Key moments

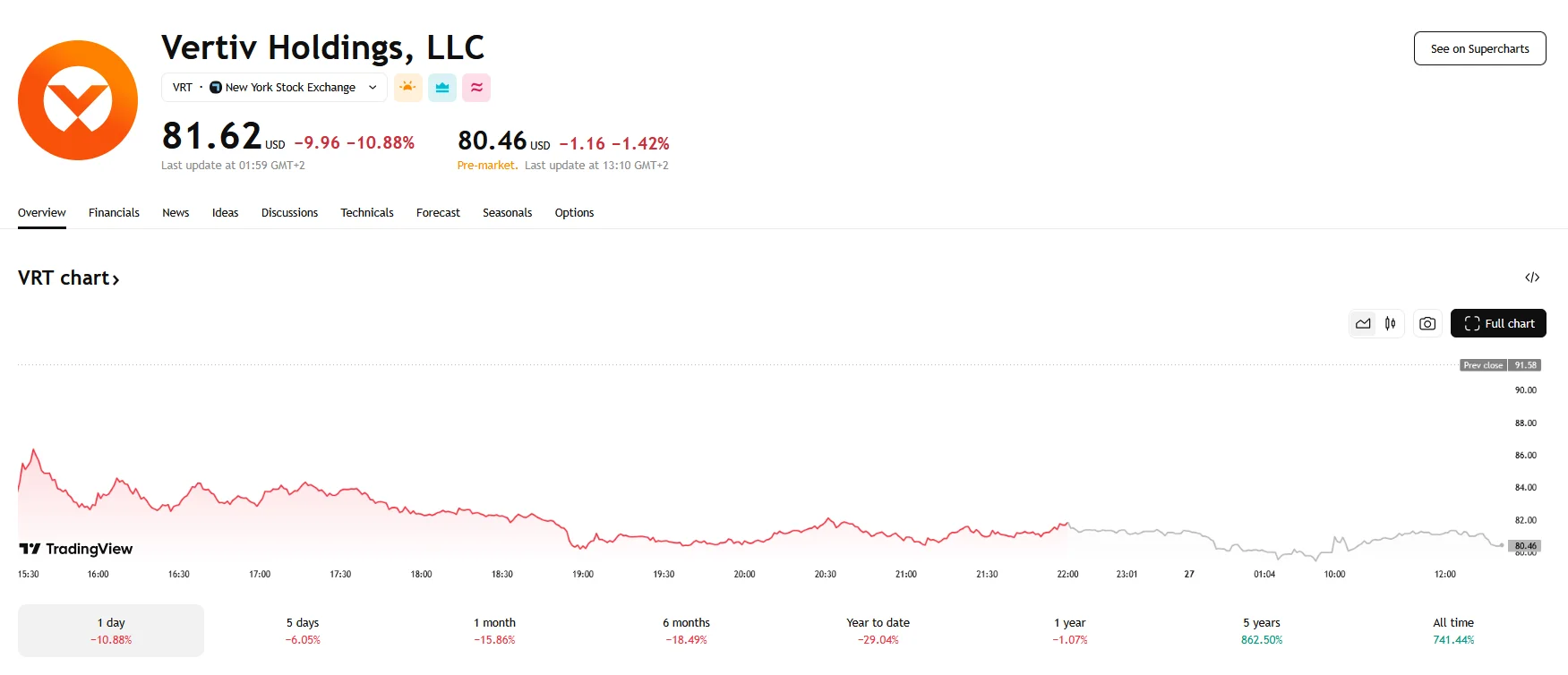

- Vertiv Holdings shares fell substantially during Wednesday’s session, with the closing price falling below the $82 mark.

- Prices did not improve on Thursday, with Vertiv dropping a further 1.42% to $80.46.

- A report by TD Cowen projects that equipment orders could decline.

Vertiv Holdings Shares Sink Below $81 on Thursday

Vertiv Holdings Co. (VRT) experienced a significant downturn on Wednesday, with its stock price plummeting by 10.88%, ultimately closing at $81.62. This sharp decline reflected growing investor apprehension, fueled by analysts’ projections of potential obstacles to the company’s future order volumes. In the subsequent pre-market trading, the stock showed no signs of recovery, further decreasing to $80.46. The decline in Vertiv Holdings’ share price appears to have been significantly influenced by a TD Cowen report, which projected potential setbacks for the company’s equipment order volumes in the first half of 2025.

The temporary decrease in equipment orders, as outlined by TD Cowen, is attributed to major technology firms like Microsoft and Google reconfiguring their data centers to support higher power consumption. Final equipment configurations hinge on the completion of the evolving data center designs. Supply chain checks at industry events such as Nvidia GTC and DCD Connect were at the core of this analysis, as they revealed a year-over-year increase in data center demand, but also an unexpected rise in lease cancellations and deferrals by Microsoft.

It should be noted that despite these concerns, Vertiv Holdings’ recent fourth-quarter performance for 2024 showcased impressive financial results. The company achieved a 27% growth rate, and profits increased by 13%, outpacing market expectations. Furthermore, Vertiv Holdings entered into a partnership with Tecogen Inc. to capitalize on the expanding data center market. The company also unveiled new solutions, namely the Vertiv™ Unify software and the CoolLoop Trim Cooler, aimed at bolstering AI capabilities and promoting energy conservation in data center operations.

However, investors’ immediate reaction to TD Cowen’s report reflected a focus on the potential near-term challenges. The projected decline in order volume for the first half of 2025, as suggested by the report, has generated investor unease, as it indicates Vertiv Holdings might struggle to secure orders until data center redesigns are complete and equipment specifications are known.