Key moments

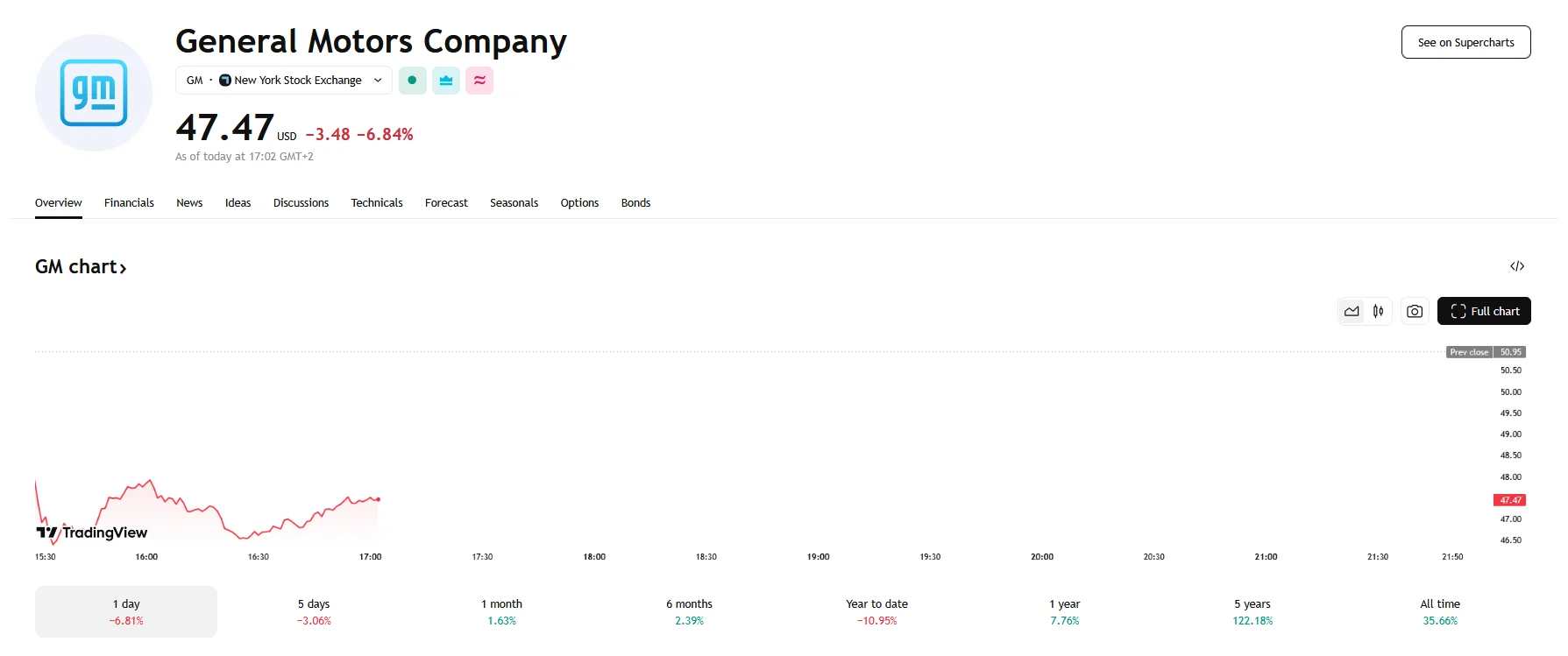

- General Motors saw its shares drop 6.84% on Thursday.

