Key moments

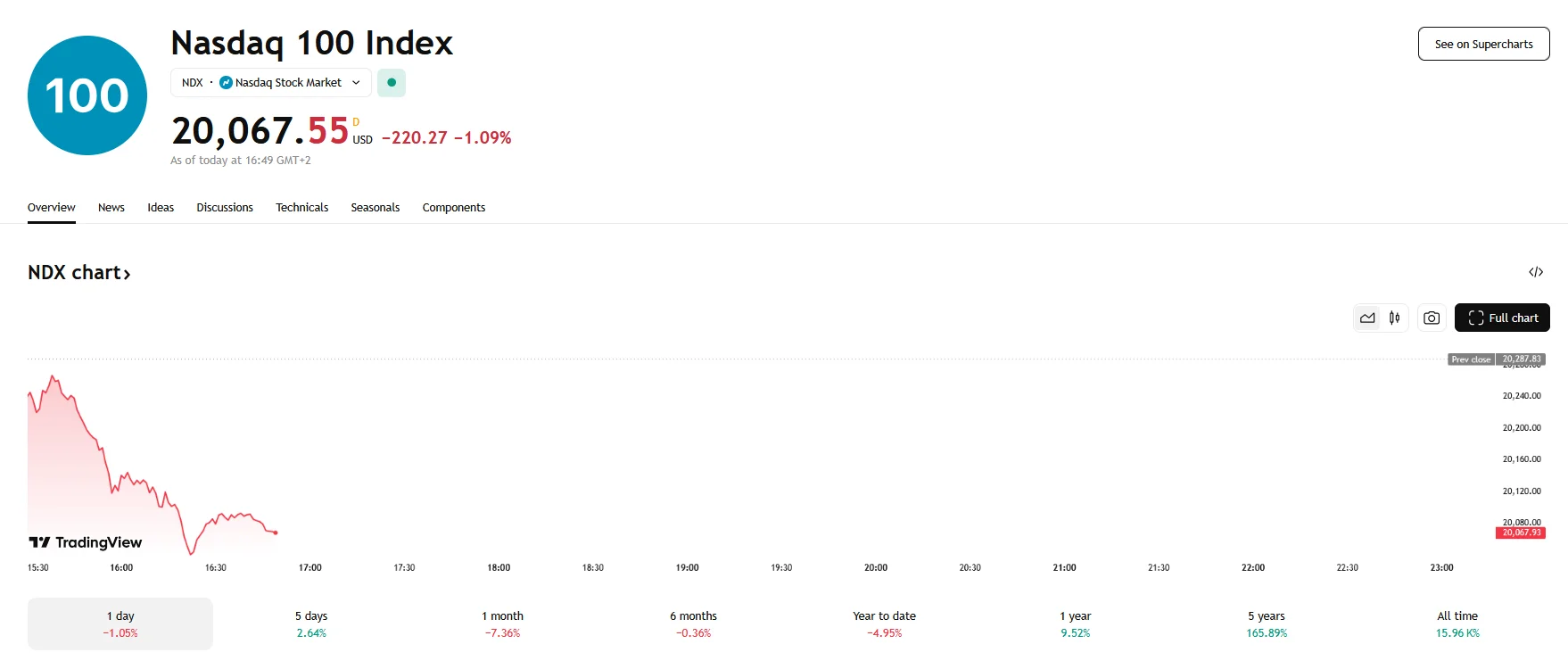

- Wall Street’s Wednesday session showcased a downturn within the technology sector, with Nasdaq dropping 1.09%.

- Tesla, Alphabet, and Nvidia are among the companies whose share prices fell.

