Key moments

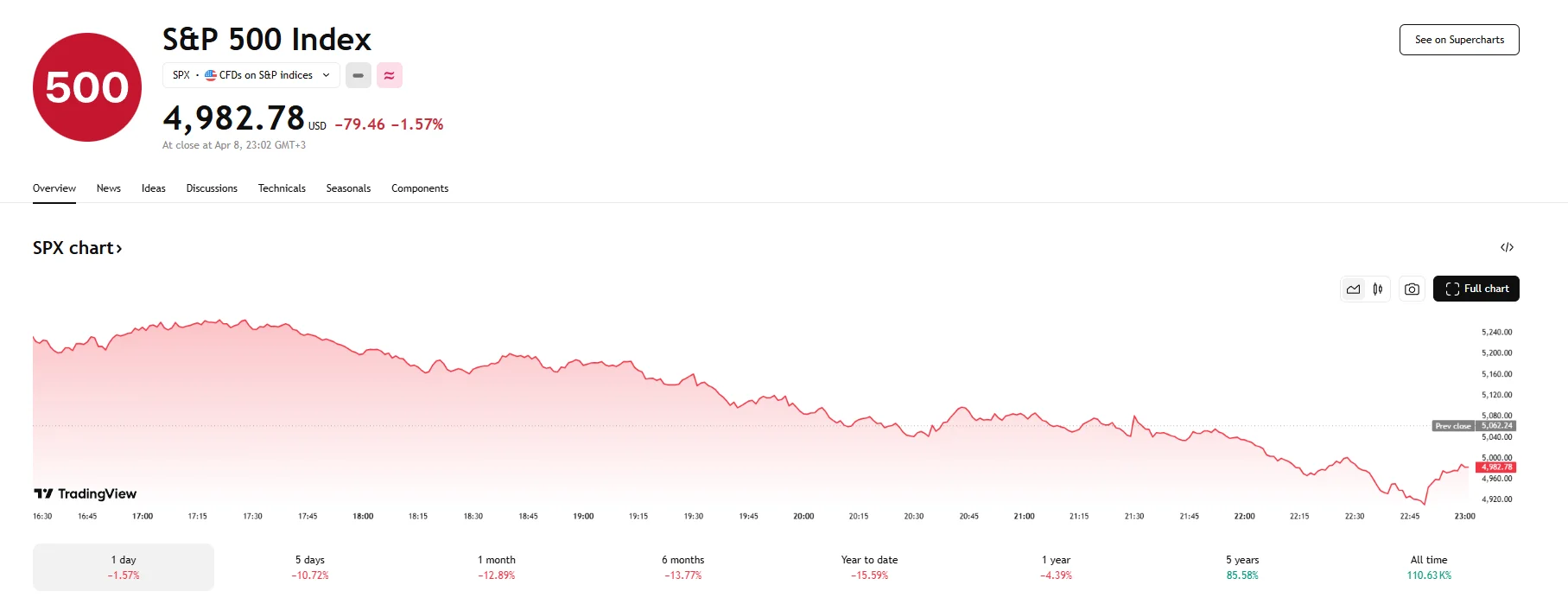

- The S&P 500 experienced a significant 1.57% drop on Tuesday, and the index has lost $5.83 trillion of its market value in the past several days.

- Tuesday’s trading also concluded with widespread declines across the broader US stock market, with the Nasdaq 100, Nasdaq Composite, and Dow Jones indices falling.

