Key moments

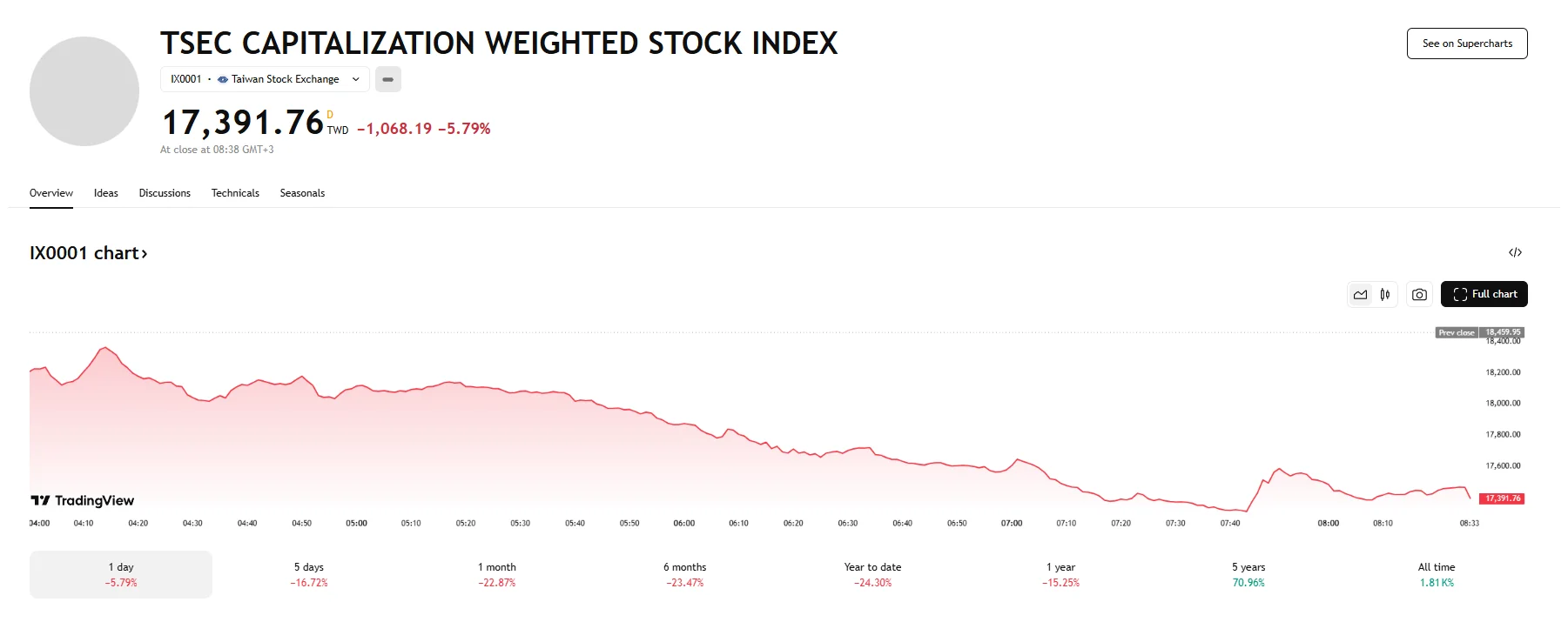

- Market turmoil across the Asia-Pacific region saw the Taiwan Weighted Index (TAIEX) slide 5.79%, while the Nikkei 225 lost 3.65%. The Hang Seng, KOSPI, and ASX 200 indices also fell.

