Key moments

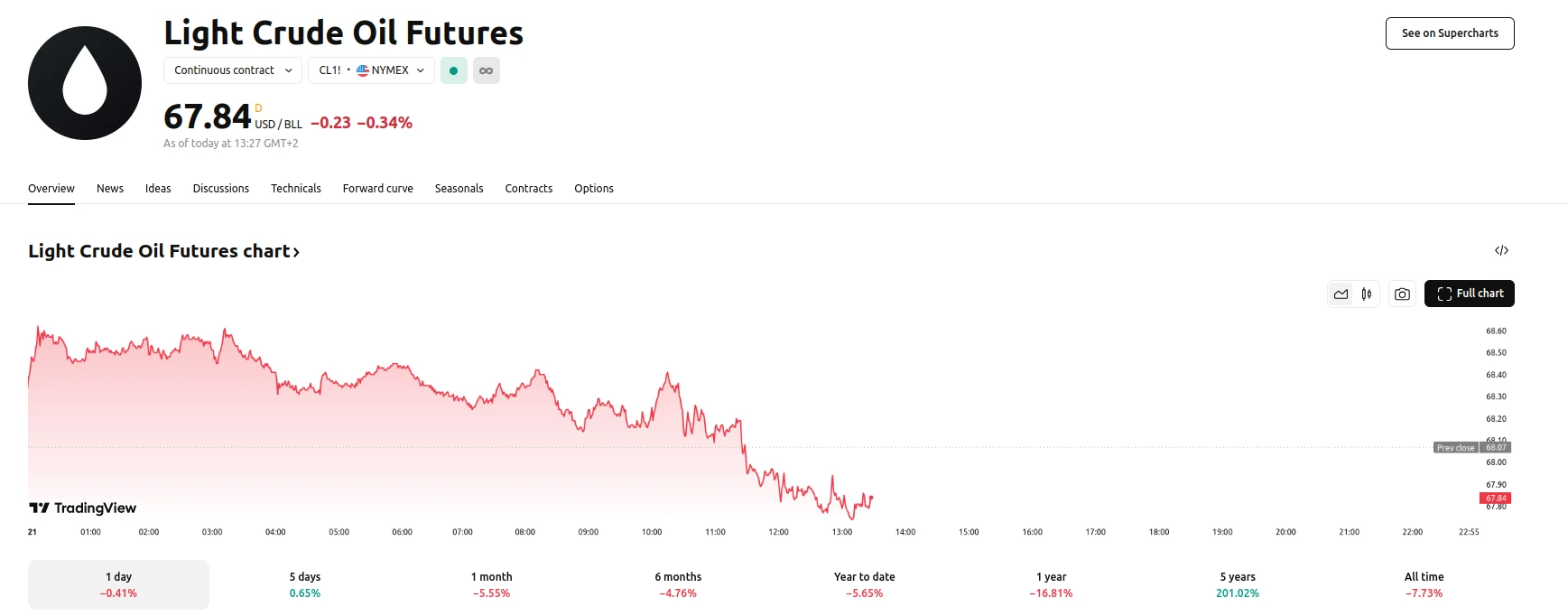

- WTI crude futures have risen approximately 0.60% within the last five trading days.

- Iranian oil exports face potential cuts of up to 1 million barrels per day as a result of new U.S. sanctions, which have broadened to include a Chinese refining company.

- OPEC+ announces additional monthly production cuts to offset past overproduction, while simultaneously allowing some members to increase output.

Crude Oil Market Reacts to Sanctions and OPEC+ Output Adjustments

WTI crude futures saw an increase, climbing to a weekly high of $68.65, and signaling a possible move towards the $68.97 resistance level. This movement suggests bullish momentum, with traders eyeing further gains towards the 200-day moving average at $70.10. The upward trend is supported by recent geopolitical developments and supply adjustments from OPEC+.

The U.S. Treasury’s imposition of new sanctions on Iranian oil exports, which for the first time include a Chinese refiner, has contributed to supply concerns. Analysts project that these sanctions could reduce Iranian oil exports by up to 1 million barrels per day. This action, aimed at tightening Iranian crude flows, has reinforced the bullish sentiment in the market.

In parallel, OPEC+ announced plans to implement additional monthly production cuts, ranging from 189,000 to 435,000 barrels per day, to compensate for past overproduction. However, the group also revealed that some members will be allowed to increase output, creating a complex supply narrative. While the commitment to offset overproduction signals a tightening market, concerns remain about the group’s ability to fully adhere to its pledged reductions. The near-term outlook for crude oil remains bullish, driven by both geopolitical tensions and OPEC+ output strategies.