Key moments

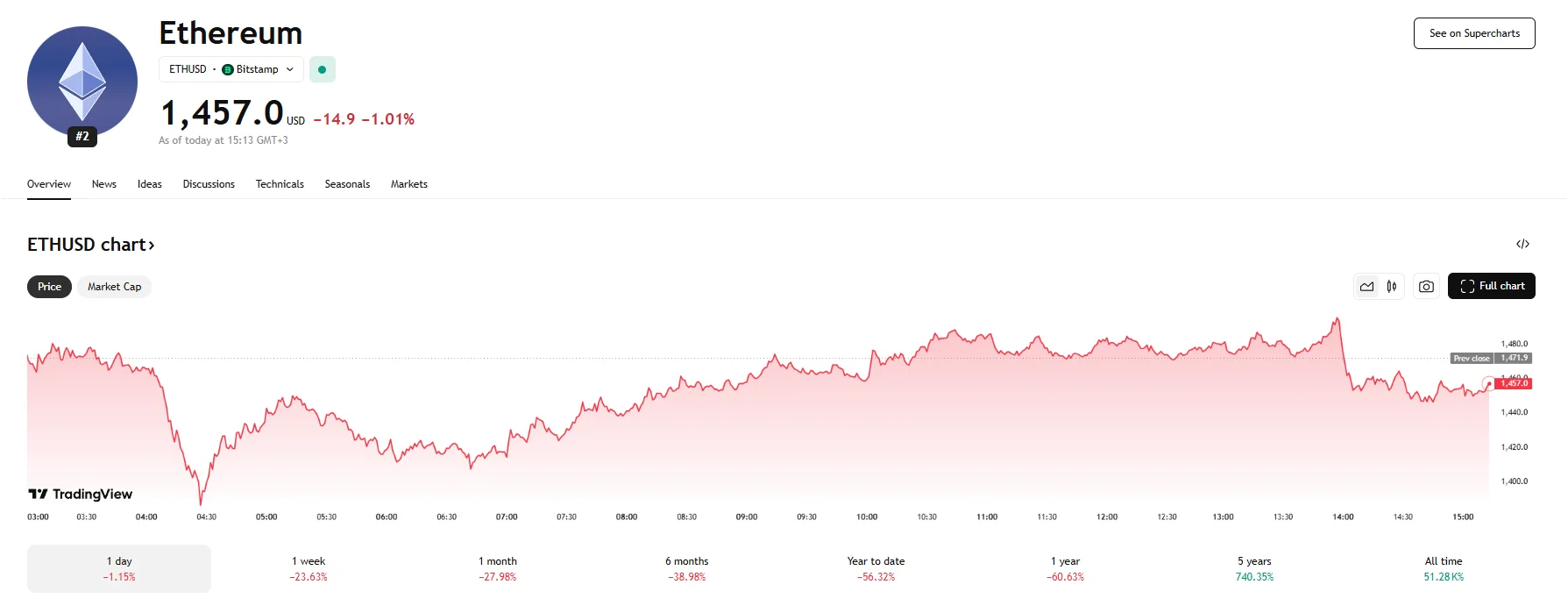

- Ethereum sank 1% on Wednesday, with its price hitting $1,457.

- The ETH/USD pair is also down, decreasing 1.24% to 0.01906.

- Price movements were influenced by US tariff policies along with a recent transaction that saw World Liberty Financial sell 5,471 ETH.

Ethereum Drops Further as World Liberty Financial Executes Massive Selloff

Ethereum experienced further downward pressure on Wednesday, declining by 1% to reach a price of $1,457. Today’s drop marks the first instance since 2023 that Ethereum’s value has fallen below the critical $1,500 threshold.

The trading losses witnessed on Wednesday compounded a substantial decline witnessed over the past week. In a concerning trend for ETH enthusiasts, Ethereum has shed over 23% of its value against the greenback in the last seven days alone, and this significant decrease highlights the intense selling pressure and the broader negative sentiment permeating the cryptocurrency market as tariff-fueled trade tensions continue to dominate market sentiments.

Adding to Ethereum’s woes, the cryptocurrency also experienced depreciation relative to Bitcoin. The ETH/USD trading pair witnessed a decrease exceeding 1.20% to 0.01906, indicating that Ethereum was underperforming even within the struggling cryptocurrency sector.

Several interconnected elements are contributing to Ethereum’s current struggles. The overarching market uncertainty, fueled by US President Donald Trump’s implementation of sweeping tariffs, has resulted in widespread uncertainty across various sectors, with investors fearing inflation and slower global growth. Cryptocurrencies like Ethereum, often perceived as high-risk assets, tend to underperform during periods of economic anxiety as investors gravitate towards safer investments.

Furthermore, specific events within the Ethereum ecosystem appear to be exacerbating the downward pressure. Earlier on Wednesday, revelations from Arkham Intelligence highlighted significant selling activity from a prominent wallet linked to Trump’s World Liberty Financial DeFi project. This wallet reportedly offloaded a substantial 5,471 ETH, valued at approximately $8.01 million at the time of the transaction. Notably, this sale resulted in a staggering $125 million in losses for the wallet, as the coins had initially been acquired at a significantly higher average price.