Key moments

- Bitcoin’s price sank below $84,600 on Wednesday, struggling to maintain a value above $85,000.

- Significant withdrawals from Bitcoin ETFs of $218 million occurred this week, with Ethereum ETFs also witnessing outflows.

- BlackRock’s IBIT ETF was the sole fund that registered positive flow activity.

Bitcoin ETF Outflows Hit $218 Million

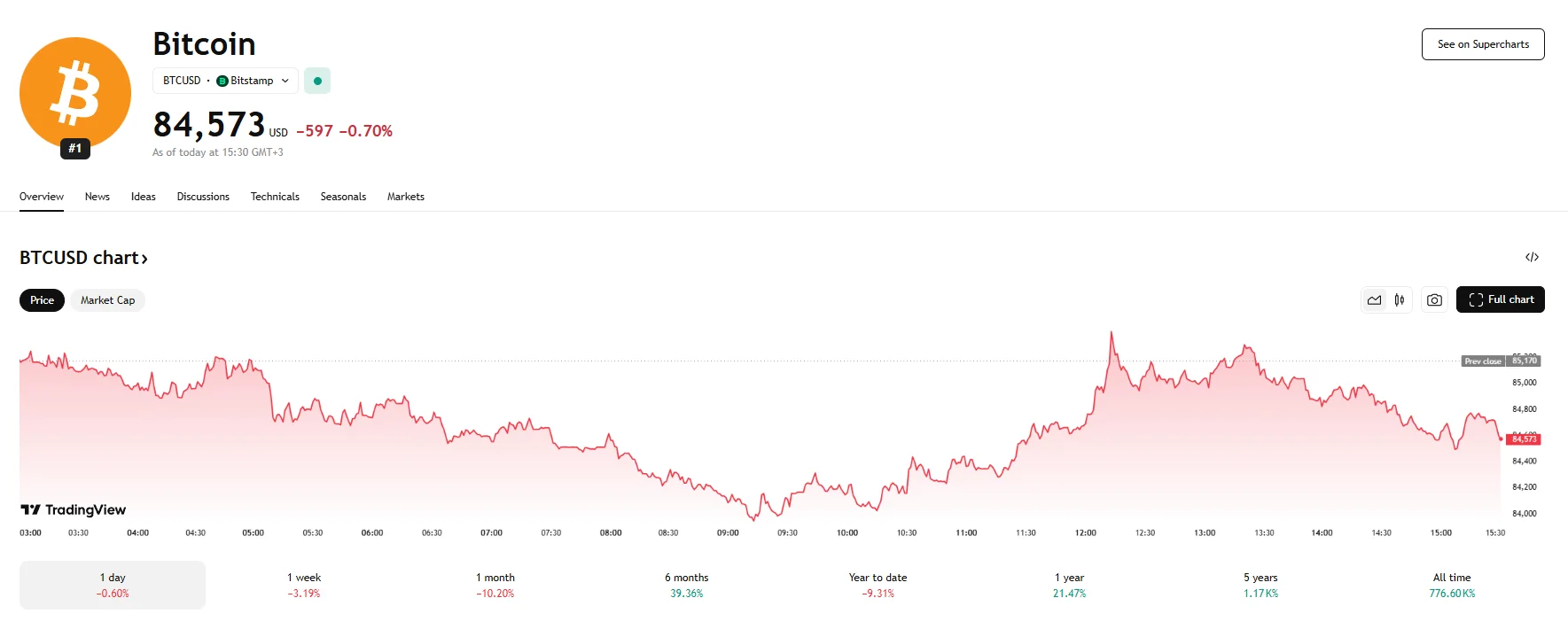

Bitcoin experienced a slight downturn, retracting by 0.70% to reach $84,573 after briefly surpassing the $85,000 mark on Wednesday. This movement occurred amid increasing market anxiety, primarily driven by the anticipation of President Trump’s impending tariff announcements. The broader cryptocurrency market reflected this sentiment, with persistent outflows from both Bitcoin and Ethereum ETFs indicating a reduction in institutional risk appetite.

The week witnessed a substantial $218 million exodus from Bitcoin ETFs. Notable outflows were recorded from funds managed by Bitwise and Ark Invest, signaling a broad trend of risk aversion. Ethereum ETFs also saw outflows, with data from Farside indicating the figure stood at $3.6 million. BlackRock’s iShares Bitcoin Trust ETF (IBIT) was the only exception.

As details regarding the Trump Administration’s tariff policies remain uncertain, with potential ramifications for global trade and the cryptocurrency market looming large, traders and investors have adopted a cautious stance as they await the details of Trump’s “Liberation Day” announcement. Reports by Bloomberg indicated that the White House had yet to finalize its tariff plan, further exacerbating market jitters.

The potential for volatility in traditional markets, particularly the S&P 500, has also weighed on Bitcoin’s performance. Historical data suggests a strong correlation between Bitcoin and U.S. equities, with sell-offs in the stock market often triggering corresponding declines in the cryptocurrency. This correlation has prompted institutional investors to reduce their exposure to Bitcoin, favoring perceived safe-haven assets such as gold.

This risk-averse sentiment is evidenced by the Bitcoin ETF outflows, particularly the $158 million that SoSoValue identified on Tuesday. Analysts have cautioned about the potential for significant market volatility, with some predicting sharp declines in both stock and cryptocurrency prices should Trump implement broad tariffs.