Key moments

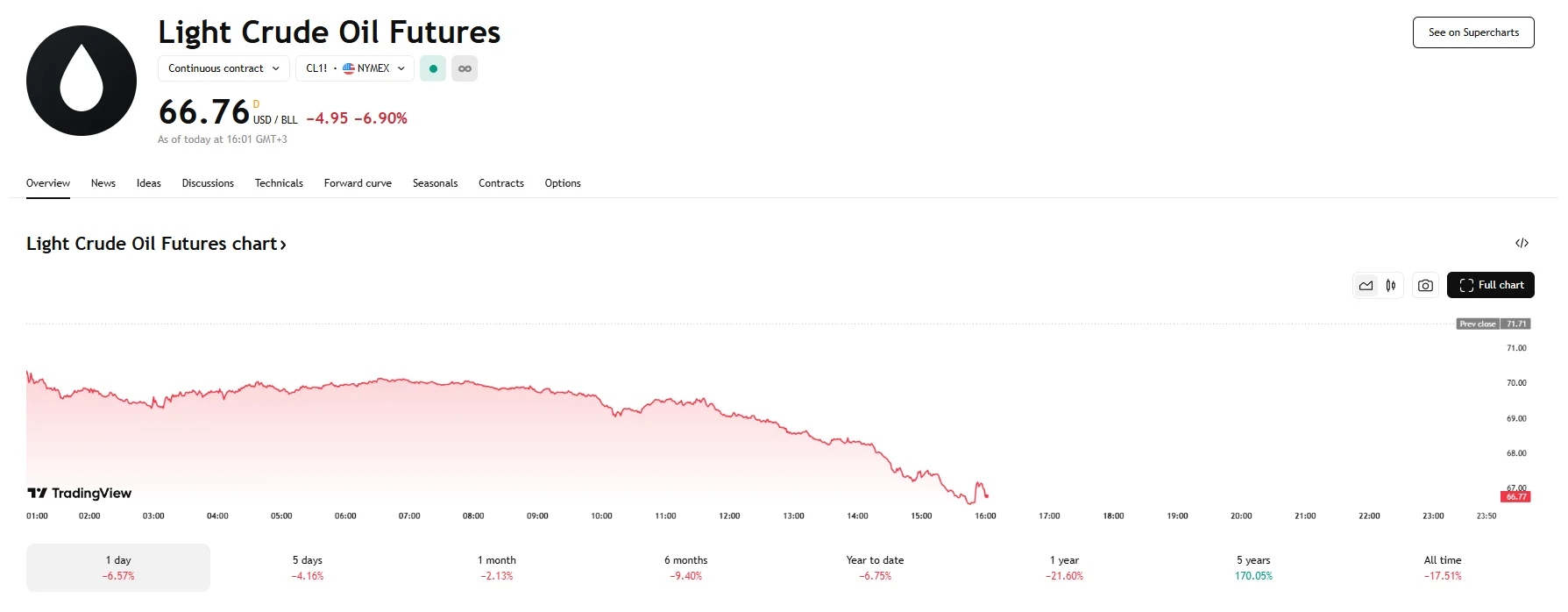

- Brent crude futures plummeted near $70 on Thursday after a 6.40% fall.

- West Texas Intermediate crude futures dropped as well, reaching $66.70.

- OPEC+ opted to increase oil production for May, setting the output target at 411,000 barrels per day. The supply increase discouraged investors, with sentiments also dampened by the Trump administration’s latest tariff announcements.

Tariff Shockwaves Exert Pressure on Crude Oil Prices

The global oil market was marked by sharp price declines on Thursday. Brent crude oil futures, a key benchmark, saw a substantial drop, approaching $70 per barrel after a 6.40% fall. Simultaneously, West Texas Intermediate (WTI) crude oil futures also faced pressure, declining by almost 7% and trading around $66.70 per barrel.

This abrupt shift followed the unveiling of new trade policies that, while excluding oil, gas, and refined products imports, have injected considerable uncertainty into the broad economic landscape. It is anticipated that the cost of these tariffs will fall upon domestic consumers and businesses, ultimately placing downward pressure on global economic growth and weighing on confidence in crude oil futures.

Compounding this situation, the OPEC+ alliance opted to accelerate its plan to unwind oil output cuts. By increasing the May output target to 411,000 barrels per day from the original 135,000, this decision further augmented the existing market surplus. The US tariff announcements and OPEC+’s output adjustments were both received poorly by the market.

According to IG market strategist Yeap Jun Rong, investors and traders were caught off guard by the final scope of the tariff implementations. Earlier forecasts predicted a flat 15-20% tariff, however, the end result was noted to be more severe as some nations are being subject to tariffs way beyond 20%. China is a notable example, as the Wednesday tariffs of 35% pushed its US export duties to a total of 54%. The European Union was hit with 20%, while Vietnam and Japan are now facing duties of 46% and 24%, respectively.

Analysts predict increased volatility in oil markets as nations may attempt negotiations to mitigate tariff impacts or enact retaliatory actions, and fears of a potential recession are now widespread among market participants. Furthermore, the US Energy Information Administration’s latest report, which showed an unexpected increase in US crude inventories to 6.2 million barrels, also had a negative impact on investor sentiment.