Key moments

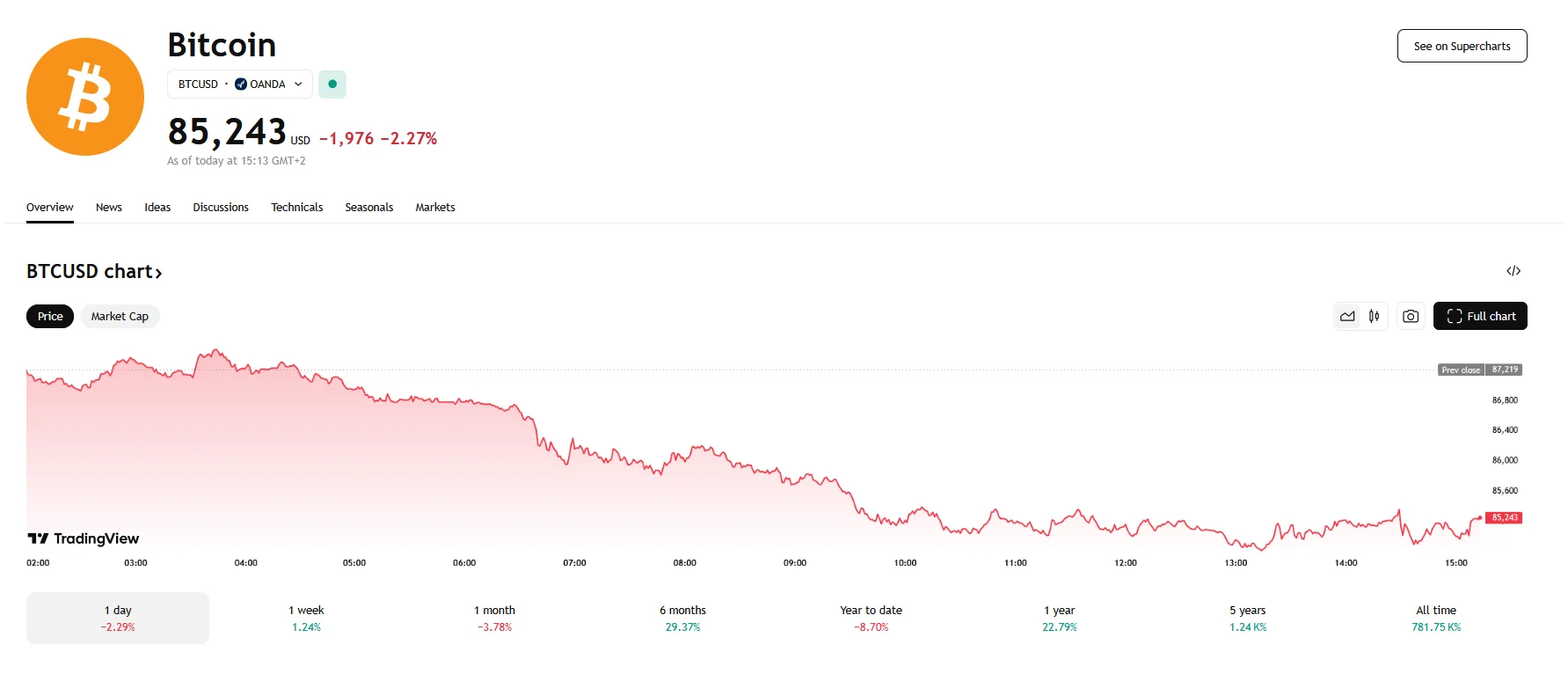

- Bitcoin’s value retreated by 2.27% on Friday.

- Ethereum’s price plummeted by 5.46%, reaching $1,893.8.

- Tariffs planned by the Trump Administration sparked trade war fears within the crypto sphere and traditional markets.

The cryptocurrency market experienced a notable downturn on Friday, with Bitcoin (BTC) and Ethereum (ETH) both registering significant losses. Bitcoin’s value decreased by 2.27%, reaching $85,243, while Ethereum witnessed a steeper decline of 5.46%, dropping to $1,893.8. This market movement reflects broader anxieties stemming from global economic uncertainties and escalating trade tensions.

A primary catalyst for investor apprehension in the crypto space is President Trump’s decision to impose tariffs of 25% on imported automobiles. This move has raised concerns about a potential trade war, particularly following Canada’s announcement of retaliatory tariffs against U.S. goods. The subsequent market turbulence has had a negative impact on major U.S. indices, and it has disproportionately affected risk-bearing assets, including cryptocurrencies. Moreover, analysts have identified a close relationship between Bitcoin’s price activity and U.S. stock market performance, with a 0.88 weekly correlation recorded on March 28th.

Further declines might be on the horizon, according to analysts. Bitcoin has struggled to maintain its position above the $86,000 mark, with analysts predicting a possible pullback towards the $84,300 level. The inability to reclaim the $90,000 threshold has raised concerns about a deeper correction, potentially pushing Bitcoin below $80,000.

Ethereum’s decline mirrors the broader cryptocurrency market’s bearish trend. The fall below the $1,900 price point represents a significant drop, driven by a combination of macroeconomic factors and internal market dynamics. Additionally, a wave of long liquidations has exacerbated Ethereum’s price decline. Thursday and Friday saw over $97 million worth of Ethereum positions being liquidated. Analysts expect Ethereum’s bearish momentum to persist, with potential targets as low as $1,200.

Despite these short-term challenges, increased network activity and a decrease in Ethereum’s exchange supply may create conditions favorable for a rebound. However, the immediate market sentiment remains cautious, with investors closely monitoring global economic developments and technical indicators.