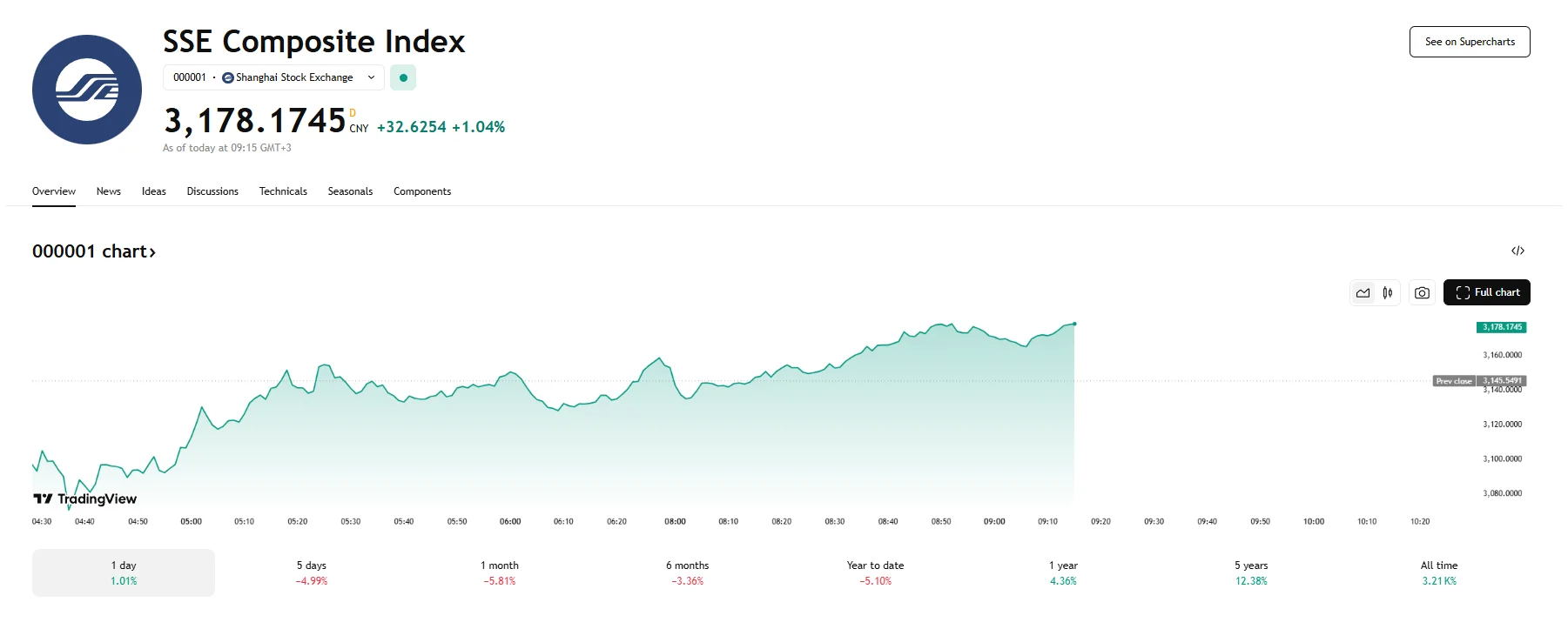

- Mainland China’s Shanghai Stock Exchange (SSE) index bucked global sentiments, achieving gains of 1%.

- The broad imposition of Trump’s tariffs on Wednesday impacted numerous countries, rattling investor confidence and triggering widespread selling pressure. Among the duties was Trump’s newest tariff of 104% on Chinese goods.

Global Trade War Fallout: Asia-Pacific Stocks Suffer, China’s SSE Holds Firm

Stock markets across the Asia-Pacific region experienced a significant downturn on Wednesday, reacting sharply to the implementation of sweeping tariffs spearheaded by President Trump. These levies, now in effect, include a particularly severe 104% duty on goods imported from China, a move announced on Tuesday that has further inflamed global trade tensions.

Taiwan’s stock market bore a heavy brunt of this negative sentiment, with its benchmark index TAIEX (IX0001) plummeting by 5.79%. Similarly, Japan’s Nikkei 225 index witnessed a substantial decline, plunging 3.64% and breaching the 32,000-point threshold after shedding over 1,200 basis points. The broader Japanese market also suffered, with the TOPIX index falling by 2.93%.

Australia’s S&P/ASX 200 index succumbed to the prevailing bearish trend as well, registering a drop of nearly 2%. Key markets in Northeast Asia were similarly affected, with Hong Kong’s Hang Seng index declining by 0.63% and South Korea’s KOSPI index losing 1.68%.

In contrast to the overarching trend, mainland China’s SSE Composite index managed to register an increase of 1%. This performance may be attributed to state-backed support for domestic equities and a degree of insulation from immediate tariff impacts on domestically focused companies. However, the broader sentiment surrounding Chinese equities remains cautious.

Beyond the massive 104% levy on Chinese imports, the United States has targeted numerous trading partners with other tariffs. Japan and the European Union were among those affected. The measures, described by the US administration as “reciprocal,” have come into force after President Trump cited what he perceives as unfair trade practices as the reasoning behind their implementation.

Adding to the unease is the ambiguous messaging emanating from the US administration regarding the longevity and ultimate goals of these tariffs. While initially declared permanent, there have also been suggestions that they are intended to pressure other nations into negotiating new trade agreements. This lack of clarity contributes to market volatility as investors struggle to assess the long-term implications.