Key moments

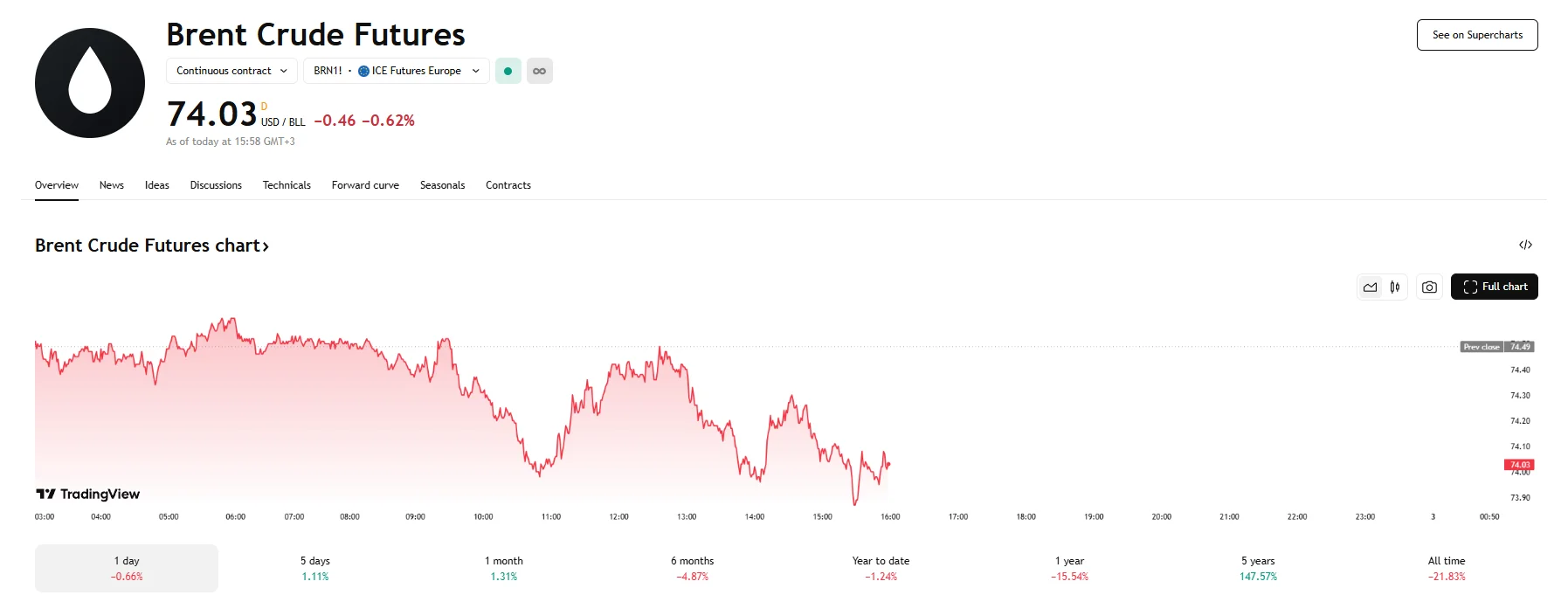

- Brent crude futures fell 0.62% on Wednesday, hitting $74.03.

