Key moments

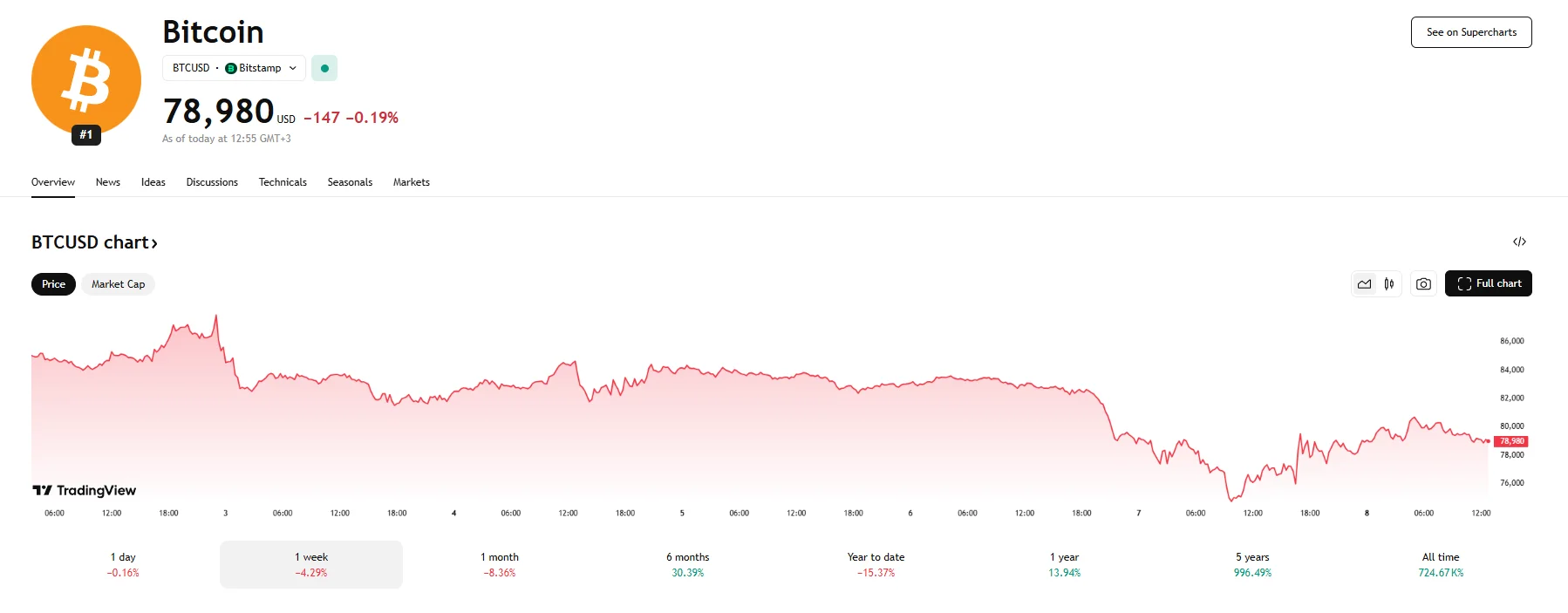

- Following a turbulent start to the week, Bitcoin has shown signs of recovery but is failing to stay above the $80,000 threshold.

- At press time, Bitcoin is trading near $79,000.

- A key factor fueling recent price instability is the ambiguity surrounding impending United States tariff policies.

Bitcoin Lingers Below $80,000

After a significant downturn on Monday that saw Bitcoin’s value plummet below $75,000, the leading cryptocurrency has since rebounded, currently fluctuating between $78,000 and $80,000. The digital asset is finding it challenging to sustain levels at or above the psychologically significant $80,000 mark, however, suggesting a cautious sentiment prevails among traders.

The factors contributing to Bitcoin’s current struggle are multifaceted, stemming from both macroeconomic headwinds and the ripple effects of geopolitical tensions. A primary driver of the recent volatility is the uncertainty surrounding the US tariff policies slated to take effect as early as Wednesday. These blanket tariffs, impacting numerous countries, have injected a significant degree of anxiety into global markets, including the cryptocurrency sector. The prospect of increased trade barriers and the potential for trade war escalation have led to concerns about broader economic instability, which can negatively impact cryptocurrencies.

Furthermore, President Trump’s assertive stance on tariffs, including a threat of an additional 50% duty on Chinese goods, has amplified these market jitters. China has already indicated its intention to retaliate with its levies on US products, further escalating the trade dispute and creating an environment of heightened uncertainty.

Adding another layer of complexity is the speculation surrounding the Federal Reserve’s future monetary policy. President Trump’s repeated calls for lower interest rates have put the central bank under pressure. Recent statements from the Fed, while hinting at a potential future rate cut if inflation moderates have also left the door open for additional rate cuts if price pressures persist. As lower rates could provide a tailwind for risk assets like Bitcoin by weakening the dollar and making borrowing cheaper, market participants will closely monitor the Fed’s actions.

Some cryptocurrency proponents remain optimistic about Bitcoin’s long-term prospects. Quinn Thompson, the founder of Lekker Capital, recently expressed a bullish outlook, predicting that Bitcoin’s value could skyrocket to $110,000.