Key moments

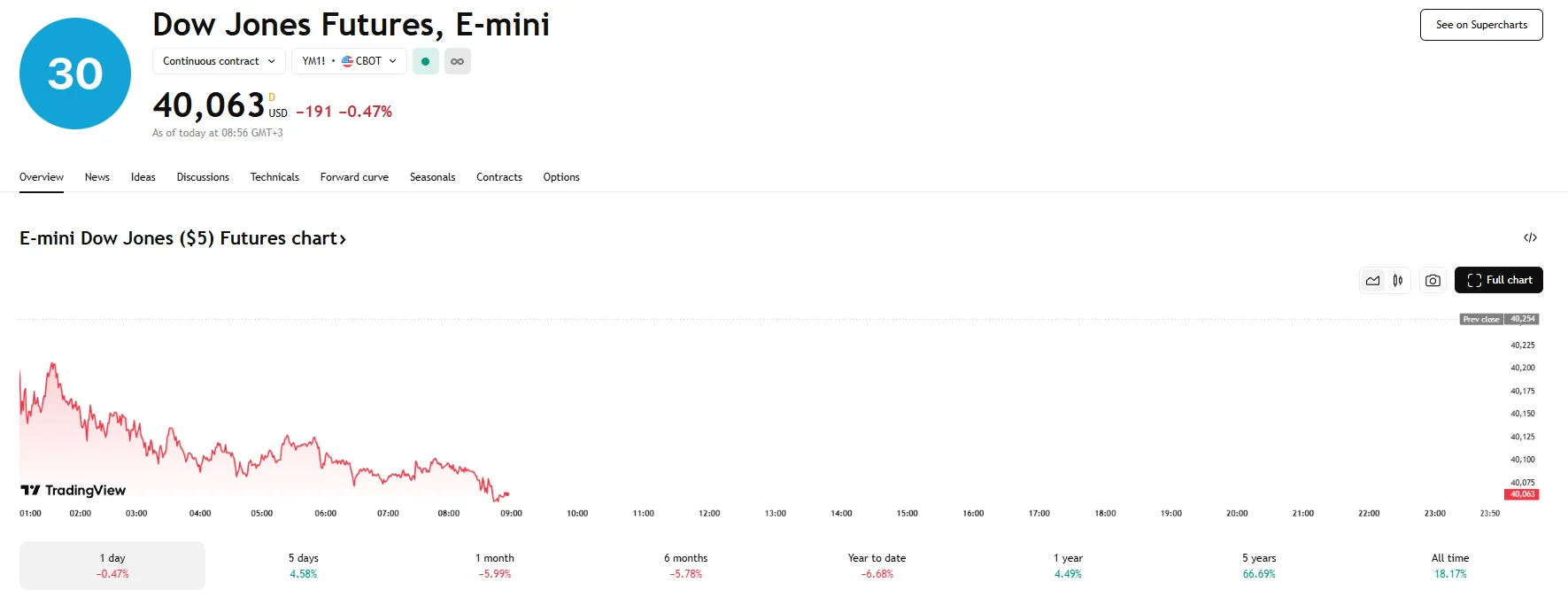

- Dow e-minis and Nasdaq 100 futures slid by more than 100 basis points on Monday.

- S&P 500 e-mini futures fell as well, dropping by 0.55%.

- Traders remain cautious ahead of a week full of corporate earnings disclosures and economic data reports.

Wall Street Wobbles as Futures Markets Retreat

Following a week of encouraging upward movement, the landscape of Wall Street shifted on Monday as futures contracts linked to prominent American stock indices indicated a slide. Both the Dow Jones Industrial Average and the technology-heavy Nasdaq 100 experienced notable declines in their respective e-mini futures, each losing over 100 points. Specifically, Dow e-minis registered a 0.47% decrease, while Nasdaq 100 e-minis saw a 0.62% drop. Similarly, S&P 500 futures also pointed towards a negative start to the trading week, falling by 0.55% to hit 5,519.25.

This prior week’s buoyancy had seen the S&P 500 achieve its most extended sequence of daily positive closes since January, fueled by a combination of factors. These included a perceived easing of the conflict between President Trump and Federal Reserve Chair Jerome Powell, alongside hints suggesting a potential resolution to the significant tariff tensions with China.

However, the momentum appears to have faltered as investors brace themselves for this week’s publication of numerous corporate earnings reports. When it comes to the S&P 500, in particular around 180 companies are scheduled to unveil their financial results for the latest quarter.

Leading the wave of disclosures are the giants of the technology sector, including Apple, Amazon, Meta Platforms, and Microsoft. Their reports will be closely scrutinized for indications of their performance in key areas, such as artificial intelligence, cloud computing, and more. The potential impacts of tariffs will also be observed. Furthermore, the market will also be attentive to the earnings updates from established companies across various sectors, such as Berkshire Hathaway, Eli Lilly, Coca-Cola, and Chevron.

Beyond the realm of corporate earnings, a series of important economic indicators are poised to shape market sentiment in the days ahead. Investors will be particularly focused on Wednesday’s scheduled release of the Personal Consumption Expenditures (PCE) index. This metric is closely monitored by the Federal Reserve as its preferred gauge of inflation and is expected to reveal the extent to which tariffs are influencing the core expenses faced by the public.

Adding to the economic data in focus is the April jobs report, slated for release later in the week. The report is a key indicator of the economy’s underlying strength. Current expectations point to last month’s nonfarm payroll job additions standing at 133,000. Economists have also forecasted an unemployment rate of 4.2%.