Key moments

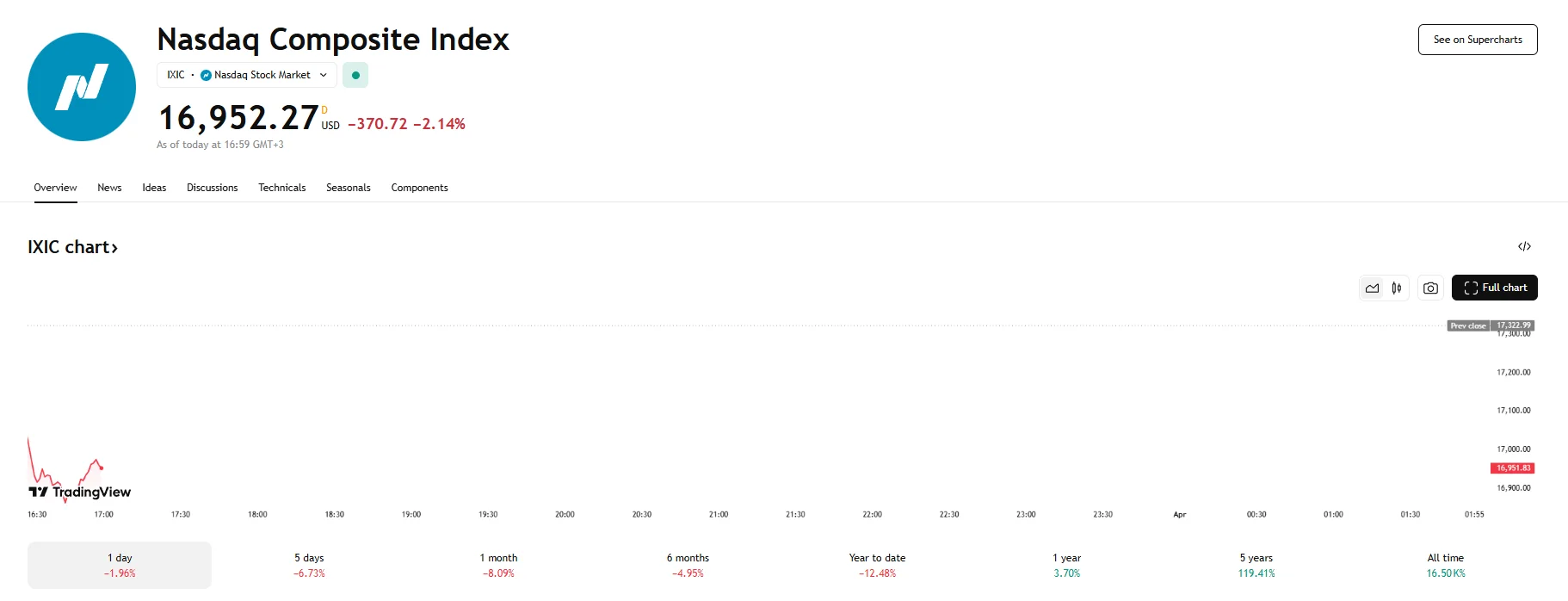

- Monday saw U.S. equity markets plummet as the Nasdaq Composite index sank 2.14%.

- The S&P 500 and Dow Jones Industrial Average also registered declines, falling 0.96% and 0.40% respectively.

- Leading tech firms faced substantial losses, with Tesla dipping over 6%.

Tariff Fears Trigger Sell-Off

U.S. stock markets experienced a significant downturn Monday, with the Nasdaq Composite index leading the decline. The index fell by a substantial 2.14% shortly after the markets opened, reflecting growing investor unease. This sell-off occurred as market participants braced for the implementation of new tariffs announced by the Trump administration, scheduled for later in the week.

The broader market also felt the impact, with the S&P 500 registering a near 1% decline and the Dow Jones Industrial Average dropping by a more modest 0.40%. This widespread market retreat followed a period of volatility marked by concerns about the potential economic repercussions of escalating trade tensions. The looming tariffs, intended as reciprocal measures against nations imposing levies on U.S. exports, have created a climate of significant market uncertainty.

The technology sector, which had been particularly volatile in recent trading sessions, bore the brunt of the sell-off. Major tech giants experienced significant losses, with electric vehicle manufacturer Tesla witnessing a drop of over 6%. Chipmaker Nvidia also saw its stock price decline by 4.51%, and e-commerce giant Amazon fell by 3.39%.

Investor confidence has been further eroded by reports indicating President Trump’s intent to impose global tariffs from the outset rather than focusing on a select group. This broad approach, along with the potential 25% levy that could affect nations reliant on Russian oil, has heightened concerns about the potential for a global trade war.

The market’s reaction reflects a broader trend of investor apprehension, as the major indices are on track to conclude March with considerable losses. The ongoing trade tensions, coupled with recent economic data indicating potential weaknesses in consumer sentiment and inflationary pressures, have contributed to a sustained sell-off.