Key moments

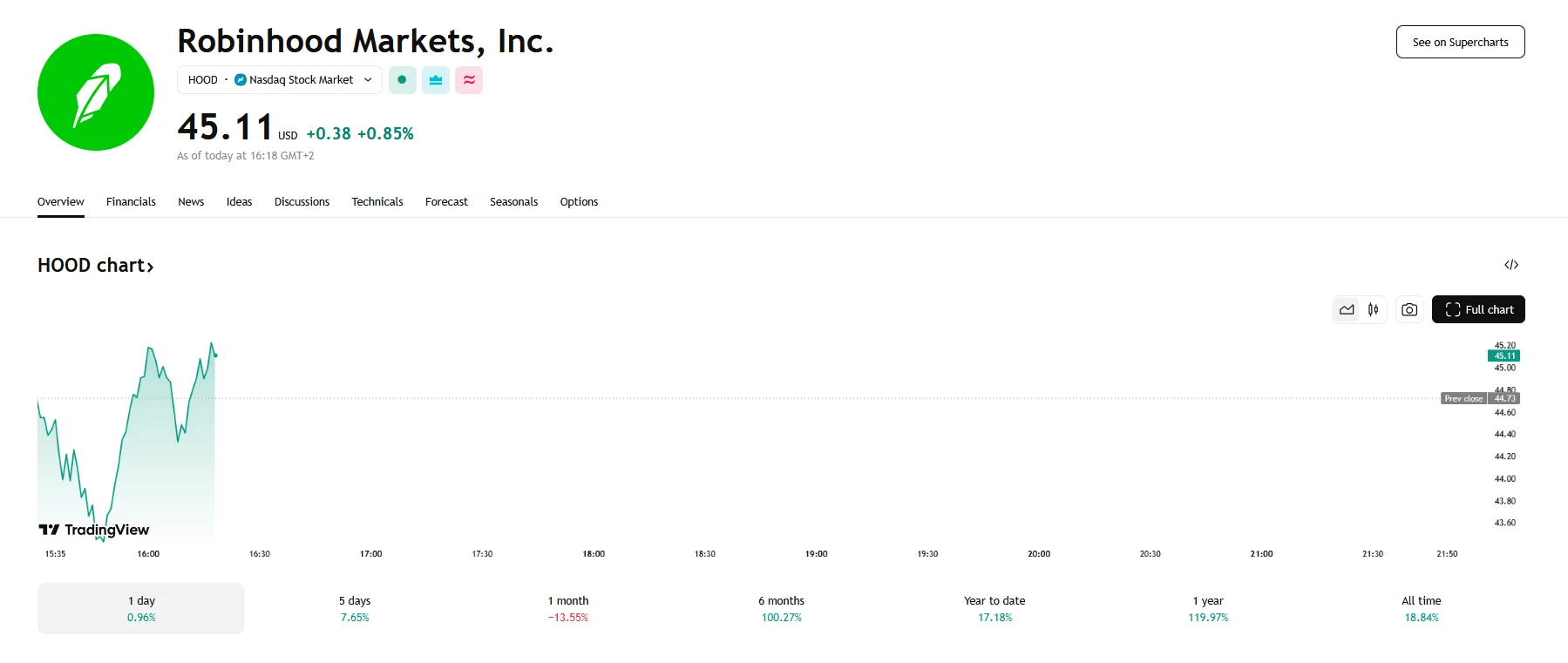

- Robinhood Markets’ share price managed to breach the $45 threshold on Thursday, but its performance has been shaky.

- Director Baiju Bhatt executed two significant share sales recently, offloading a total of 270,551 shares.

- Robinhood is collaborating with Coastal Community Bank in order to launch its new Robinhood Banking service.

Robinhood Shares Under Pressure Following Wednesday’s Slump

Robinhood Markets’ stock price fell 3% on Thursday, an initial extension of Wednesday’s 7.10% downward swing, before staging a recovery that saw the share price successfully reach the $45 mark. At press time, the stock is fluctuating between $44 and $45, and these price movements followed notable trading activity of Director Baiju Bhatt.

Bhatt sold a substantial number of shares in two separate transactions. On Monday, March 24th, Bhatt sold 47,023 shares ($2,180,457). This followed a larger sale that occurred last Friday, where he offloaded 223,528 shares for a total of $9,658,645. These sales resulted in a notable reduction in Bhatt’s holdings, raising concerns among investors about insider confidence in the company’s future performance.

Contrary to the stock’s volatility, Robinhood announced the launch of a new service, Robinhood Banking, which will offer savings accounts with a competitive 4% Annual Percentage Yield (APY). The service will be reserved for Robinhood’s Gold subscribers. This offering positions Robinhood to compete with traditional online banks while leveraging its existing user base.

The company is partnering with Coastal Community Bank to provide FDIC insurance protection for customer deposits, covering up to $2.5 million. Additionally, Robinhood is introducing “Robinhood Strategies,” a wealth management product designed to offer personalized portfolio management and investment insights with the help of AI technology.

The above initiatives prompted Cantor Fitzgerald analysts to reaffirm their positive outlook on Robinhood, maintaining an Overweight rating and a $62 price target. According to Cantor Fitzgerald, the introduction of these fresh products, along with the AI-driven “Robinhood Cortex,” represents a calculated effort by Robinhood to broaden its reach and gain a more significant portion of the financial services market.

The launch of these new services, including the AI-driven “Robinhood Cortex,” is seen by Cantor Fitzgerald as a strategic move to expand Robinhood’s Total Addressable Market (TAM) and capture a larger share of the financial services industry.