Key moments

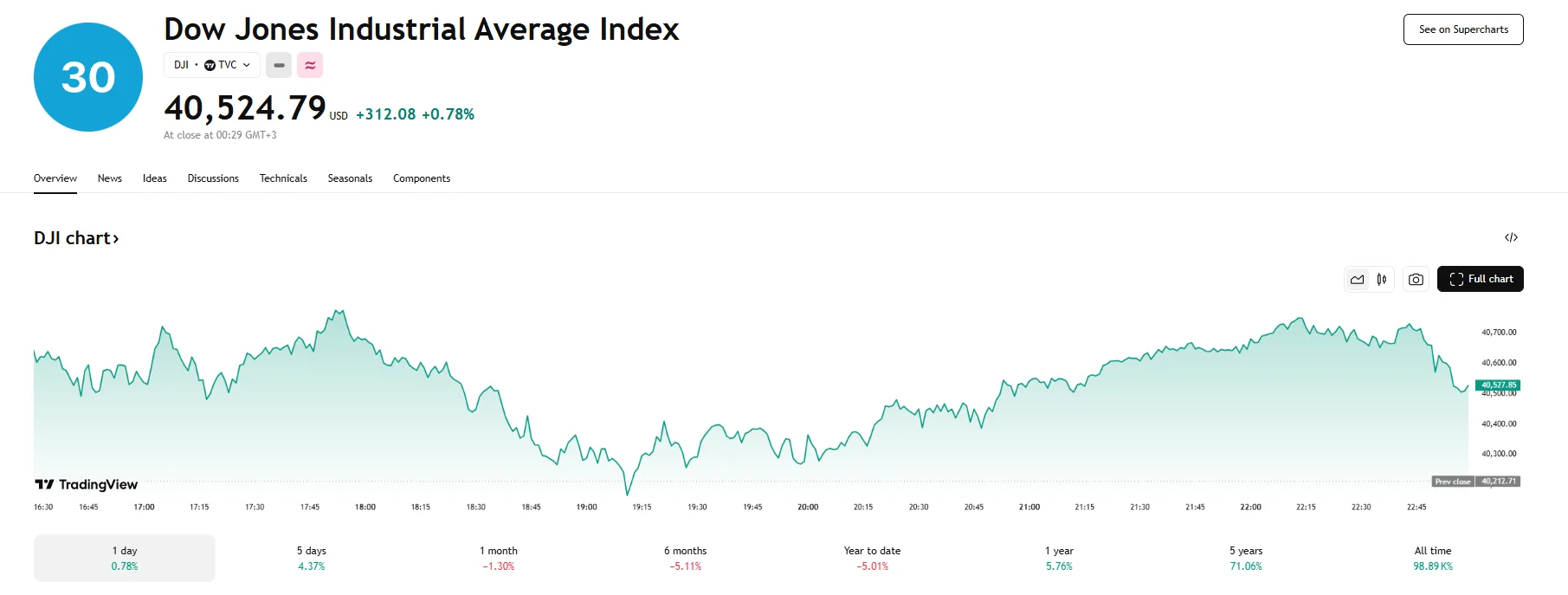

- Monday’s trading session ended with the Dow, Nasdaq, and S&P 500 climbing over 0.5%.

- Companies like Apple and Intel saw gains, while Nvidia’s stock dropped 0.20%.

