Key moments

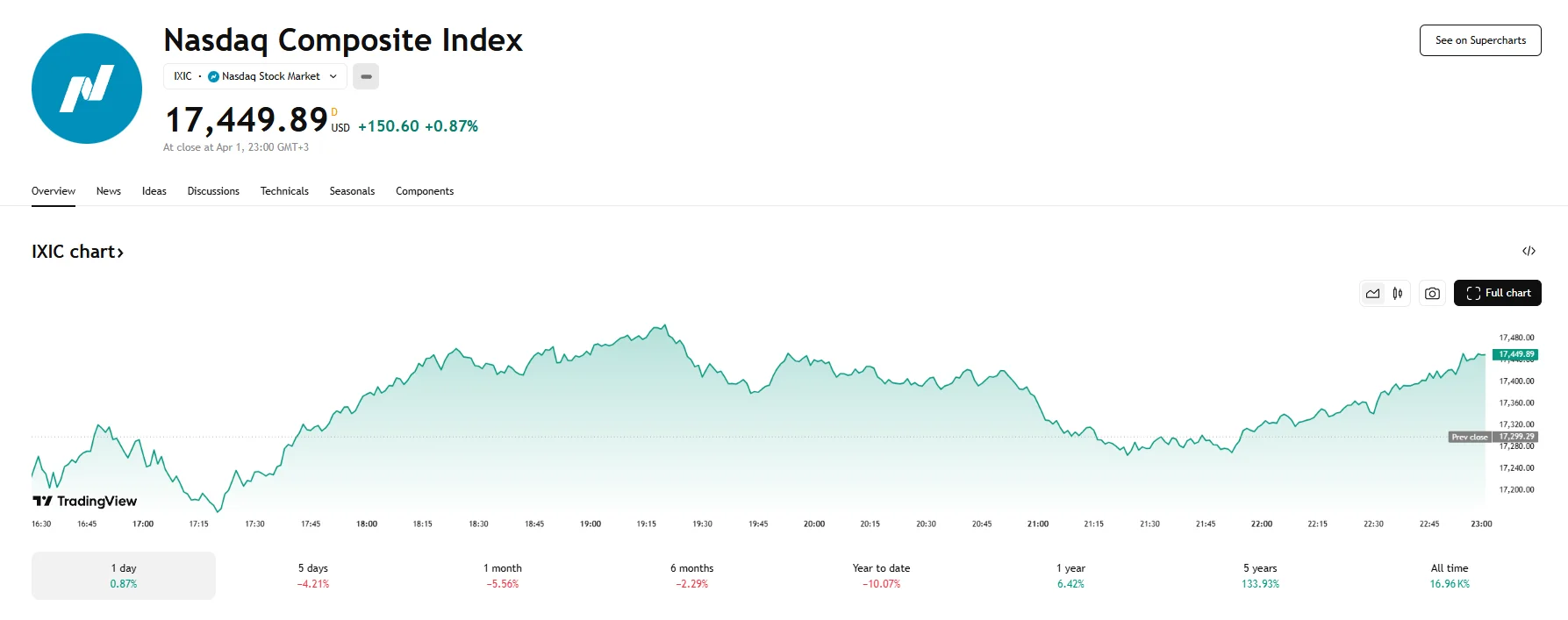

- The Nasdaq Composite jumped 0.87% on Tuesday, while the S&P 500 index edged 0.38%.

- Dow Jones underperformed by falling 0.03% after Johnson & Johnson’s stock fell sharply.

- The first quarter of 2025 proved challenging for Wall Street, with major US indices suffering losses.

Stocks Gained on Tuesday, But Q1 Figures Slump

Despite the overarching uncertainty as investors braced themselves for the impending announcement of new tariffs from the Trump administration, the tech-heavy Nasdaq Composite managed to close Tuesday’s trading session with a 0.87% gain. The surge was fueled by a resurgence in technology stocks. However, the broader market remained cautious, with the S&P 500 registering a more modest 0.38% increase, while the Dow Jones Industrial Average slipped by a marginal 0.03%.

The Nasdaq’s upward trajectory was largely driven by a surge in demand for technology giants. Leading the charge was Tesla, which saw its shares jump by nearly 4% ahead of its first-quarter deliveries report. Other major tech players, including Microsoft, Nvidia, Alphabet, Amazon, and Meta Platforms, all experienced gains exceeding 1%, contributing to the index’s positive performance.

Conversely, the Dow Jones Industrial Average faced headwinds, primarily due to a sharp decline in Johnson & Johnson shares after the dismissal of a proposed $10 billion settlement in a talc-related lawsuit, triggering a sell-off that weighed heavily on the index. The Dow Jones, after minor fluctuations, ended around 0.03% lower. Beyond Johnson & Johnson, airline stocks also faced downward pressure following analyst downgrades.

The S&P 500’s figures fluctuated on Tuesday, swinging between gains and losses as investors grappled with economic data and the looming tariff announcement. The index ended just above 5,630, with consumer discretionary stocks rising while investors lost confidence in healthcare stocks.

The market’s anxiety stemmed from the anticipation of President Trump’s tariff announcement, scheduled for Wednesday. The lack of clarity surrounding the details of the tariffs has created a sense of unease, with concerns that the trade measures could trigger inflation and hinder economic growth. This uncertainty was further compounded by weaker-than-expected economic data, including a decline in job openings and a contraction in manufacturing activity.

While some indices ended Tuesday on a positive note, 2025’s first quarter has been challenging for the U.S. stock market, with Wall Street experiencing a significant downturn. The S&P 500 registered its worst quarterly performance since 2022’s third quarter, declining by 4.3%. The Nasdaq Composite ended Q1 with an even steeper decline, falling by 10.3%. The “Magnificent Seven” tech stocks, which had previously driven market gains, were subject to significant sell-offs, with their combined value tumbling by approximately 16% in the first quarter.

The Dow Jones Industrial Average also fell by 0.9%. This quarterly downturn marks a stark contrast to the market’s performance in previous quarters, highlighting the impact of policy uncertainty and economic concerns.