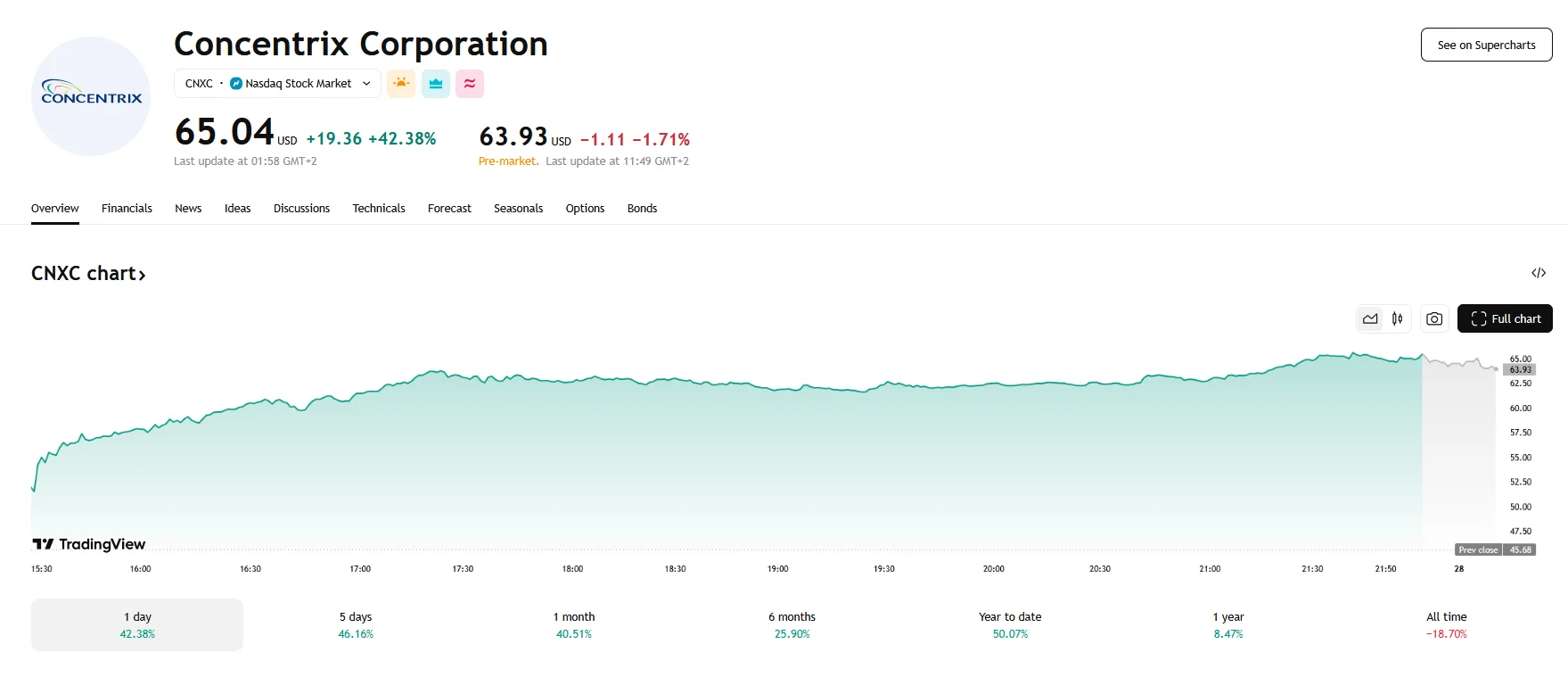

Key moments

- Concentrix shares reached $65.04, a 42.38% jump

- The company’s first-quarter financial report is the main catalyst behind the increase, as Q1 revenue rose to $2.37 billion.

- A minor decline saw the stock’s premarket prices fall 1.71%.

Concentrix Shares Skyrocket on Q1 Success

Concentrix stock experienced a dramatic surge on Thursday, climbing by 42.38% and concluding the trading day at $65.04 per share. This remarkable ascent stemmed from the company’s exceptional first-quarter financial results, which surpassed market expectations. Pre-market trading on Friday did witness a slight dip, however, with the stock sinking below $64.

Concentrix’s revenue for the first quarter reached $2.37 billion, marking a 1.3% increase when adjusted for currency fluctuations. The company’s non-GAAP operating income stood at $322 million, and its adjusted EBITDA reached $374 million, reflecting strong financial health.

Notably, non-GAAP earnings per share (EPS) surpassed projections, hitting $2.79, a 9% year-over-year increase. The company anticipates non-GAAP EPS to be between $11.18 and $11.77 for the fiscal year.

In terms of other projections, Concentrix has provided optimistic figures for the second quarter and the full fiscal year. Q2 revenue is expected to fall in the $2.370 billion to $2.390 billion range, while full-year revenue is projected to reach either $9.490 billion or climb toward $9.635 billion.

Analysts have offered varied perspectives on Concentrix’s future. Barrington analyst Vincent Colicchio reaffirmed a Buy rating and price target of $54.00, citing the company’s solid financial performance and growth prospects, particularly in AI-driven services. Bank of America Securities’ Ruplu Bhattacharya opted to maintain a “Hold” rating. He also adjusted the price target to $59.00, expressing cautious optimism but warning of potential risks.

Driving Concentrix’s exceptional Q1 performance was the successful integration of AI technologies throughout its business activities. A considerable expansion of its client base also played a role, along with the fact that revenue from major clients experienced significant growth. In addition, the company demonstrated notable progress in rolling out its IXLO suite.

Despite these positive indicators, Concentrix faces some challenges. Revenue stagnation was observed within the healthcare and media segments, and the company carries a considerable debt burden, featuring a €700 million obligation that is set to mature in September 2025. Nevertheless, Concentrix’s enhanced cash flow, coupled with its strategic emphasis on AI integration and business service development, has fostered optimism regarding its future growth trajectory.