Key moments

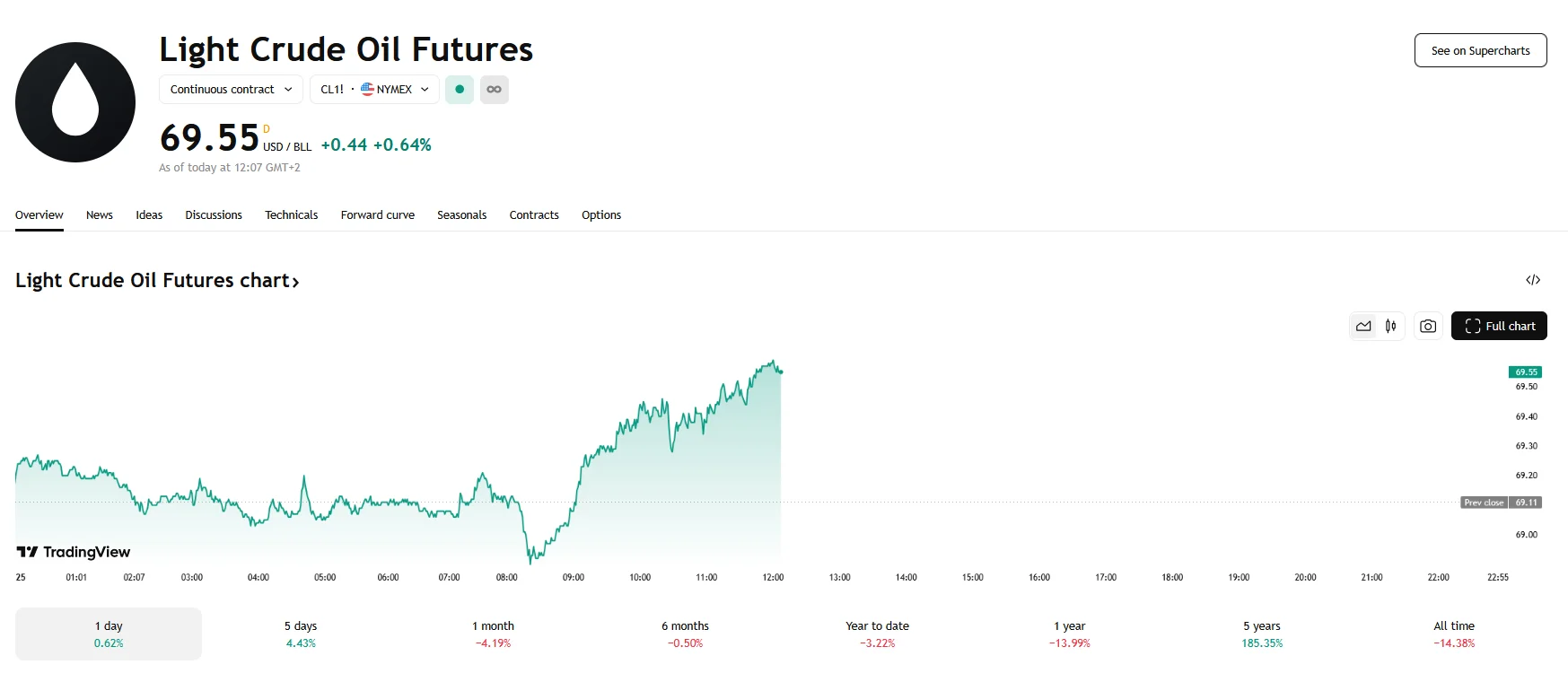

- West Texas Intermediate (WTI) crude futures are approaching $70 per barrel.

- President Trump announced that countries importing crude oil from Venezuela will be subject to tariffs of 25%.

- Heightened interest in WTI crude oil futures resulted from mounting anxieties about global oil supplies.

Crude Oil Market Grapples With the Latest Tariffs Imposed by the Trump Administration

West Texas Intermediate (WTI) crude futures demonstrated upward momentum on Tuesday, reaching levels near $70 per barrel thanks to an increase of 0.64%. This surge in oil prices can be attributed to heightened anxieties surrounding global supply.

The United States’ decision to levy a 25% tariff on nations importing Venezuelan crude oil has triggered considerable concerns regarding potential supply constraints. This development is particularly significant given Venezuela’s heavy reliance on oil exports and China’s position as its principal customer. The added pressure exerted on China, which is already the target of U.S. tariff policies, has the potential to significantly disrupt global crude oil balances, consequently fostering a bullish environment within the oil market.

Analysts from ING have emphasized that these tariff measures could result in a substantial tightening of the global oil supply. Furthermore, the extension of Chevron’s deadline to cease operations in Venezuela, now set for May 27th, has further compounded supply-related anxieties. According to ANZ, this move could lead to a reduction in Venezuela’s oil output by an estimated 200,000 barrels per day.

In addition to the concerns surrounding Venezuelan oil, recent U.S. sanctions targeting Iranian exports have also contributed to the apprehensions regarding supply limitations. The combined effect of these geopolitical factors has created a climate of uncertainty within the oil market, leading to increased price volatility.

Market observers have noted that while investor anxieties regarding potential economic slowdowns caused by widespread tariffs persist, the immediate concern lies with the diminishing supply from Venezuela and Iran. The unpredictability of policy changes from the U.S. administration makes predicting the stability of the price of oil more difficult. Some forecasts point to potential rises in seasonal WTI crude oil prices during the summer driving season.

It is worth noting that while the fear of a reduced oil supply from Venezuela and the effects of other tariffs are raising the price, it has also been reported that the oil-producing nation, OPEC+, is likely to increase oil output during May. The increase in production from OPEC+ could offset some of the feared reductions in supply.