Key moments

- On Thursday, the ECB lowered Europe’s interest rates by 25 basis points. The primary deposit facility rate now stands at 2.25%.

- The ECB’s decision to lower borrowing costs was primarily driven by growing concerns about the Eurozone’s weakening economic growth prospects.

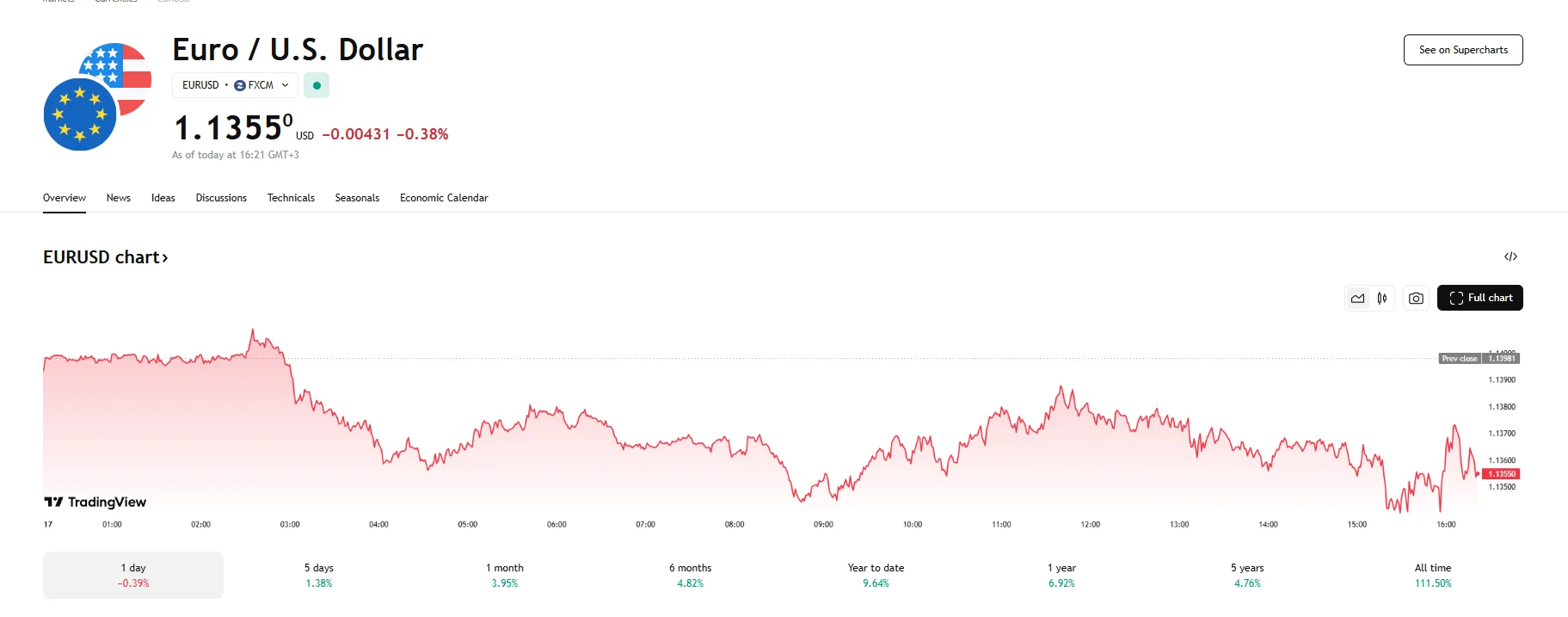

- After the ECB’s announcement, the EUR/USD declined to 1.1355.

Euro Loses Ground as ECB Implements Expected Interest Rate Cut

The European Central Bank (ECB) implemented a widely anticipated reduction in several of the Eurozone’s benchmark interest rates on Thursday, decreasing them by 25 basis points. This decision was reportedly unanimous and marks a further easing of monetary policy by the central institution. The adjustment places the key deposit rate at 2.25%, its lowest point since early 2023.

Several interconnected factors appear to have influenced the ECB’s interest rate cut. A primary concern highlighted by the central bank is the deteriorating outlook for economic expansion within the Eurozone. This weakening growth forecast is largely attributed to escalating global trade tensions and the associated uncertainty they generate. The ECB explicitly noted in its policy statement that the rise in trade disputes is expected to dampen confidence among both households and businesses. Furthermore, the central bank expressed apprehension that the volatile market reactions to these trade tensions could lead to a tightening of overall financing conditions within the Eurozone, further hindering economic activity.

Following the ECB’s announcement of the rate cut, the EUR/USD currency pair experienced a decline. The exchange rate depreciated by approximately 0.40%, falling to the 1.1355 mark. Despite a roughly 5% gain for the Euro against the Dollar earlier in April, driven by factors such as a reassessment of the Dollar’s global role and expectations of increased defense spending in some Eurozone countries, the immediate response to the rate cut indicated a shift in sentiment.

ECB President Christine Lagarde, in her post-meeting press conference, emphasized that the decision to cut rates was agreed upon by all Governing Council members. She acknowledged the “exceptional uncertainty” clouding the economic outlook, citing new trade barriers facing Eurozone exporters, disruptions of international commerce, financial market tensions, and geopolitical uncertainty as significant headwinds.

Despite these concerns, Lagarde also pointed to some underlying resilience within the Eurozone economy, noting that it likely experienced growth in 2025’s first quarter. Furthermore, the ECB’s assessment indicated that the “disinflation process is well on track,” and inflation is expected to settle around 2%. This assessment of inflation provided a rationale for the rate cut as a measure to support economic growth without jeopardizing price stability.