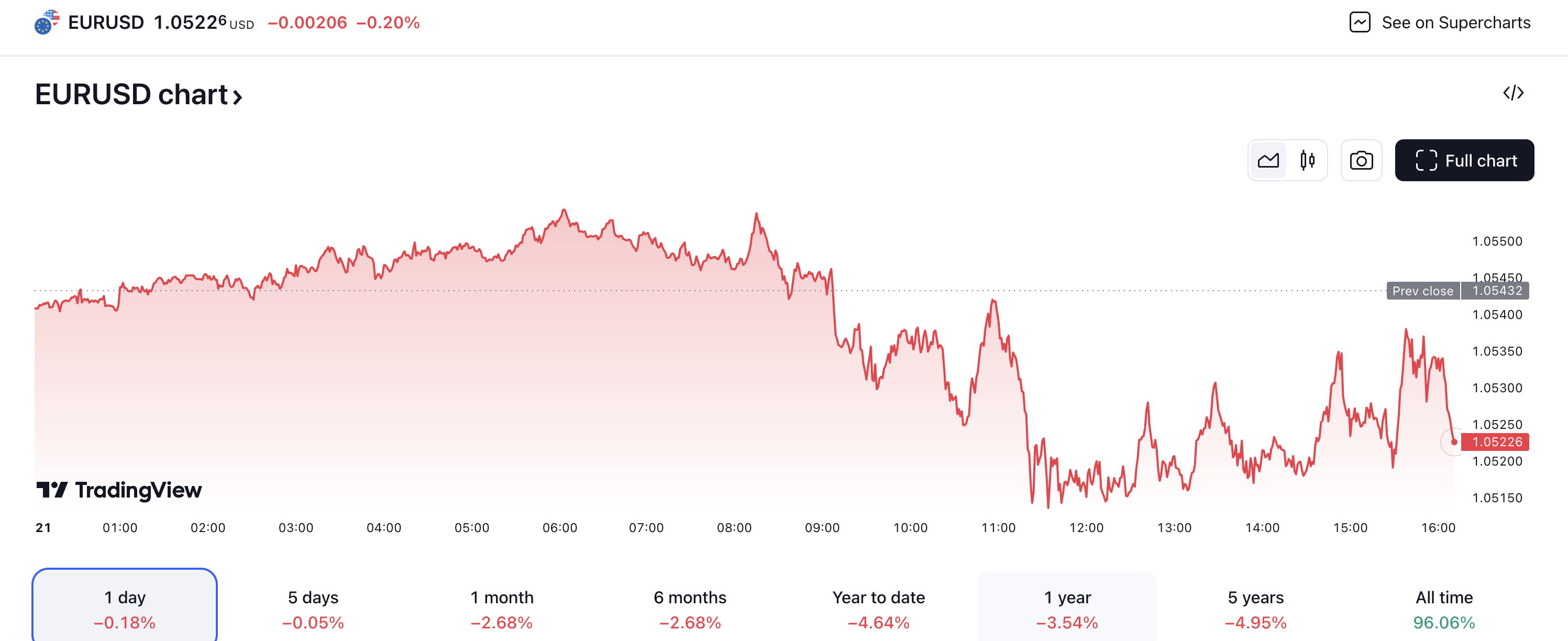

The EUR/USD currency pair is under pressure, falling below 1.0500, as European Central Bank (ECB) officials express concerns about the growing risks to Eurozone economic growth. ECB policymaker François Villeroy de Galhau has called for more rate cuts, citing a shift in the balance of risks to inflation and growth to the downside.

The US Dollar, on the other hand, is gaining strength, driven by the expectation that the Federal Reserve will not cut interest rates deeply due to the inflationary impact of Donald Trump’s policies. Market speculation for a December rate cut has declined to 56% from 73% a week ago, as indicated by the CME FedWatch tool.

ECB officials, including Yannis Stournaras, are advocating for further interest rate cuts, with Stournaras supporting a 25 basis point cut in December. The ECB is expected to accelerate its policy-easing cycle, with a potential cut to its Deposit Facility Rate to 3% in the December meeting.

Investors are now focusing on the flash Eurozone/US PMI data for November, which will be released on Friday. The data is expected to show that overall private business activity remains at the expansionary borderline. The EUR/USD pair remains vulnerable above the psychological support of 1.0500, and investors are worried about the Eurozone’s economic outlook, particularly with the potential for a global trade war under Trump’s presidency.