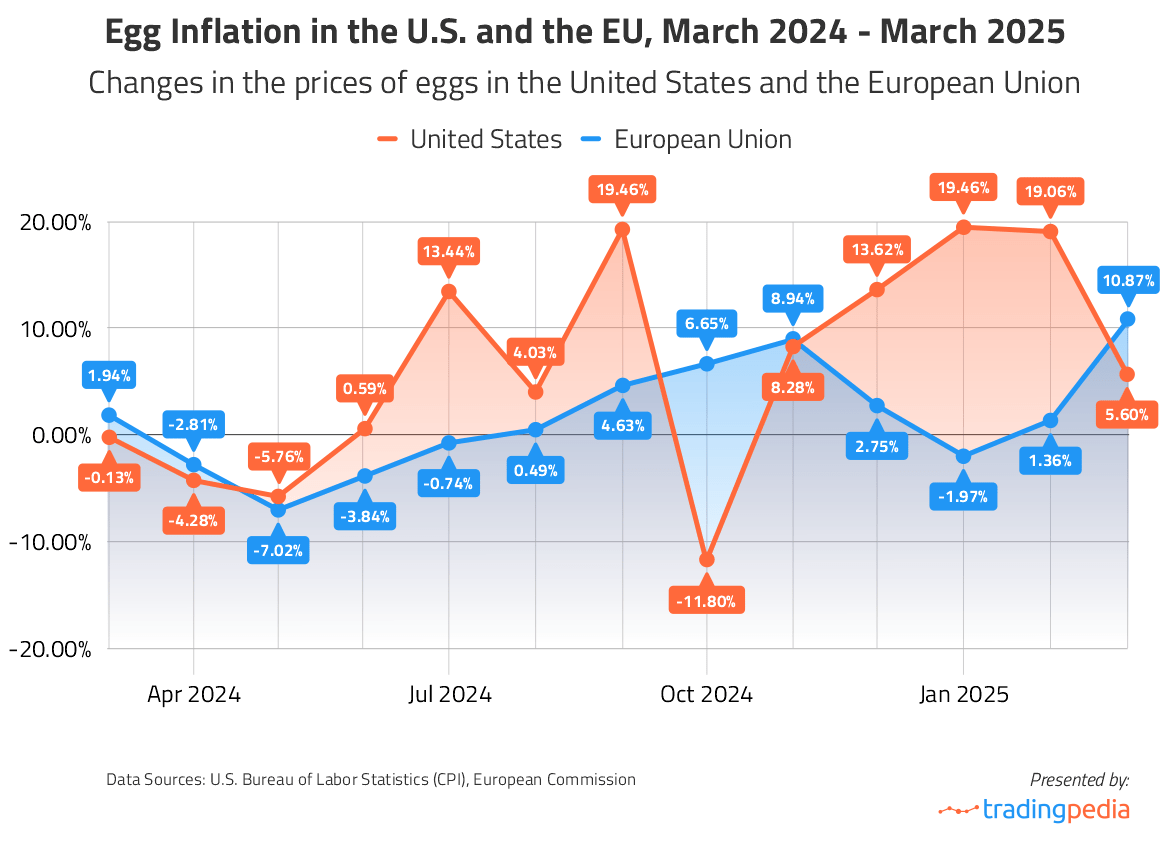

The severe outbreak of avian influenza (bird flu), which has led to a major egg shortage in the U.S., has been escalating for months. Now, with the newly introduced universal tariffs by President Donald Trump, concerns are growing over where Americans will source their eggs; and how much a carton might cost ahead of Easter. However, Europe barely has any surplus of eggs, especially days before Easter when the increased demand has driven the already high prices up. The team at TradingPedia analyzed egg prices in the U.S. and the EU over the past 12 months and found that despite America’s severe egg crisis, prices there have started to cool down, rising roughly 5.6% in March compared to 19% price hikes in January and February. In Europe, however, egg prices climbed much more significantly in March, increasing nearly 11% from February.

