Key moments

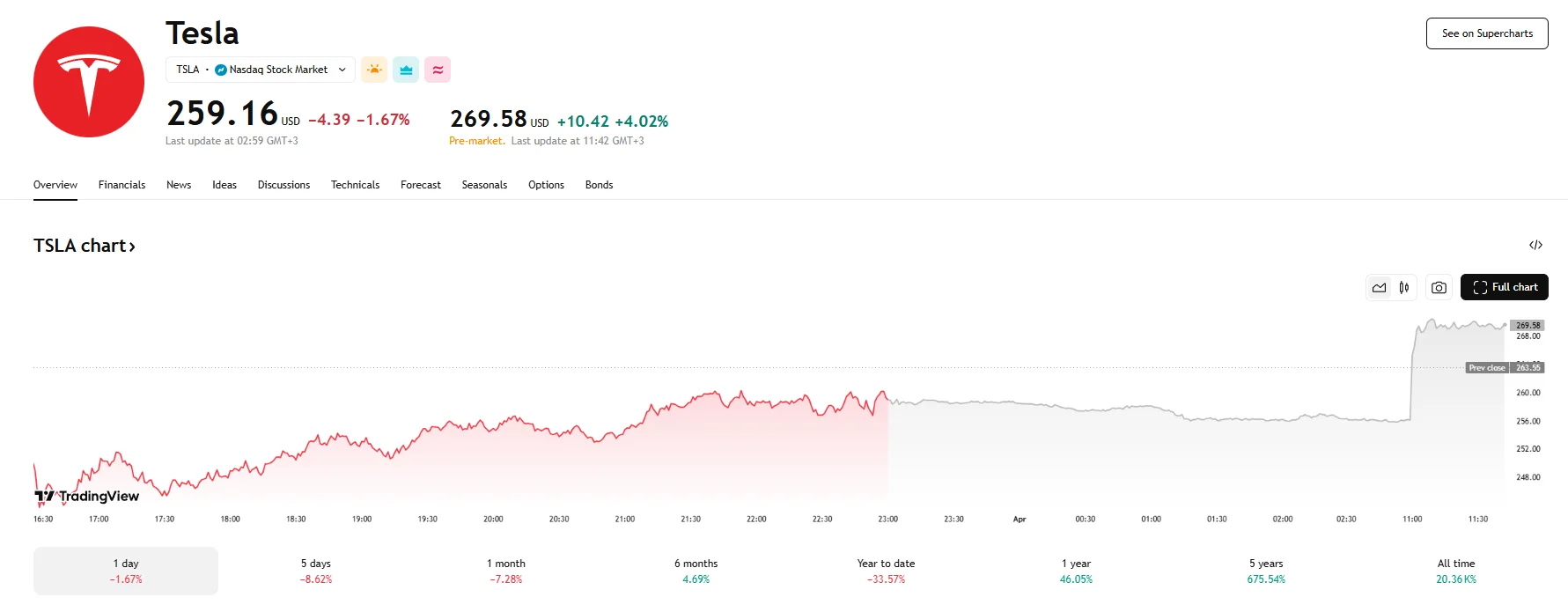

- Tesla shares experienced a notable 4% pre-market increase on Tuesday, with the stock price reaching $269.58.

- In Sweden, Tesla sold 911 cars in March, 63.9% less than last year.

- The company’s presence in France also suffered, as it reported a 36.83% decrease in purchases.

Tesla Stock Rebounds Despite Record Low French, Swedish Sales

Tesla Inc. (NASDAQ: TSLA) has maintained a notable surge in its stock value during Tuesday’s pre-market trading. The electric vehicle manufacturer’s shares climbed by approximately 4%, pushing the price towards $270. This marks a significant recovery from the previous day’s 1.67% decline, which saw the stock close at $259.16.

The positive pre-market activity contrasts sharply with recently released data revealing a substantial drop in Tesla’s sales figures in key European markets. In March, sales to French consumers plummeted to 3,157 units, marking a 36.83% year-over-year decrease. The Q1 figures also fell, standing at 6,693.

In Sweden, the situation was even more dire, as Tesla managed to sell 1,929 vehicles over the first quarter. Moreover, March sales fell to a mere 911 vehicles, the lowest since 2021, marking a staggering 63.9% decline compared to the same period last year.

Several factors have contributed to Tesla’s sales slump in Europe. The company’s aging vehicle lineup faces increasing competition from both traditional automakers and emerging Chinese electric vehicle manufacturers, which are launching newer and often more affordable models. Additionally, CEO Elon Musk’s vocal support for right-wing political parties in Europe has alienated some potential customers.

Analysts are closely monitoring Tesla’s global first-quarter delivery figures, scheduled for release on Wednesday, to gauge overall consumer sentiment towards the brand. According to Wall Street, Tesla will report a 3.6% YoY drop in deliveries, with estimates averaging around 373,000 vehicles. However, Deutsche Bank analysts’ predictions range as low as 340,000 to 350,000 units.

The company’s stock, which has experienced a significant decline this year, is also facing the potential impact of newly imposed tariffs on imported vehicles and auto parts. While Tesla’s domestic manufacturing may mitigate some of the effects, the company remains vulnerable to retaliatory tariffs from other countries.