Key moments

- The Trump administration has reaffirmed April’s implementation of the latest levies on US imports.

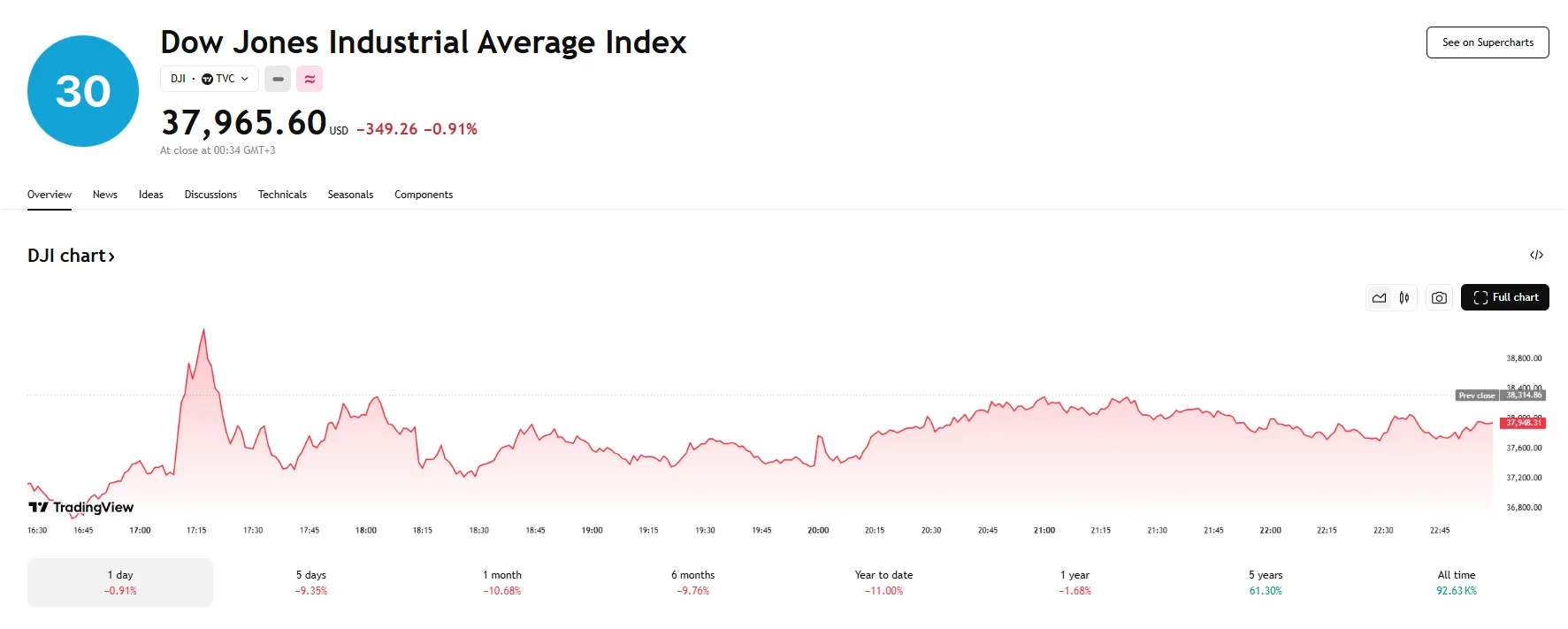

- The Dow fell 0.91%, closing at 37.966 on Monday.

- The S&P 500 suffered losses as well, dropping 0.23%, but the Nasdaq Composite index rose 0.10%.

Stocks Whiplash as Tariff Pause Hopes Dashed

Monday’s trading session was marked by dramatic swings driven by conflicting signals surrounding President Trump’s tariff policies. Initial market panic gave way to a brief surge when rumors spread about a potential 90-day pause. However, the White House promptly refuted these claims, sending stocks tumbling once more.

The Dow Jones Industrial Average suffered a notable setback, closing nearly 1% lower after losing approximately 350 basis points. The S&P 500 also experienced a decline, albeit a more modest one, managing to stay above the 5,062 mark. The Nasdaq Composite narrowly avoided a negative close, finishing the day with a marginal gain of 0.10%.

The day’s volatility underscored the market’s heightened sensitivity to trade policy pronouncements. The initial downturn reflected investor fears of a looming economic slowdown, fueled by the prospect of increased tariffs and retaliatory measures. President Trump’s threat of an additional 50% tariff on goods imported from China, coupled with Beijing asserting it would retaliate and “fight to the end,” intensified concerns about a prolonged trade war.

Influential voices from the financial sector, including JPMorgan CEO Jamie Demon, expressed alarm over the potential economic repercussions of the tariffs. Larry Fink, currently serving as the CEO of BlackRock, claimed the economy was already at a recession stage due to the controversial tariff policies. Despite these warnings, the Trump administration remained steadfast in its commitment to the tariff strategy, with trade advisors asserting that the policy was not a subject for negotiation.

The day’s trading served as a stark reminder of the market’s vulnerability to geopolitical tensions and policy changes. The abrupt shifts in sentiment were driven by conflicting reports and presidential pronouncements, and as the April 9th deadline for the imposition of tariffs on the European Union approached, market participants are bracing for further volatility.