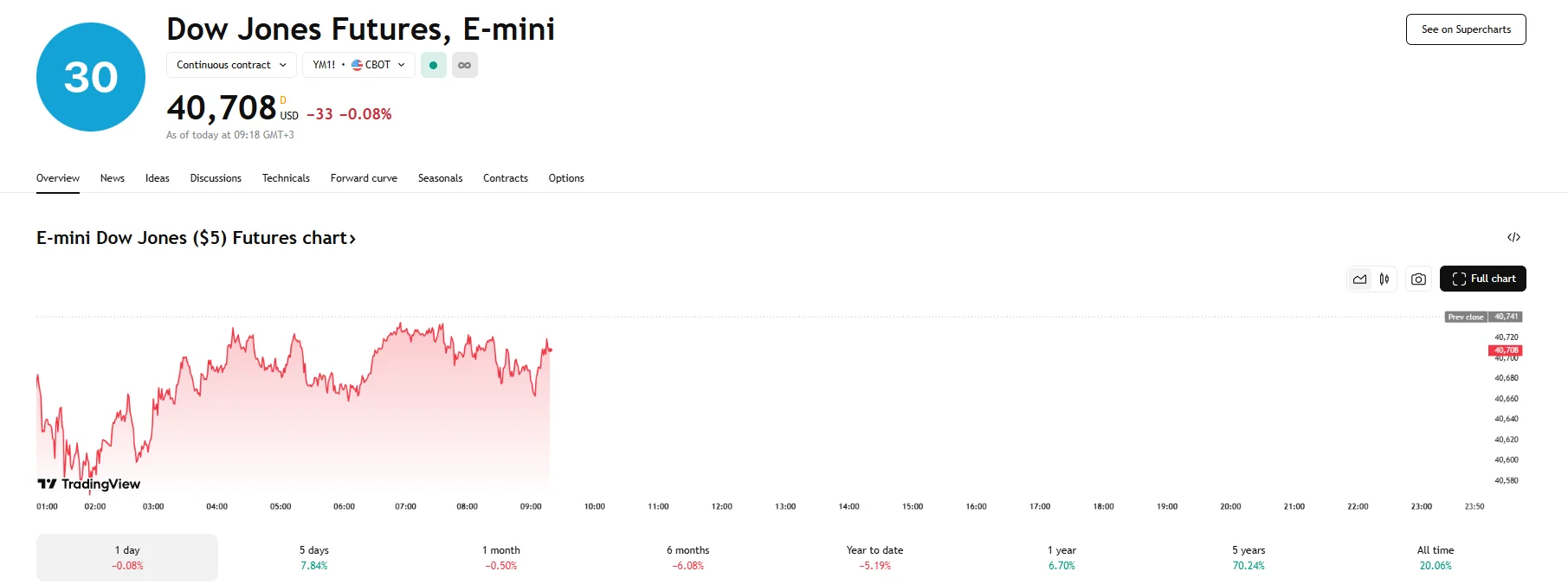

- E-mini futures for the Nasdaq 100, S&P 500, and Dow fell on Tuesday.

Wall Street Gains on Monday Amid Easing Trade Talk, Tuesday Futures Hint at Cooldown

Monday witnessed a generally upbeat session on Wall Street, as the Wall Street indices concluded the day in positive territory. Investor sentiment appeared to be lifted by developments suggesting a potential softening of the trade stance from Washington, particularly concerning tech imports. However, this optimism was tempered by signals indicating that these reprieves might be temporary and followed by another set of duties, leading to a more cautious outlook for the subsequent trading day.

The Dow Jones Industrial Average exhibited a notable upward movement, adding over 300 points to close at 40,524.79. This gain of 0.78% reflected a positive reaction to the evolving trade narrative. Similarly, the technology-centric Nasdaq Composite also experienced a boost, advancing by 0.64% to reach 16,831.48. Within this sector, the Nasdaq 100, which tracks the performance of the largest non-financial companies listed on the Nasdaq, saw an increase of 0.57%, settling at 18,796.02. The broad-based S&P 500 Index also participated in the day’s rally, rising 0.79% to 5,405.96.

Several factors appeared to contribute to this upward momentum. A key element was the easing of tariffs on specific electronics originating from China. This development seemed to particularly resonate with investors in the tech sector, as evidenced by the performance of several prominent companies. Apple, a major player with significant international manufacturing operations, saw its stock price climb by a substantial 2.21%. Dell Technologies also experienced a significant increase in its share value, jumping by 3.98%. Additionally, chipmaker Intel recorded a positive movement, with its stock price rising by 2.89%. These gains suggest that the prospect of reduced trade barriers for key electronic components and devices provided a significant tailwind for these specific stocks.

However, not all technology giants experienced the same positive trajectory. While the broader sector generally advanced, Nvidia, a leading semiconductor company, saw its stock price edge down by 0.20%. Meanwhile, software behemoth Microsoft experienced a marginal decrease of 0.16%.

Despite the overall positive close on Monday, the outlook for Tuesday appears less robust. E-mini futures contracts for the Nasdaq 100 and the S&P 500 indicated a downturn earlier today, as both registered declines exceeding 0.10%. Dow e-mini futures also pointed towards a slightly negative sentiment, edging down by 0.08%. This suggests that the initial optimism fueled by the tariff news might be fading, potentially due to the lingering uncertainty surrounding the longevity and scope of these exemptions.