Key moments

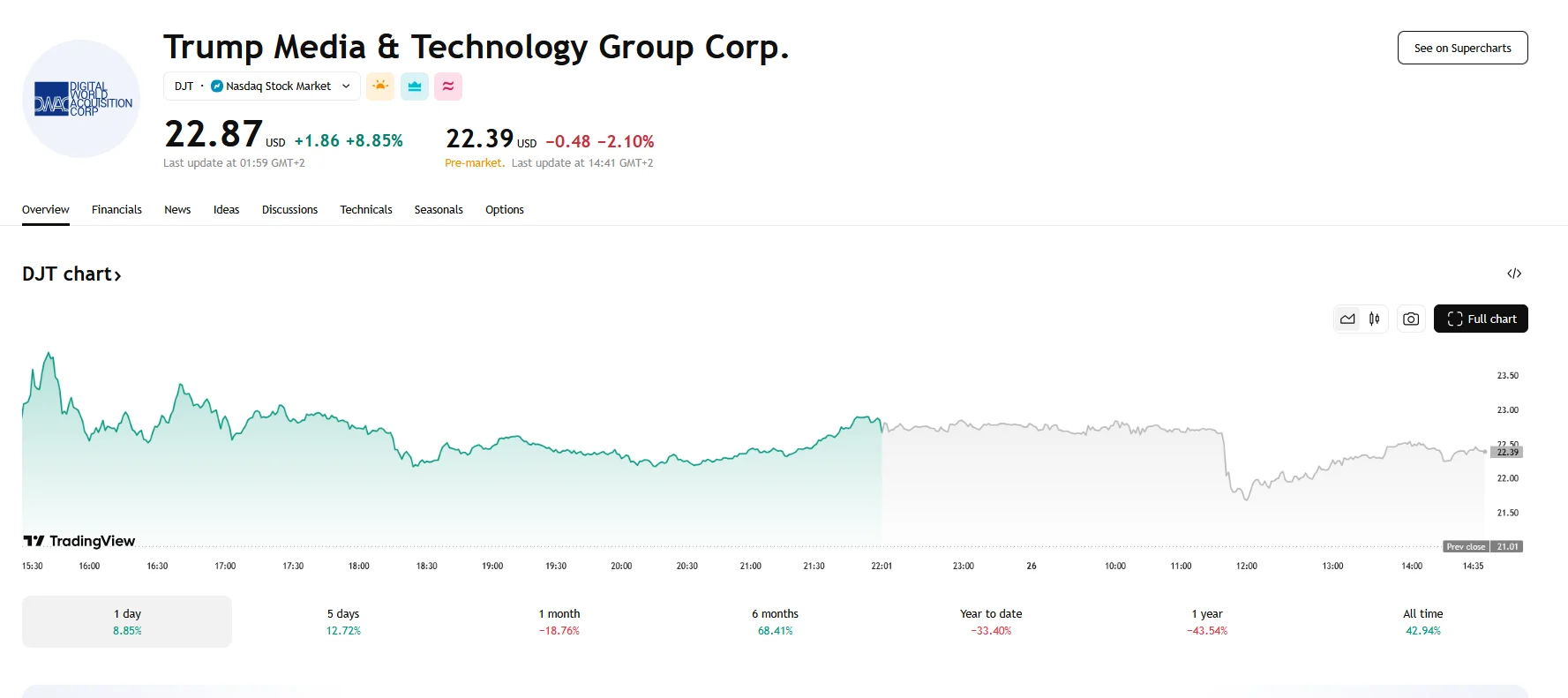

- Trump Media’s stock experienced a major uptick on Tuesday, rising by 8.85% and concluding the day at $22.87.

- This notable upswing occurred after the company disclosed its partnership with Crypto.com to launch crypto-focused exchange-traded funds.

- While pre-market trading suggested continued upward movement, the stock saw a 2.10% decrease on Wednesday.

DJT Shares Surge as Market Reacts to Crypto.com Alliance

Trump Media & Technology Group witnessed a significant surge in its stock value on Tuesday, with shares climbing by 8.85% to close at $22.87. This notable increase followed the company’s announcement of an alliance with Crypto.com to introduce a new line of exchange-traded funds (ETFs). The partnership aims to leverage the platform’s expertise in digital asset trading to expand Trump Media’s financial technology offerings under its Truth.Fi brand.

The planned ETFs are designed to feature a unique blend of cryptocurrencies. A distinctive aspect of these investment products will be their “Made in America” focus, prioritizing companies across various sectors that contribute to the U.S. economy. According to current expectations, these ETFs will be accessible to investors in America, Europe, and Asia thanks to Foris Capital, the broker-dealer of Crypto.com.

However, the initial enthusiasm surrounding the announcement appeared to wane slightly on Wednesday. While pre-market trading initially indicated continued positive momentum, with shares initially showing gains, and the stock subsequently experienced a decline of 2.10%. This fluctuation suggests that while the partnership with Crypto.com generated significant initial excitement, sustained investor confidence remains subject to market dynamics and broader economic factors.

Prior to the Crypto.com collaboration, Trump Media’s stock had faced considerable challenges, experiencing a substantial decline in value throughout the year. The company’s financial reports revealed significant losses, contrasting sharply with its revenue figures. The partnership with Crypto.com and the introduction of “Made in America” focused ETFs represent a strategic pivot for Trump Media, aiming to revitalize investor interest and establish a foothold in the competitive fintech landscape. These ETFs are set to launch sometime in 2025, provided they are approved by regulators.