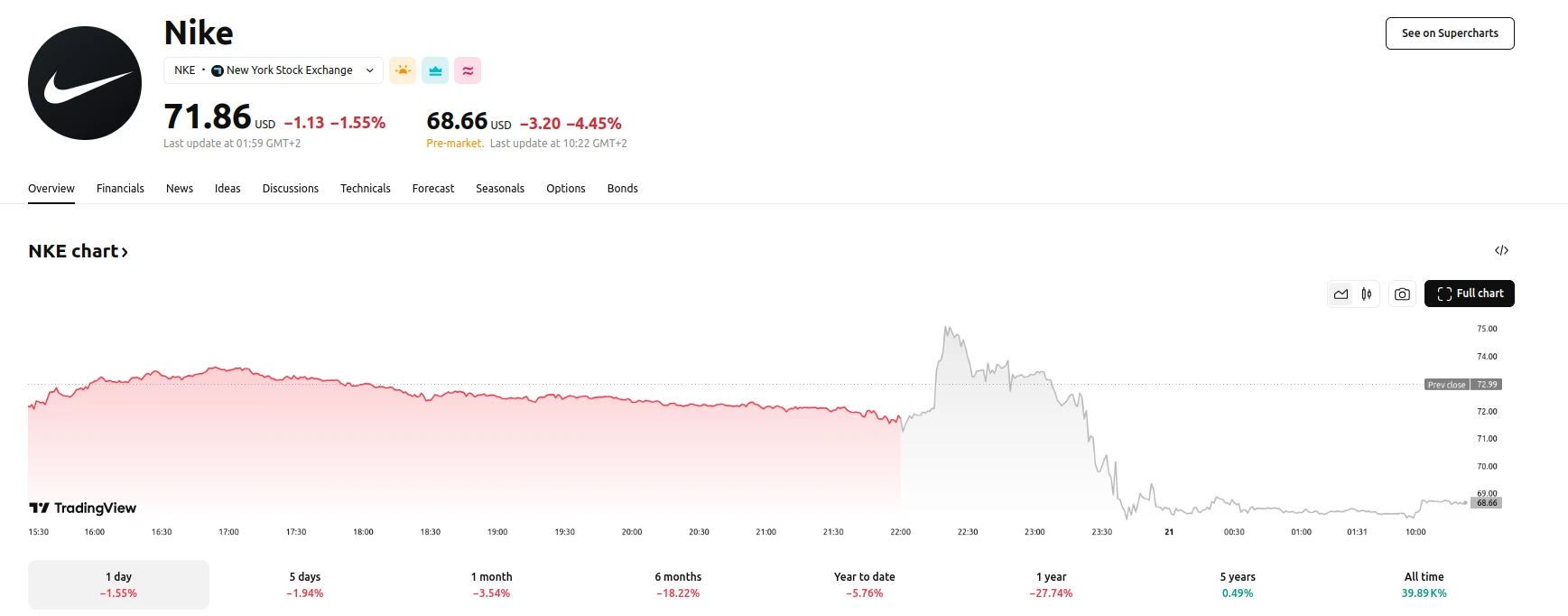

- Nike’s stock declines following a projected “mid-teens percentage” sales drop for the upcoming quarter.

- The company reports Q2 earnings exceeding analyst expectations, yet forward guidance overshadows positive results.

- Concerns over tariff impacts and internal restructuring contribute to the pessimistic outlook, leading to investor apprehension.

Nike’s Market Valuation Affected by Projected Sales Decline Amidst Economic and Internal Shifts

Nike Inc. experienced a decline in its stock value following the release of its quarterly earnings report and subsequent forward guidance. Despite reporting second-quarter earnings that surpassed analyst projections, the company’s outlook for the upcoming quarter triggered investor concern. Specifically, Nike projects a “mid-teens percentage” decrease in sales for the May quarter, a figure that exceeded analyst expectations and contributed to a post-earnings trading decline. This projection has significantly impacted the company’s market valuation, pushing it below the $100 billion mark, a level not seen since 2020.

The company’s second-quarter results, while demonstrating revenue of $11.3 billion and earnings per share of $0.54, which both exceeded analyst estimates, were overshadowed by the forward-looking statements. Nike’s financial officer, Matt Friend, attributed the projected sales decline to factors including potential impacts from tariffs and internal restructuring within the company’s executive leadership. These factors have introduced uncertainty into Nike’s near-term financial performance, leading to a reassessment of the company’s stock by investors.

The decline in Nike’s stock reflects a broader trend of investor sensitivity to economic and operational uncertainties. The company, which has seen its stock value decrease by 60% from its 2021 peak, is now navigating challenges related to both external economic pressures and internal organizational changes. The projected sales decrease has prompted a reevaluation of Nike’s short-term growth prospects, despite the company’s efforts to emphasize its commitment to improving overall results. The company, which has activist investor Bill Ackman holding a $1.4 billion stake, is now facing increased scrutiny due to the projected sales decline.