Key moments

- The German DAX rose on Monday, soaring 2.63% to 20,909.35.

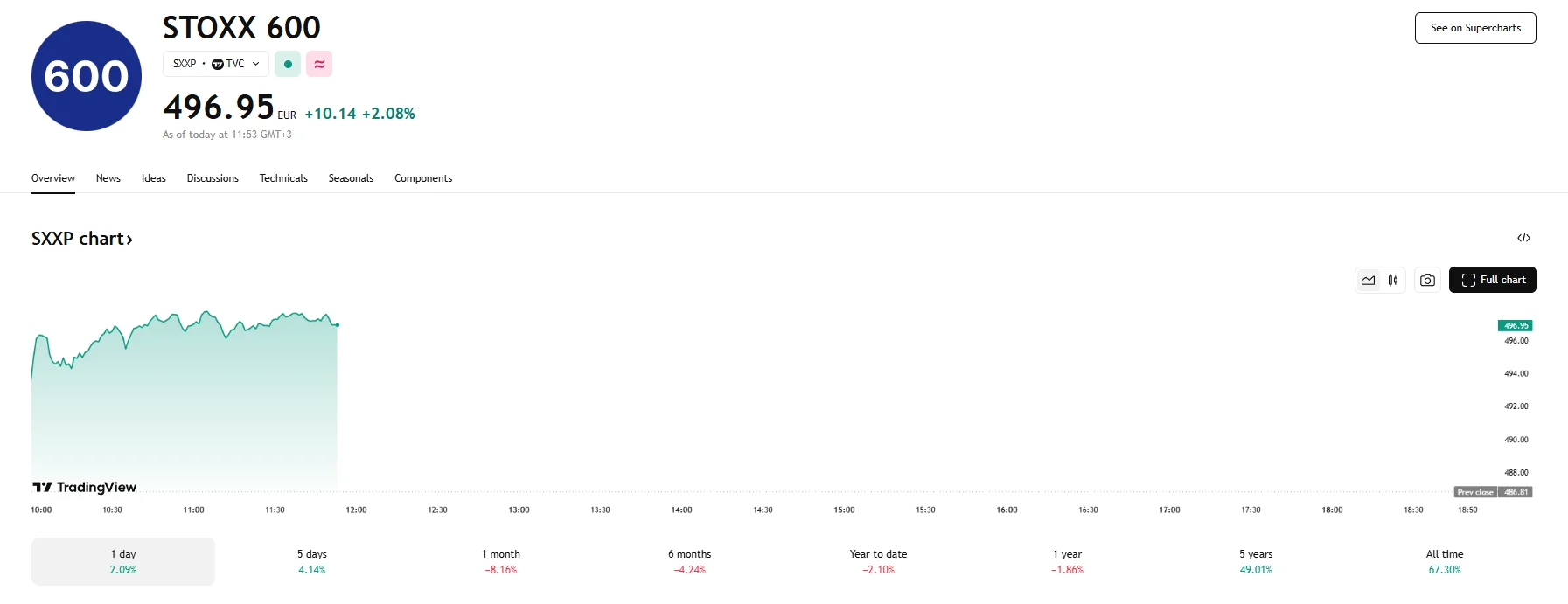

- Europe’s STOXX 600 climbed by over 2% as well.

- Investor confidence was propelled by the Trump administration’s postponement of certain tariffs on technology imports from China.

DAX and STOXX 600 Skyrocket

Monday witnessed a significant upswing in European equity markets, with both the German DAX index and the STOXX 600 registering substantial gains exceeding the 2% threshold. This buoyant trading day was largely attributed to a shift in sentiment following news regarding temporary exemptions from certain US tariffs on specific technology products imported from China.

The DAX index in Germany experienced a powerful rally, adding over 500 basis points to its value. This impressive surge translated to a substantial climb of 2.63% to 20,909.35, reflecting the positive reaction of German investors to the evolving trade landscape. The Frankfurt-based exchange saw broad-based buying interest, particularly in the technology sector, which was among the top performers across Europe.

The STOXX 600, a benchmark representing a wide range of companies across the European continent, also edged higher. The index rose by a notable 2.08% to 496.95, and this widespread increase indicated a general improvement in investor confidence across European markets, mirroring the optimism observed in Germany. Once again, technology stocks played a significant role in this pan-European rally. Sectors such as oil, gas, and banking also saw strong gains, contributing to the overall positive performance of the STOXX 600.

As established, the primary catalyst behind this surge in European stock values appeared to be the recent decision by the White House to temporarily exclude certain electronic products, including smartphones and computers, from the recently imposed tariffs on goods originating from China. While these exemptions were clarified as temporary by US officials, as these goods will still be subject to other US-mandated duties, the move was interpreted by many investors as a potential sign of a softening stance on trade.

Despite this wave of optimism, market participants remained cautious, closely monitoring further developments in US trade policy. The US President indicated an upcoming announcement regarding tariff rates on imported semiconductors, adding a layer of uncertainty to the technology sector’s longer-term outlook. It should also be noted that investment banking giant Goldman Sachs revised its 12-month forecast for the STOXX 600 downwards for the second time in April. The new projection of 520 represented a decrease from the earlier estimate of 570. Goldman Sachs cited concerns that ongoing US tariffs and the strengthening of the euro could negatively impact the earnings of European corporations.