Key moments

- Alphabet’s stock leaped over 5% on Friday. Class A shares rose to $167.50, while Class C shares almost reached $170.

- Revenue surged 12% to $90.2 billion in the first quarter. Net income grew even further, surging 46% to hit $34.5 billion.

- The company will be issuing $70 billion in stock buybacks.

Alphabet Shares Surge Over 5% as Markets Cheer Robust Earning

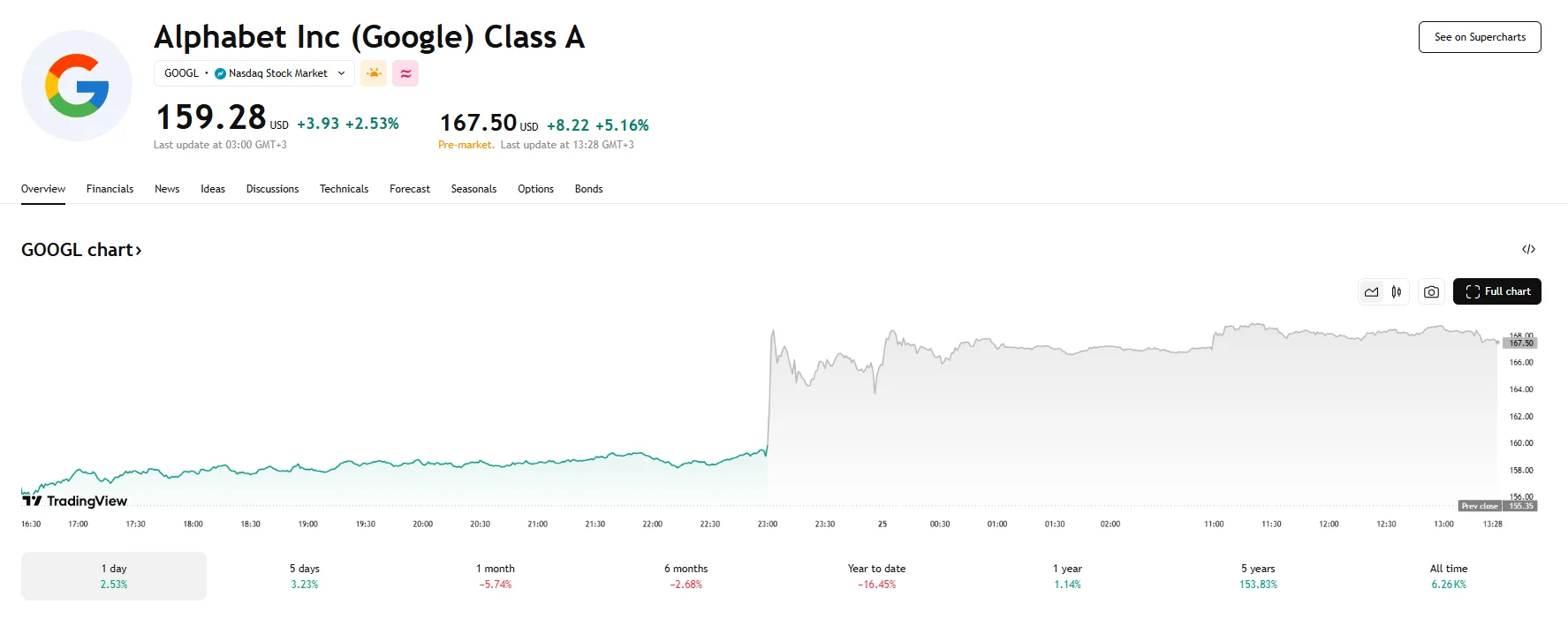

Google’s parent company, Alphabet, enjoyed a significant surge in its stock value during Friday’s after-hours trading session. Investors reacted favorably to the company’s impressive earnings report, propelling the company’s Class A shares upwards by a substantial 5.16% to $167.50. Similarly, Alphabet’s Class C shares also experienced a notable increase, registering a gain of 5.05% to almost hit $170. This pre-market enthusiasm built upon the positive momentum from the previous trading day when Alphabet’s stock ended with gains exceeding 2%.

The substantial jump in share price followed the publication of the company’s Q1 earnings report, which provided tangible evidence that its significant investments in AI have begun to yield substantial returns. A key highlight was the performance of Google’s advertising division, which constitutes nearly three-quarters of Alphabet’s total revenue. In 2025’s Q1, this segment generated $66.89 billion, marking an 8.5% increase compared to the same period last year. While this growth rate was slightly lower than the previous quarter’s 10.6% surge, it comfortably beat analysts’ expectations. As shown by LSEG data, the growth rate forecasts had stood at 7.7%.

Furthermore, Alphabet’s cloud computing division, Google Cloud, also showed significant growth, with the revenue figures reaching $12.26 billion, a climb of 28%. This metric represented a strong expansion from the previous quarter’s 30.1% growth rate.

Overall, for the first quarter, Alphabet reported a 12% YoY increase in revenue, reaching $90.2 billion. The company’s net income saw an even more impressive surge of 46%, climbing to $34.5 billion compared to the same period last year.

Looking ahead, Alphabet reaffirmed its commitment to investing heavily in its AI infrastructure, reiterating plans to allocate approximately $75 billion this year toward expanding its data center capacity. Moreover, Alphabet announced a 5% increase in its quarterly dividend and authorized stock buybacks of $70 billion.