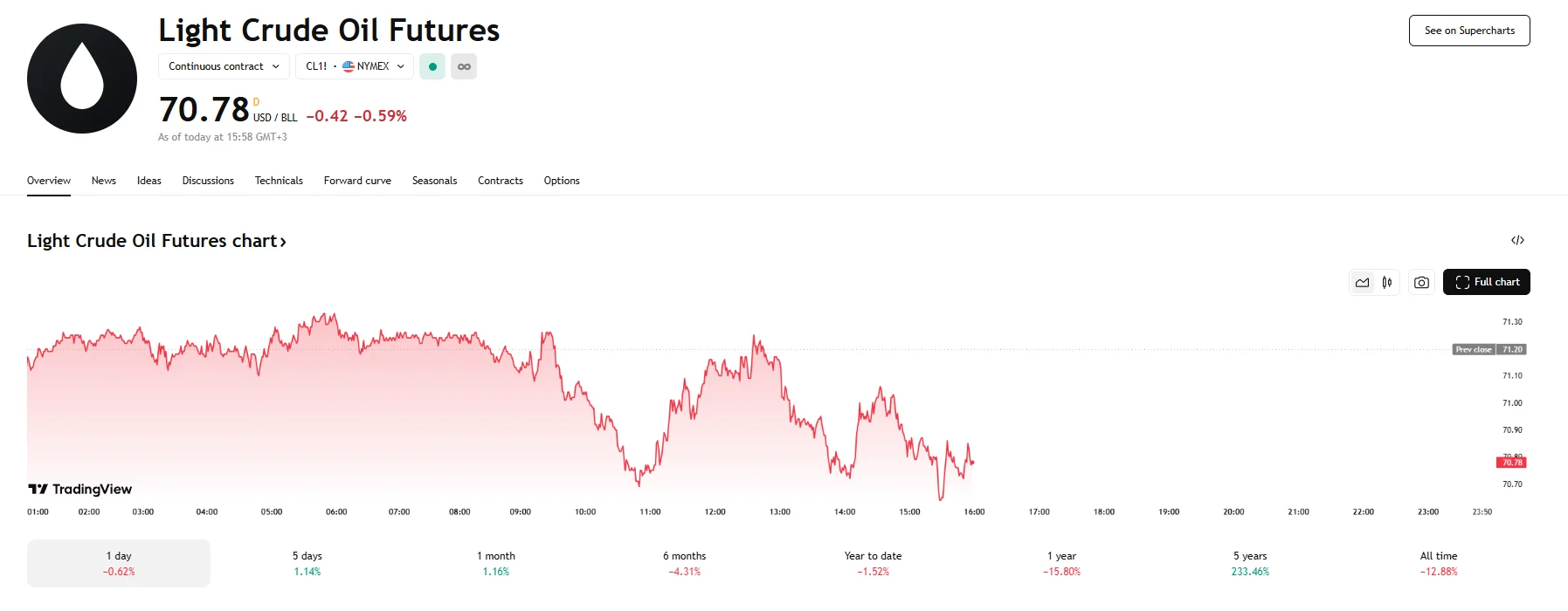

- WTI also dropped, with its price lowering to $70.78.

- Market anxiety surrounding upcoming U.S. tariff announcements and growing concerns about rising crude oil inventories played key roles in oil price fluctuations.

Brent and WTI Slip Amid Market Jitters

Wednesday saw oil market prices going downwards, as both Brent and West Texas Intermediate (WTI) crude oil futures declined. Brent crude saw a 0.62% decrease, with its price falling to $74.03 per barrel. Meanwhile, WTI crude witnessed a near 1% drop that pushed the price below $71. This downward pressure stemmed from a combination of factors, including apprehension surrounding impending U.S. tariff announcements and concerns over growing crude oil supply.

Traders are closely monitoring the White House’s scheduled announcement of new U.S. tariffs. President Trump has previously threatened that tariff policies could be broad and apply to numerous trade partners. Should a trade war be sparked as a result of these tariffs, market participants fear it could impede global economic growth and lower crude oil demand.

The market’s reaction also reflected concerns about the latest crude oil supply data. Data from the American Petroleum Institute indicated a significant increase in U.S. crude oil inventories, with a 6 million barrel rise being reported in the week ending March 28th. This added to the downward pressure on prices. Gasoline inventories, on the other hand, saw a decrease of 1.6 million barrels. In addition, distillate inventories declined by 11,000 barrels.

Geopolitical factors, such as recent sanctions on Iran and potential secondary tariffs on countries that purchase Russian oil, provided some support for crude oil prices. Nevertheless, traders maintained a generally cautious perspective, concentrating their attention on the broader economic repercussions expected from the upcoming tariffs.

In summary, the decline in Brent and WTI crude oil prices reflected a confluence of factors, including apprehension over U.S. tariffs, concerns about rising inventories, and ongoing geopolitical tensions. The market’s focus remained on the upcoming tariff announcements and the EIA’s inventory report, both of which were expected to provide further clarity on the direction of oil prices.