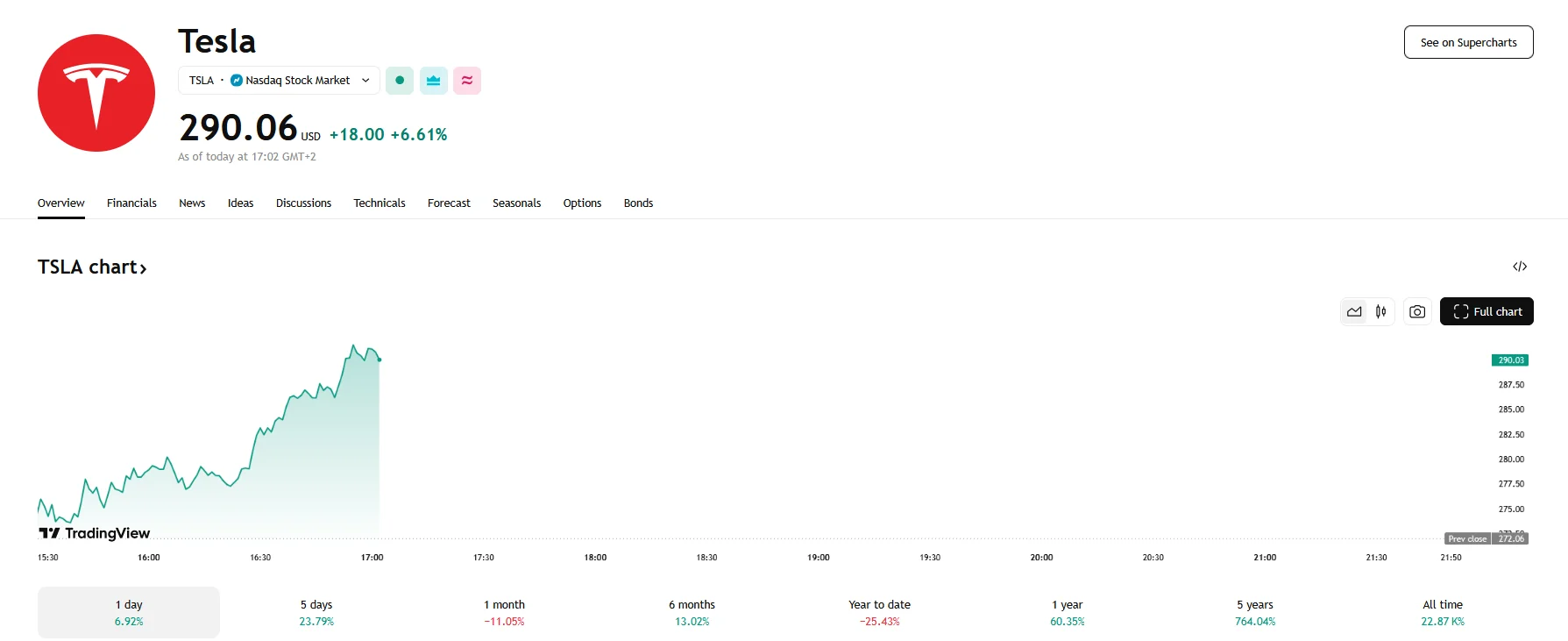

- President Trump’s new 25% tariff on imported vehicles and parts caused a sharp divide in automotive stock performance as Tesla’s shares achieved upward momentum.

- S&P 500 and the Nasdaq Composite index are up 0.20%.

Trump’s Tariffs Shake U.S. Auto Stocks, GM Shares Plummet

The U.S. automotive market experienced a dramatic shift following President Donald Trump’s announcement of a 25% tariff on all imported vehicles and certain auto parts, set to begin in April. This policy shift triggered a notable divergence in stock performance between traditional automakers and electric vehicle manufacturer Tesla.

General Motors (GM) shares witnessed a significant decline, falling by 6.84%, as investors reacted negatively to the potential impact of the new tariffs on their supply chain and production costs. Similarly, other traditional automakers like Ford and Stellantis also saw their stock prices decrease. In contrast, Tesla (TSLA) shares surged by 6.61%, climbing just beyond $290.

Major U.S. stock indices initially struggled to find their footing on Thursday. Concerns about a potential trade war and its detrimental effects on the global economy were widespread, but despite initial volatility, the S&P 500 and Nasdaq Composite indices both managed to climb approximately 0.20%.

The imposed tariffs, which will apply to imported passenger vehicles, light trucks, engines, and transmissions, are aimed at bolstering domestic car manufacturing. However, the complexity of the automotive supply chain, involving tens of thousands of parts sourced from numerous countries, raises concerns about potential disruptions. While vehicles assembled in the U.S. will be exempt, the tariffs will affect components imported from abroad.

Fears persist that the new levies could exacerbate inflation and slow economic growth, potentially leading to a recession. This concern overshadows recent positive economic data, such as the revised fourth-quarter GDP growth of 2.4%. Investors are now focused on upcoming economic indicators, such as the Personal Consumption Expenditures Index, to gauge the potential impact of the tariffs on the U.S. economy.

It should be noted that despite its domestic production, Tesla still sources components from overseas, which will be subject to the new levies. However, the market’s positive reaction to Tesla’s stock indicates investor confidence in its ability to navigate the tariff-related challenges and capitalize on the shift towards domestic production.