Key moments

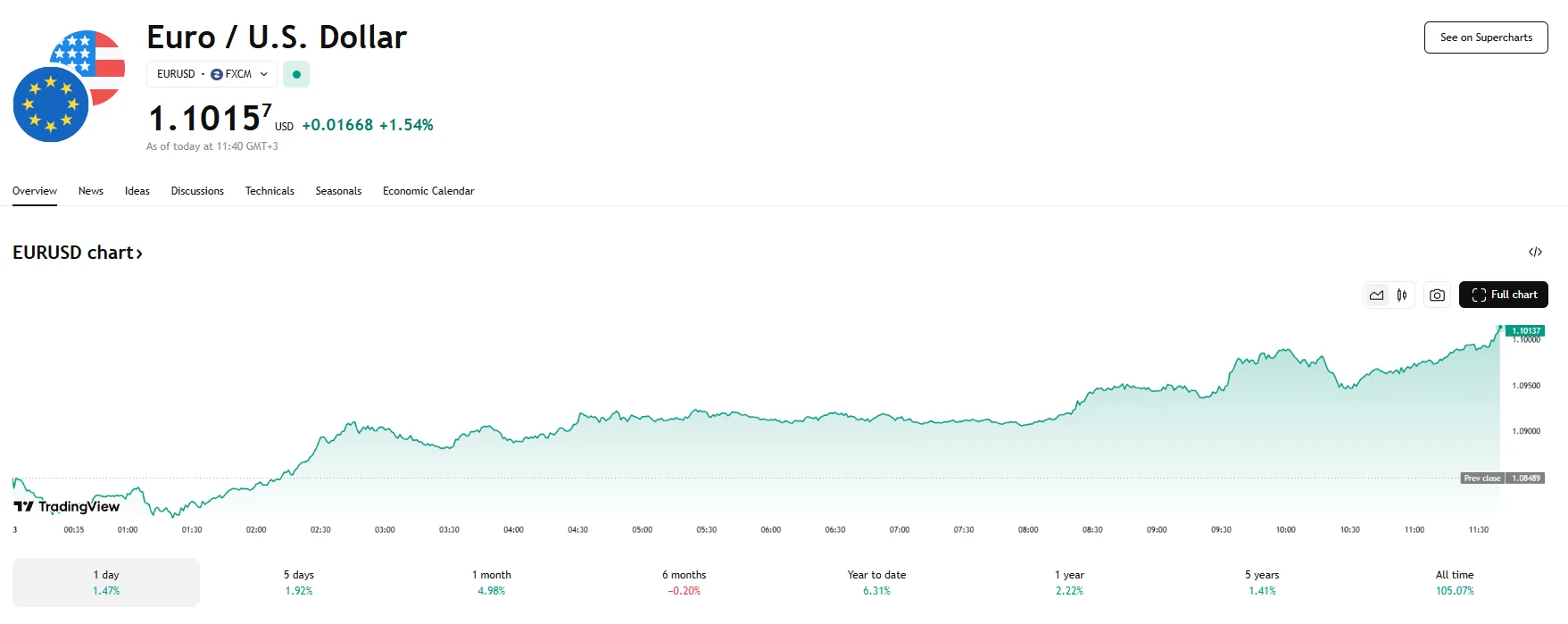

- The EUR/USD exchange rate has hit its highest value in six months, reaching 1.1010 and climbing even higher.