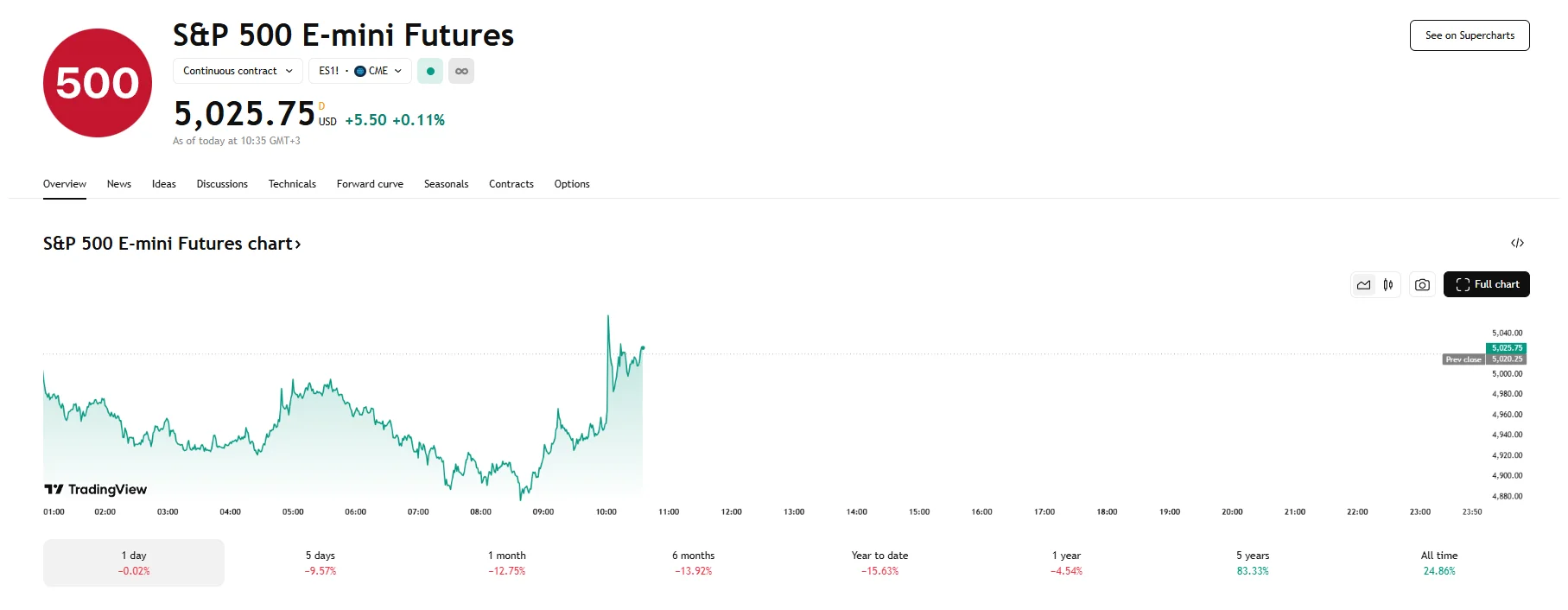

- On Wednesday, US E-mini futures climbed higher.

Trade War Dynamics See Major US Indices Fall

Tuesday’s trading session concluded with a notable downturn for the S&P 500, as the benchmark index registered a significant 1.57% decline. This sell-off drove the index below the critical 5,000-point threshold, marking its lowest closing value in almost a year. The substantial drop was the result of escalating anxieties among investors about US President Donald Trump’s controversial trade policies.

The S&P 500 shed an enormous $5.83 trillion in market capitalization over the preceding four sessions. This precipitous fall represents the most significant four-day loss for the index since its inception, highlighting the profound impact of the trade tensions on investor sentiment and market valuations.

The broader market also experienced considerable declines on Tuesday. The Dow Jones Industrial Average concluded the session with a 0.86% decrease, reflecting the widespread apprehension across various sectors.

Technology-focused indices faced even greater headwinds, with the Nasdaq 100 falling by 1.95% and the more comprehensive Nasdaq Composite Index registering a substantial 2.15% drop due to anxieties surrounding the impact of tariffs on global supply chains and the profitability of major technology firms. Electric vehicle manufacturer Tesla saw its share price erode by 4.90%, while chipmaker Nvidia also faced selling pressure, with its stock price declining by 1.37%.

Despite the pervasive market unease that characterized Tuesday’s trading, Wednesday witnessed a tentative shift in sentiment during the futures market. After the Trump administration’s tariffs came into effect after midnight, US futures initially indicated continued downward pressure. However, as the trading day progressed, these futures began to show signs of recovery. S&P 500 E-mini futures edged upwards by 0.11%, while Dow E-mini futures climbed above the 37,870 level. Nasdaq 100 E-mini futures also demonstrated a positive trajectory, rising by 0.47%.

The tariffs that were implemented on Wednesday, including a 104% duty on goods imported from China, have been met with strong criticism and the threat of retaliatory actions from affected nations. The coming days and weeks will be crucial in determining the economic impact of these tariffs and the subsequent responses from both domestic and international stakeholders.