Key moments

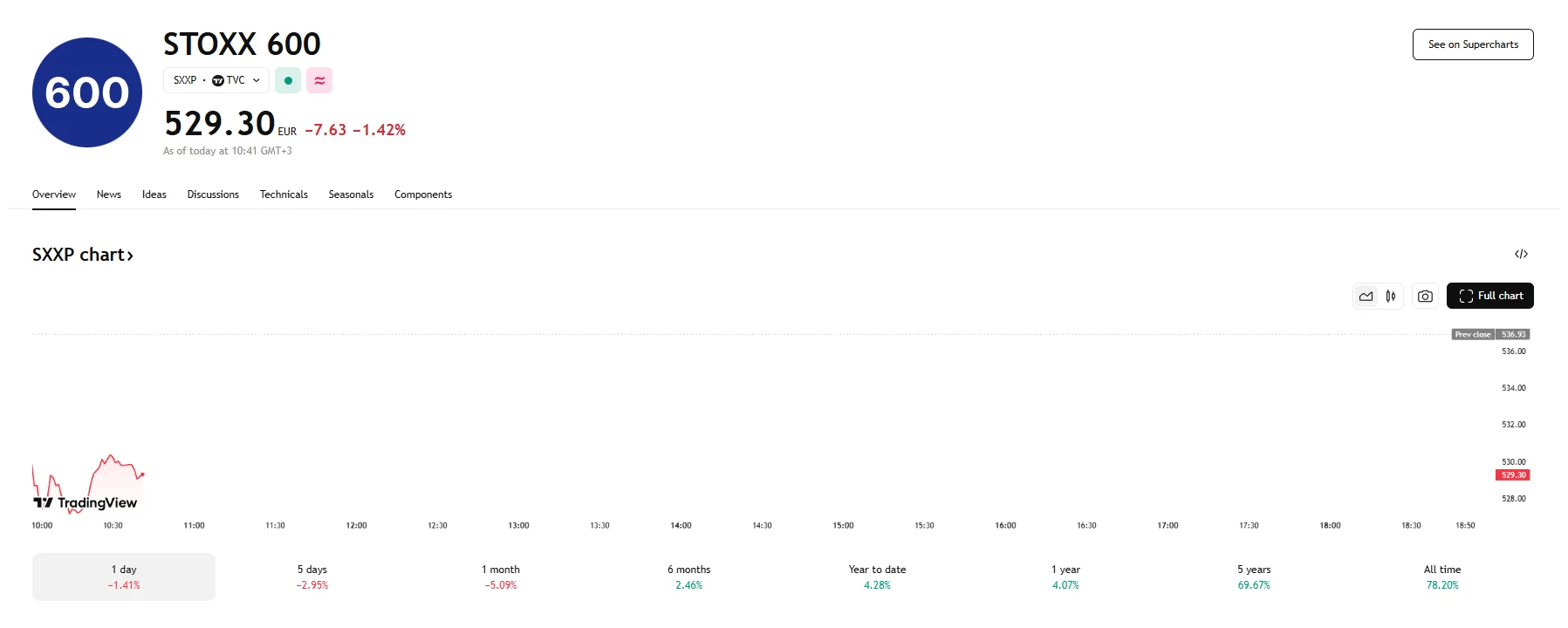

- The STOXX 600 index sank by 1.42% on Thursday after the White House announced 20% tariffs on imports from Europe.

