Key moments

- Widespread anxiety among investors about the potential ramifications of ongoing tariff disputes triggered a market slump across the Asia-Pacific region.

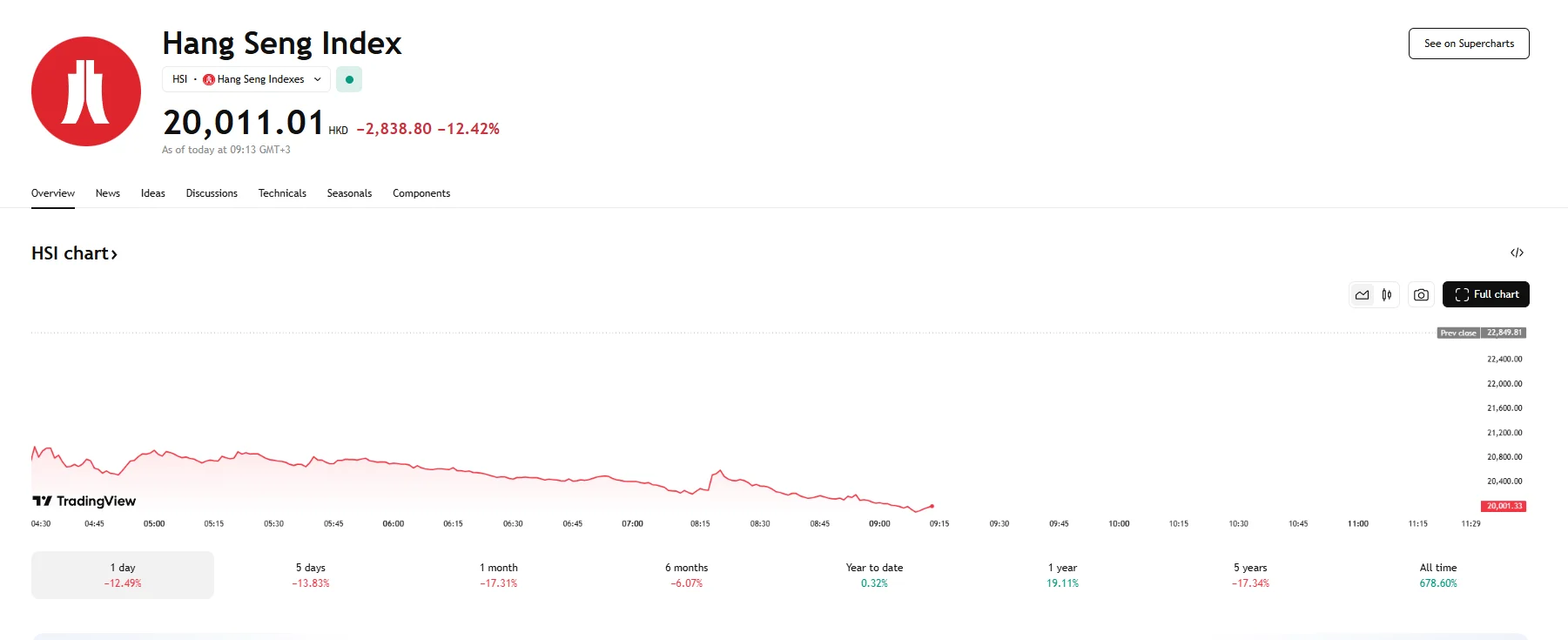

- Hang Seng and Nikkei both shed more than 2,000 basis points, falling 12.42% and 7.04%, respectively. The ASX 200 witnessed a 4.29% fall. In Korea, the KOSPI index slid 5.42%.

- Mainland China indices suffered as well, with the SSE Composite dropping 7.37%, while the CSI 300 sank 8.08%.

Tariff Fallout Sees Investors Lose Confidence in Asia-Pacific Markets

A wave of intense selling pressure swept across Asia-Pacific stock markets on Monday. As escalating concerns surrounding international trade tensions triggered a broad retreat from equities, several key benchmarks experienced substantial declines.

Hong Kong’s Hang Seng Index bore the brunt of the sell-off, plummeting by 12.42% to 20,011 HKD, a fall equivalent to over 2,000 basis points. This dramatic decrease underscored the heightened sensitivity of the Hong Kong market to global trade dynamics and its close economic ties to mainland China. Japan’s Nikkei 225 index also suffered a significant downturn of over 2,000 basis points, sliding by more than 7%. This substantial drop pushed the index to levels unseen in roughly eighteen months.

South Korea’s KOSPI index was not immune to the regional turmoil, registering a substantial 5.42% decline. The rapid pace of selling in the South Korean market triggered a temporary circuit breaker mechanism designed to curb excessive volatility and prevent so-called panic selling.

Mainland Chinese markets also experienced considerable losses. The SSE Composite Index concluded the day with a 7.37% decrease, while the blue-chip CSI 300 index saw an even sharper fall of 8.08%. These declines came as markets reopened following a public holiday, with investors reacting strongly to prevailing negative sentiments. Market analysts suggest that the forceful response from China to recently implemented tariffs has amplified these concerns. The comprehensive nature of China’s retaliatory actions has been interpreted by many as a sign of further escalation, increasing the perceived risk of a prolonged and damaging trade conflict. Market sentiments have also soured due to local concerns, such as inflation and supply chain issues.

Australia’s ASX 200 index also succumbed to the widespread selling pressure, tumbling by 4.29%. This decline pushed the index into correction territory as its value eroded since its recent peak.

The primary catalyst for this widespread market downturn appears to be escalating worries regarding the global implications of tariff policies following US President Donald Trump’s last week of a global 10% levy and the increased duties on imports from countries like China and Japan. The imposition of these tariffs, along with retaliatory measures by the affected countries and regions, has fueled fears of a damaging trade war that would slow global economic growth. This environment of heightened uncertainty has triggered a shift towards risk-off sentiment, prompting investors to reduce their exposure to equities and seek safer asset classes.