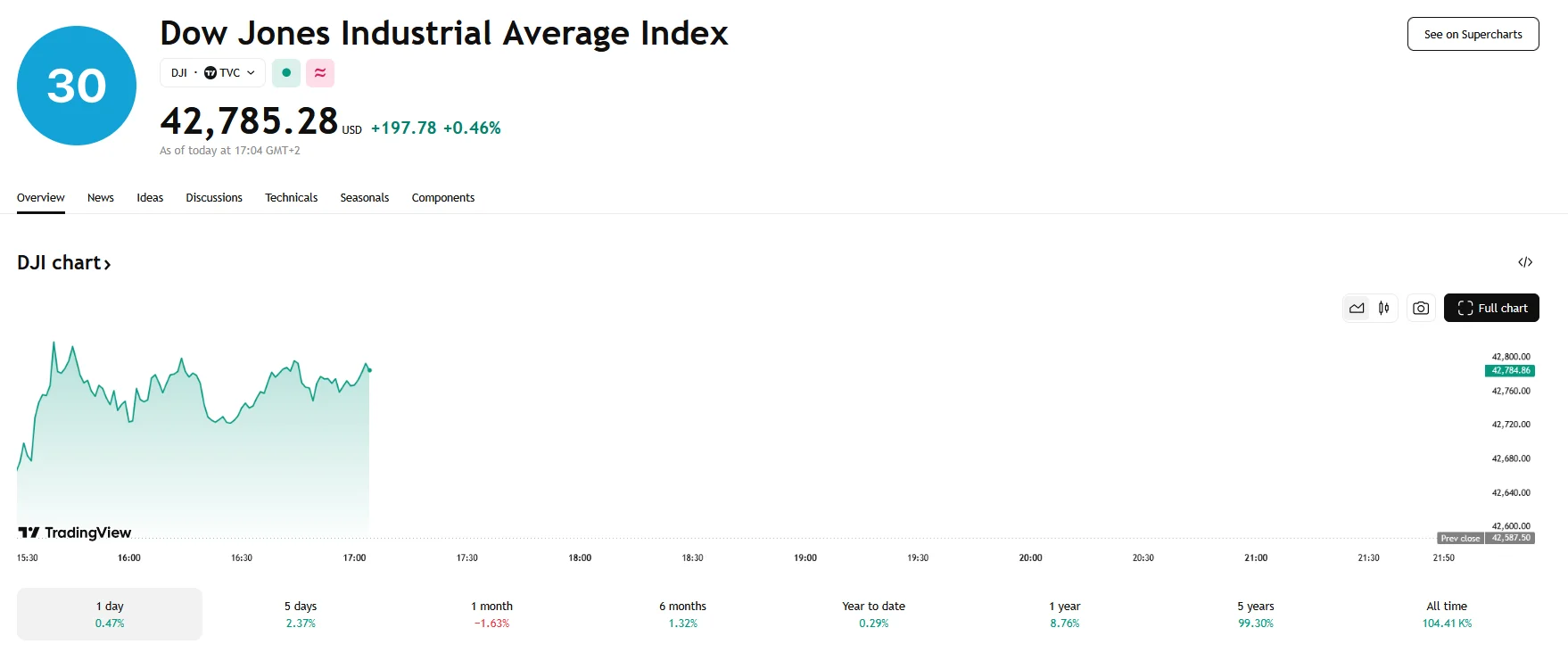

- The S&P 500 also underperformed, but Dow Jones managed to climb 0.46%.

Nasdaq Composite Falls, Tech Giants Face Pressure

Wednesday’s trading session on Wall Street saw the technology sector experiencing significant downturns while the broader market showed resilience in certain areas. The Nasdaq Composite Index, heavily weighted in tech shares, notably declined by over 1%.

Tesla and Nvidia were some of the companies that saw their shares slump on Wednesday. Tesla’s stock fell by 3.70%, reaching $277.47, while Nvidia, a key player in artificial intelligence chip manufacturing, witnessed its shares plummet by 4.42%, falling to just above the $115 mark. Additionally, Alphabet’s Class A and C shares both suffered price declines exceeding 1.20%, further contributing to the Nasdaq’s downward trend.

The broader market, as represented by the S&P 500, registered a 0.31% decrease. This decline marked the end of a three-day upward momentum. Market participants are increasingly concerned about potential economic headwinds, particularly in light of President Trump’s proposed tariffs. The Dow Jones Industrial Average, however, bucked the trend, demonstrating a 0.46% increase.

Investor anxiety primarily centers on the impending implementation of reciprocal tariffs, scheduled for April 2nd. The uncertainty surrounding the scope and impact of these tariffs has created volatility in the market. Trump’s recent statements during a Newsmax interview, when he suggested a potentially “more lenient” approach, have provided some momentary relief, but the overall apprehension remains.

Economic data also plays a crucial role in shaping investor sentiment. Recent consumer confidence reports have indicated a pessimistic outlook across the U.S., raising concerns about a potential recession. However, Bespoke Investment Group co-founder Paul Hickey spoke with news channel CNBC about how “hard data,” such as housing starts and industrial production, paints a more optimistic picture, which signals that the economy may not be as fragile as perceived.

The mixed signals from economic indicators and the evolving tariff situation have created a climate of uncertainty, leading to cautious trading. The tech sector’s vulnerability, as evidenced by the significant declines in Tesla and Nvidia, has contributed to the Nasdaq’s downward trend, while the Dow’s positive performance reflects the market’s complex and multifaceted nature.