Key moments

- Brent futures sank 2.29% to $63.98 on Thursday.

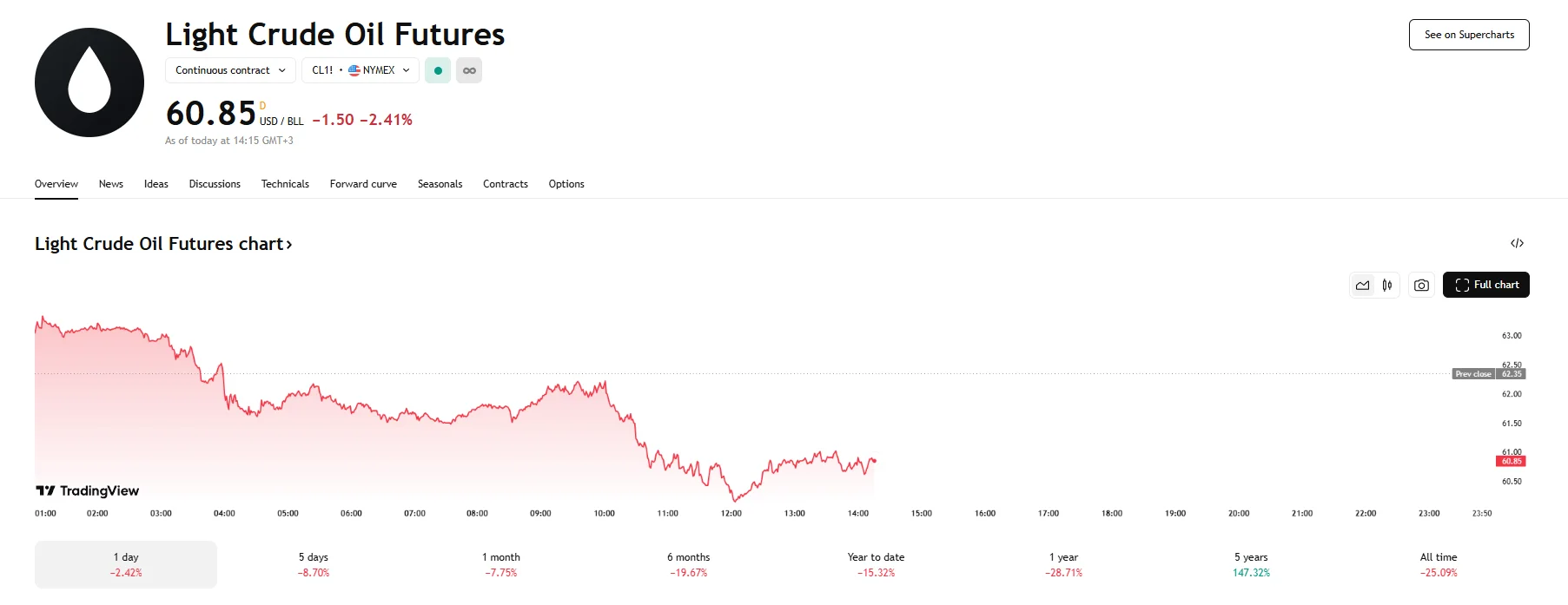

- WTI futures suffered a decline of 2.41% to $60.85.

- Traders continue being influenced by a potential decrease in crude oil demand as US-China trade tensions weigh on markets.

Oil Futures See Significant Losses on Thursday

Crude oil markets experienced another day of downward pressure on Thursday, extending losses as both the prominent Brent and West Texas Intermediate (WTI) benchmarks registered declines exceeding 2%. This continued slide highlights persistent concerns among investors regarding the potential for a deepening global economic slowdown as the trade conflict between the United States and China has shown no signs of diminishing.

Specifically, Brent crude futures witnessed a significant downturn, plummeting by 2.29% to trade just below the $64 per barrel mark. Similarly, West Texas Intermediate crude futures also experienced a notable decrease, falling by 2.41% to hit $69.85 per barrel. It appears the initial optimism following a temporary reprieve in broader US tariffs has been overshadowed by the tariff hike on China’s US exports, along with Beijing’s own retaliatory duties.

Contributing to market participant caution is the upcoming release of the US Consumer Price Index (CPI) data for March, which is scheduled to be released later today. Inflation data could provide further insights into the health of the US economy and potentially influence future monetary policy decisions by the Federal Reserve. Any signs of weakening economic activity could further dampen the outlook for oil demand, contributing to downward pressure on prices.

The current slump in oil prices follows a volatile trading session on Wednesday. Initially, crude benchmarks had experienced a sharp decline, falling 7% at some point. Despite a subsequent partial recovery later in the day, spurred by President Trump’s announcement of a 90-day pause on elevated tariffs for most countries, the underlying concerns regarding the US-China trade relationship quickly resurfaced. Moreover, on top of excluding China from the tariff pause, the Trump administration hiked duties on Chinese imports further. They now stand at 124%, versus the previous rate of just over 100%.