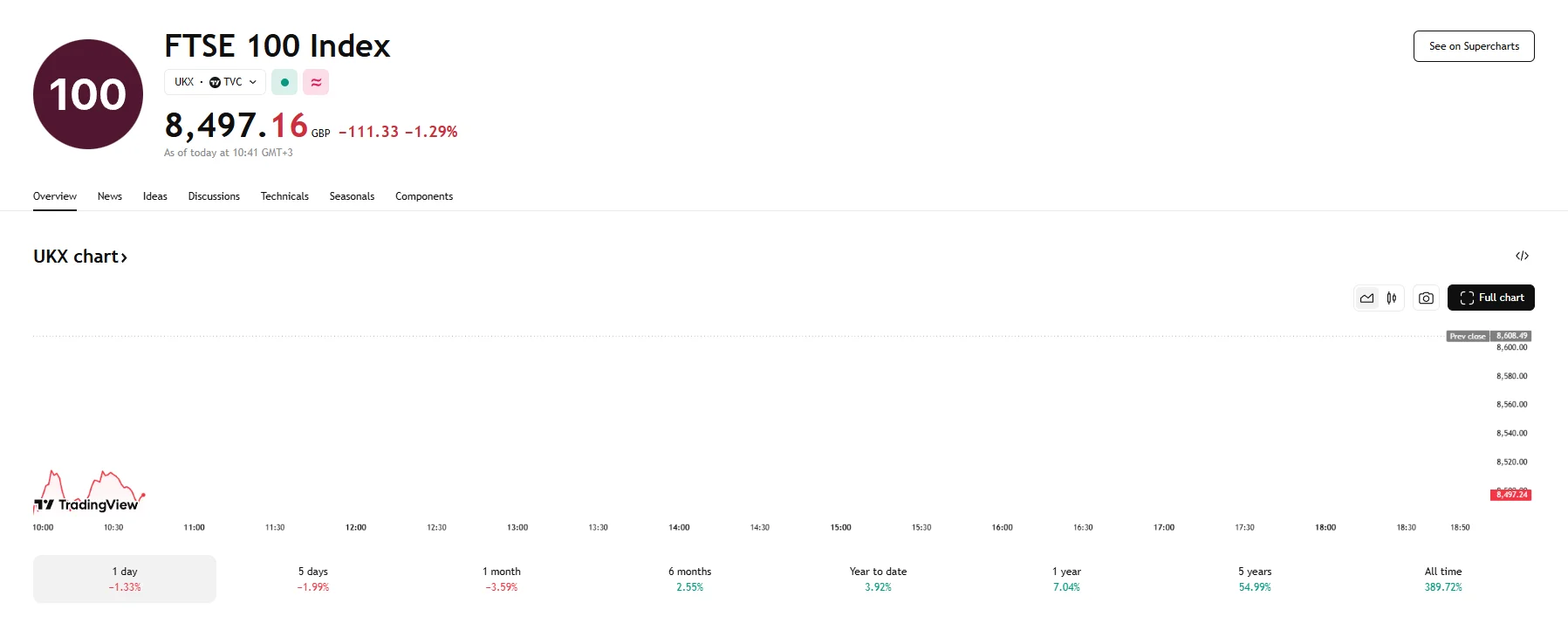

- The FTSE 100 saw a 1.29% decline.

- EURO STOXX Auto futures were not spared either, dropping 1.31%.

Trump Tariffs Trigger Market Slump Across Europe and the UK

The reverberations from President Trump’s newly implemented tariffs were immediately felt across European and British stock markets, which fell on Thursday. The regional STOXX 600 index witnessed a significant drop of 1.42%, while the UK’s FTSE 100 index also suffered, losing over 110 points, reflecting a 1.29% decrease in early trading. This broad downturn affected various sectors, including but not limited to technology, construction, and financial services.

Market turmoil followed Trump’s announcement of a 10% baseline tariff on all imported goods, coupled with a 20% tariff specifically targeting European Union imports. Furthermore, the automotive sector was particularly hard-hit. EURO STOXX Automobiles & Parts futures fell 1.31% as Trump’s 25% tariffs on imported vehicles took effect on Thursday.

Ursula von der Leyen, currently serving as President of the European Commission deemed the tariffs a “major blow to the world economy” and threatened countermeasures if ongoing discussions with the United States fail to yield a favorable resolution. Similarly, China, facing tariffs of 54%, voiced its opposition and vowed to retaliate against the US tariffs.

In the United Kingdom, Business Secretary Jonathan Reynolds disclosed that the government is actively pursuing a trade deal with the Trump administration to mitigate the impact of the tariffs. The US is subject to the baseline 10% tariff, and although Prime Minister Sir Keir Starmer has indicated that the UK will not immediately engage in a trade war, he has also stated that “all options are on the table.”

The economic implications of these tariffs are substantial, with analysts predicting higher prices in the US and a slowdown in global economic growth. According to the Office for Budget Responsibility, UK economic growth could be hit by 1%.

Several European leaders have also voiced their disapproval of Trump’s tariffs. Italian Prime Minister Giorgia Meloni described the decision as “wrong” but pledged to work towards a negotiated settlement. Spanish Prime Minister Pedro Sánchez reaffirmed Spain’s commitment to open trade, while Irish Taoiseach Micheál Martin labeled the decision “deeply regrettable.”