Key moments

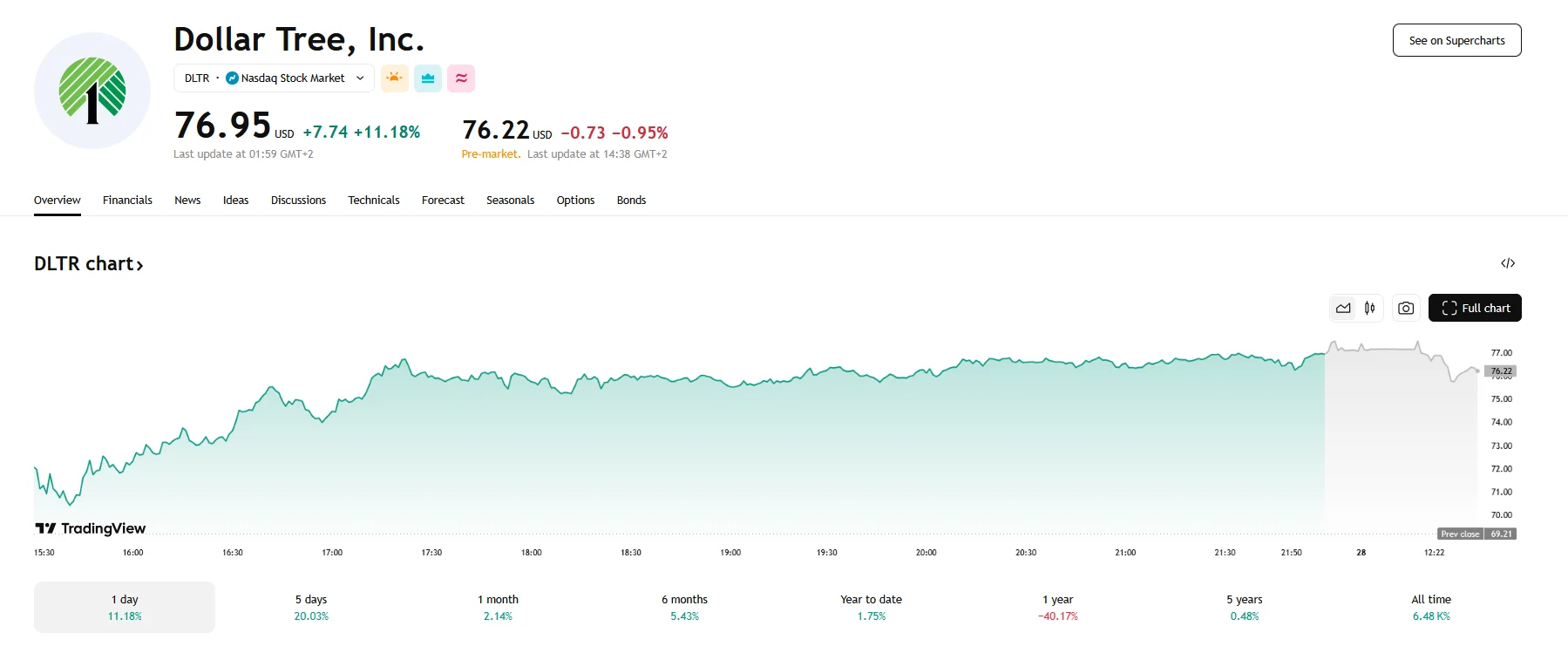

- Dollar Tree’s stock experienced a significant boost, rising 11.18% to $76.95 on Thursday.

- The pre-market share price receded to $76.22 on Friday but generally stayed above the $76 threshold.

- Market positivity arose from Dollar Tree’s deal to sell Family Dollar for $1 billion, and the transaction is expected to be finalized in 2025’s second quarter.

Dollar Tree Stock Hits $76.95 As Investors Welcome Family Dollar Deal

Dollar Tree’s stock surged 11.18% on Thursday and closed at $76.95 as investor confidence grew following the announcement of the Family Dollar divestiture. A slight retraction occurred during Friday’s pre-market hours, with the stock price dipping by 0.95% to $76.22.

The market’s positive reaction stemmed from Dollar Tree’s decision to sell Family Dollar, which had been unprofitable over the past twelve months, for $1 billion. The acquisition agreement was made between Dollar Tree, Brigade Capital Management, and Macellum Capital Management. Market reception has been positive despite the sale price falling 88% short of the $8.5 billion Dollar Tree paid when it purchased Family Dollar in 2015.

Analysts at UBS have expressed strong optimism regarding Dollar Tree’s prospects. A $95 price target (gain of around 27%) was set by Michael Lasser, who reaffirmed UBS’s “buy” rating. Lasser’s confidence is rooted in the belief that the Family Dollar sale will provide Dollar Tree with the necessary resources to invest in its core business, as well as improve cash flow and enable share buybacks.

Bernstein and JPMorgan analysts, on the other hand, adjusted their price target for Dollar Tree shares from $80 to $78. Margin risks that could stem from U.S. President Donald Trump’s tariff policies, as well as concerns regarding the company’s ability to achieve its 3-5% comparable sales growth guidance for fiscal year 2025, were cited as the main factors behind Bernstein’s decision. It should be noted that Bernstein did not change Dollar Tree’s “market perform” rating, however, largely due to expectations that Dollar Tree’s fiscal 2025 will see the company’s EPS grow to $5.43 thanks to the Family Dollar divestiture.