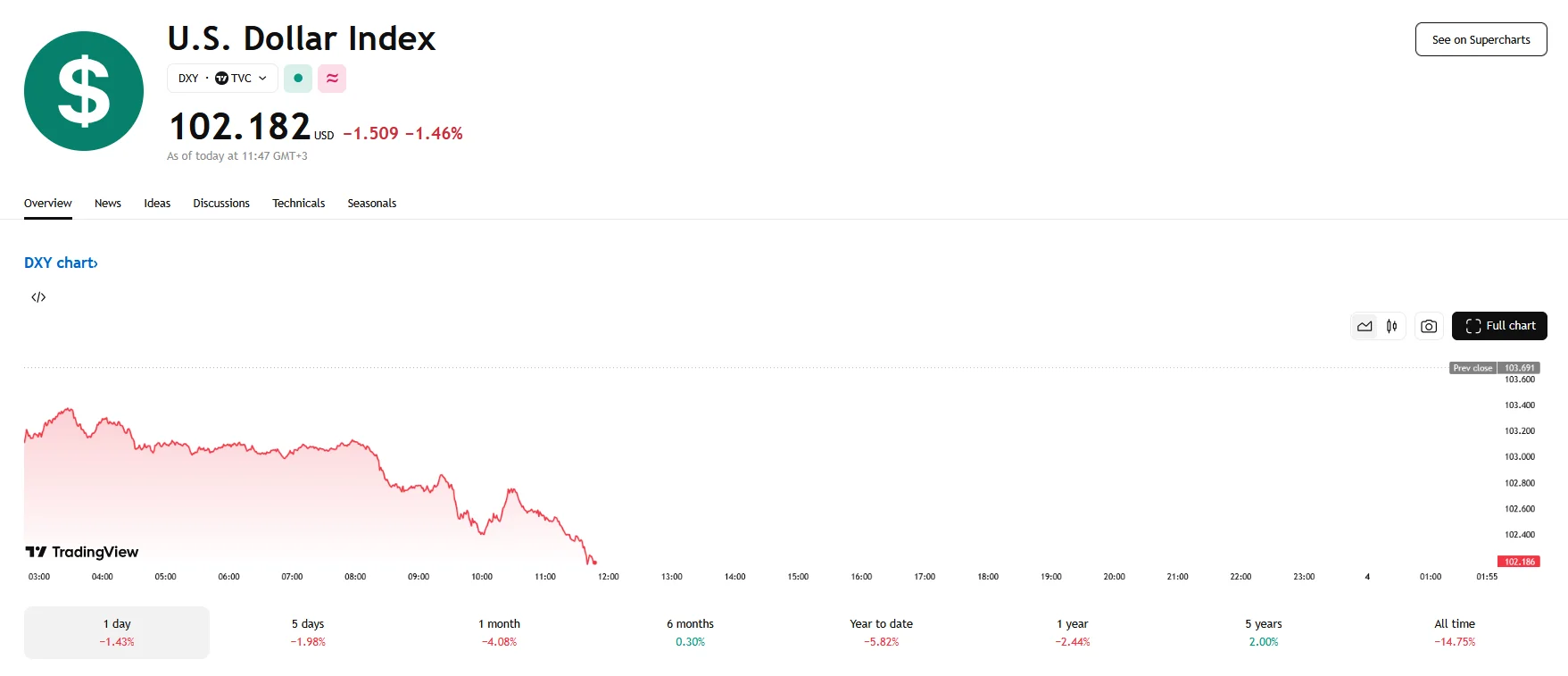

- The US Dollar Index fell 1.46% to 102.182.

- These price movements were the result of President Trump’s tariffs, which turned out to be harsher than expected.

The announcement of sweeping US tariffs, spearheaded by a 10% baseline levy on numerous imports, triggered a significant shift in currency markets, notably propelling the EUR/USD exchange rate to a six-month high. The euro soared past the 1.1010 threshold and even momentarily exceeded 1.1015 as the US dollar weakened considerably in response to President Trump’s trade policies.

The US Dollar Index (DXY), which measures the dollar’s value against a basket of six major currencies, plummeted 1.46% to 102.182. This decline reflected widespread investor apprehension regarding the economic implications of the newly imposed tariffs. The euro, viewed as a substantial and liquid alternative to the dollar, benefited from this weakened greenback.

President Trump’s decision to implement these tariffs, including a 20% levy on European Union imports, prompted strong reactions across local markets. Given that over 20% of EU exports are destined for the US, particularly affecting economies like Germany, the potential for a trade war looms large.

OCBC analysts Frances Cheung and Christopher Wong observed a diminishing bearish momentum for the euro, with the Relative Strength Index (RSI) indicating a potential for further gains. The next resistance level was identified at 1.1020, with support levels at 1.0850 and 1.0820. These technical indicators, coupled with the fundamental backdrop of US tariff policies, contributed to the euro’s upward trajectory. They did mention the tariffs may exert pressure on the euro, however.

Despite the US being a major economic power, the analysts cautioned against underestimating the economic strength of other regions, such as the EU and China. They suggested that if US growth falters due to its own protectionist measures while other economies maintain stability, the dollar could weaken further. This scenario, they stressed, could even challenge the dollar’s status as a reserve currency when combined with rising US debt and diminishing US economic exceptionalism.