Based on our calculations, Americans will need approximately 180 million extra eggs for Easter and another 30 million for Passover. However, the ongoing trade war could jeopardise egg imports and drive prices back up just as they have started to ease from record highs. Imported eggs may now be subject to the new tariffs, as President Trump has announced fresh import duties on dozens of economies, including rates of up to 125% on Chinese products.

To address domestic shortages, the U.S. imported more than 4.78 million dozen eggs in January and February, which is equivalent to over 57.4 million consumer-grade chicken eggs. In February alone, U.S. imports of shell eggs and egg products soared, rising 551% from January and 404% year-over-year. Table egg imports specifically jumped 378% month-over-month. Despite the shortages, U.S. egg exports have remained steady, with 176 million eggs shipped abroad in the first two months of the year. (Interestingly, Canada remains the top destination for U.S. table eggs, receiving 86% of all exports.)

Here are a few key highlights from our analysis:

- So far in 2025, outbreaks of highly pathogenic avian influenza (HPAI) among commercial egg-laying flocks have resulted in the loss of 30.3 million birds. The USDA’s Animal and Plant Health Inspection Service (APHIS) has confirmed 40 outbreaks across layer flocks in nine different states.

- In February, total imports of shell eggs and egg products surged-up 551% compared to January and 404% year-over-year. The overall value of these imports rose 328% month-over-month and 450% compared to the same month in 2024.

- Imports of table shell eggs alone increased by 378% in February, with Turkey and Mexico supplying roughly 60% and 40% of that total, respectively.

- Liquid egg product imports fell 13% from January, though they were still 43% higher than the year before. Dried egg product imports, meanwhile, recorded the most dramatic increase-soaring 1,816% from January and 294% year-over-year.

- Despite the domestic shortages, the U.S. remains a net exporter of table eggs. In January and February 2025, the country imported 57.4 million eggs while exporting 176 million.

- In the U.S., the average price of large, grade-A eggs reached $6.227 in March, up 5.60% from the previous month and 108.12% higher than in March 2024.

- Following three months of relative stability, the market price for large and medium eggs in the European Union also jumped in March. In the 24 countries reporting data to the European Commission for the past year, the average price for 100 kg eggs increased by 10.87% to €266.17.

The increased demand for eggs in the few weeks before Easter has driven prices up, with wholesale prices for large table eggs in the U.S. hitting an all-time high of $8.17 per dozen on March 3. The cost has dropped since then to $4.9 on March 13 and even further to $3.24 on April 8, according to the U.S. Department of Agriculture (USDA).

Retail prices, however, have remained relatively high despite the “light to moderate” demand as the USDA has described it. According to the monthly inflation report by the Bureau of Labor Statistics (BLS), consumers in the U.S. paid an average of $4.953 per dozen grade A, large eggs in January, which was an increase of 19.46% compared to the previous month and up 96.39% from January 2024. In February, the average price soared another 19.06% month-over-month to $5.897, up 96.83% from the same month last year.

In March, prices continued to increase, albeit at a slower rate, going up only 5.60% from last month to $6.227 per dozen eggs. Compared to March 2024, the cost more than doubled, an increase of 108.12%.

Prices also jumped across the European Union in 2025, with 100 kg eggs selling for 1.47% more (to €240.07) in February and 10.87% more (to €266.17) in March, following a slight drop of 1.97% in January. There were notable annual increases in Belgium, where in March, the market price for 100 kg eggs soared by 42.8% from March 2024 and in the Czech Republic, where the price was up 44.4% for the same period. Significant monthly increases were reported, once again, in Czechia (20.4%) and Belgium (20.34%), as well as in Spain (20.15%), while the prices in Ireland and Croatia dropped slightly by less than 1%.

This is how egg prices changed across the EU in March from February 2025 (average market prices for 100 kg. of large and medium eggs):