Key moments

- Dow futures rose 0.89% to nearly $42,670, while S&P 500 futures also increased (1.16% to $5,785).

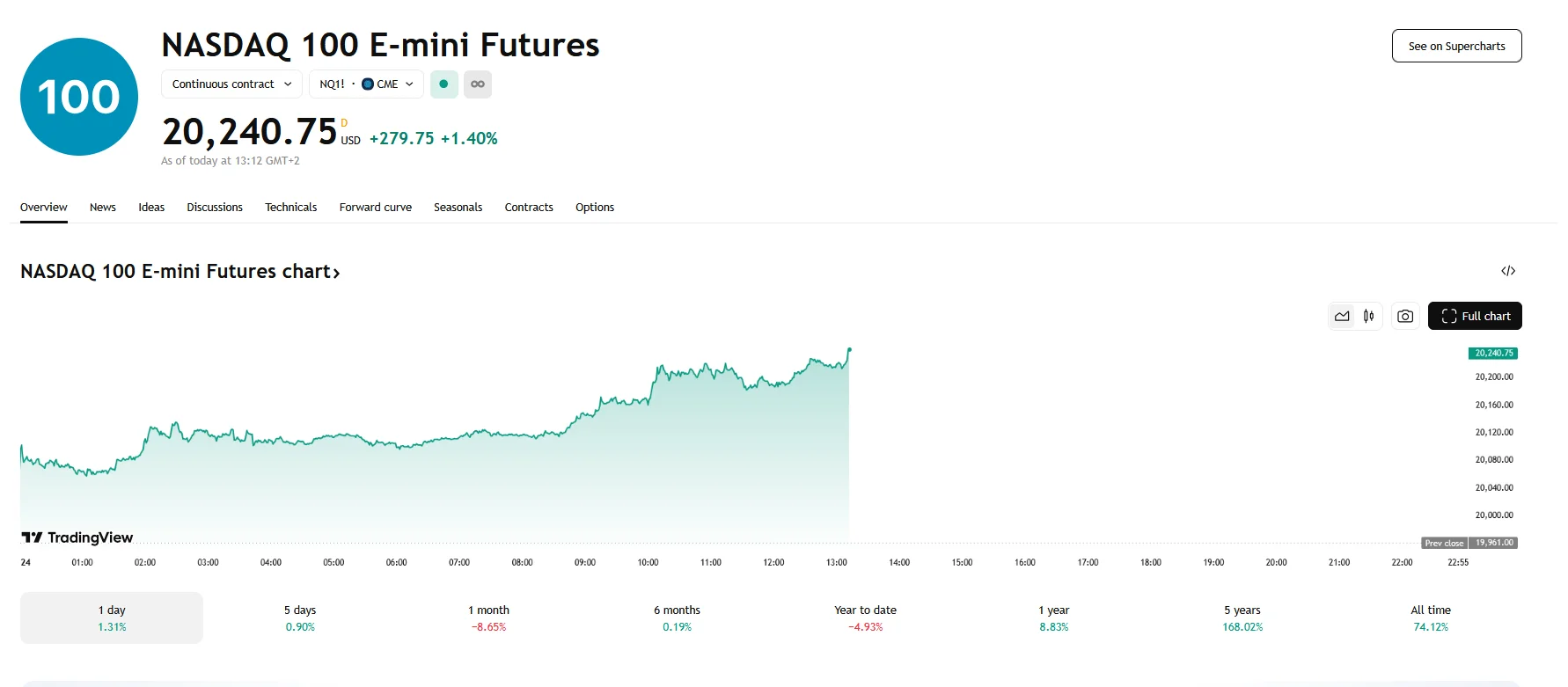

- Nasdaq 100 futures led in terms of gains with a 1.40% increase, with figures reaching $20,240.75.

- Hopes of revised Trump tariffs were the primary catalyst of positive market sentiment.

Market Optimism Grows, Reduced Tariff Expectations Propel Futures Higher

Gains across U.S. stock futures characterized the market on Monday, with the momentum fueled by emerging optimism surrounding potential adjustments to the Trump administration’s upcoming tariff policies. Dow E-mini futures surged by 0.89%, while S&P 500 E-mini futures experienced a 1.16% increase. The Nasdaq 100 rose highest by 1.40% to $20,240.75.

Reports from the Wall Street Journal suggest that Trump’s tariff policies, scheduled for implementation on April 2nd, could be more narrowly focused than expected. The Trump administration may adopt a more targeted approach to tariffs, potentially excluding certain industries and nations. This adjustment in policy is seen as a move to mitigate the potential negative impacts of a full-blown trade war on the global economy, and investors are cautiously optimistic that these developments could signal a period of reduced market volatility.

This shift in expectations has eased fears of heightened inflation and a further slowdown in economic activity, leading to a renewed appetite for risk among investors. The yield on the 10-year Treasury also saw a modest increase of 4.29%, reflecting this improved market sentiment.

Today’s positive momentum followed strong index closures on Friday, where the Dow and S&P 500 each rose by 0.08%, and the Nasdaq 100 advanced by 0.39%. These figures were bolstered by indications of tariff flexibility from the Trump administration.

The upcoming week is packed with crucial economic data releases, including the Personal Consumption Expenditures price index and the University of Michigan’s consumer confidence survey. Additionally, market participants are looking forward to information regarding the Purchasing Managers’ Indexes indicator.

Despite the recent gains, concerns about the potential for economic slowdown and inflationary pressures persist. However, statements from Jerome Powell, currently serving as Chair of the Federal Reserve, suggesting that any tariff-related impacts would likely be temporary, have provided some reassurance.