Key moments

- Germany’s annual consumer price growth slowed to 2.3% in March.

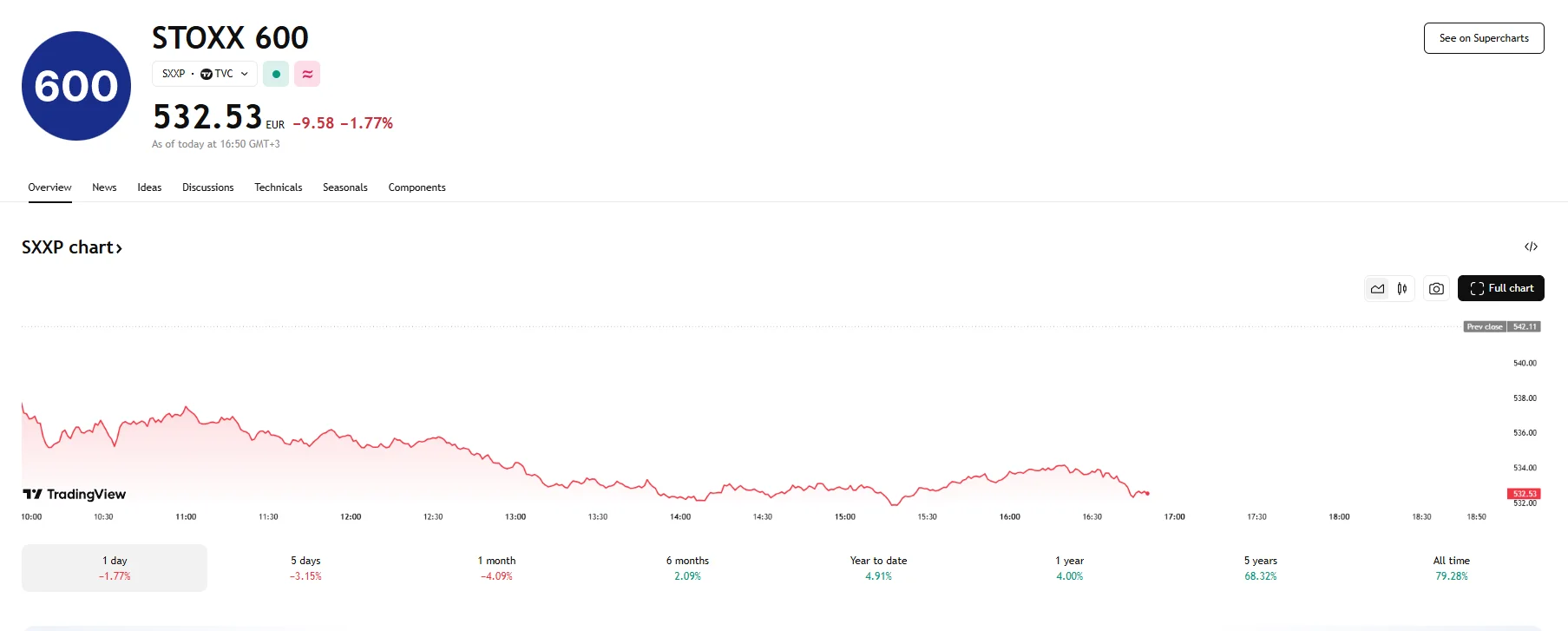

- European stocks tumbled, with the STOXX 600 index losing 1.77% and STOXX 50 falling 1.87%.

- The observed slowdown in Germany’s March inflation data may serve as a compelling justification for the European Central Bank to explore lowering interest rates.

European Stocks Plummet Amid US Tariff Threats and German Inflation Slowdown

Germany’s March inflation figures revealed a notable deceleration, offering a potential catalyst for the European Central Bank (ECB) to consider interest rate cuts. The Federal Statistics Office, Destatis, reported a 2.3% year-on-year increase in consumer prices, a decline from February’s 2.6% and slightly below the 2.4% projected by analysts. This downward trend, coupled with a core inflation rate of 2.5%, strengthened the argument for those advocating for a more accommodative monetary policy within the ECB.

Following the data’s disclosure, European equity markets experienced a significant downturn. The STOXX 600 index witnessed a substantial 1.77% drop, while the STOXX 50 index fell by 1.87%, reflecting heightened investor apprehension. This market volatility is largely attributed to mounting anxieties surrounding potential trade conflicts, particularly concerning impending tariffs imposed by the United States. President Trump’s proposed tariffs, including those targeting the automobile sector and a potential 20% global tariff on imports, are major contributors to market uncertainty.

Investors continue monitoring tariff developments, as well as the potential for interest cuts in the Eurozone. The ECB faces a complex balancing act, weighing the potential benefits of stimulating economic growth against the risk of inflationary pressures. Although the March inflation figures indicate a moderation in price increases, the central bank remains vigilant. ECB President Christine Lagarde has emphasized the ongoing struggle with inflation, acknowledging that while progress has been made, sustained vigilance is crucial. The ECB must consider factors that may cause inflation to increase, such as rising defense spending in Germany and retaliatory tariffs from the European Union.

The downturn in the services sector, where companies are finding it increasingly challenging to pass on rising labor costs, may further incentivize the ECB to pursue rate cuts. The weak Eurozone economy, coupled with the potential adverse effects of U.S. tariffs on GDP growth, presents a compelling case for easing monetary policy. However, the ECB must also factor in the potential for import price inflation, which could counteract the effects of lower interest rates.