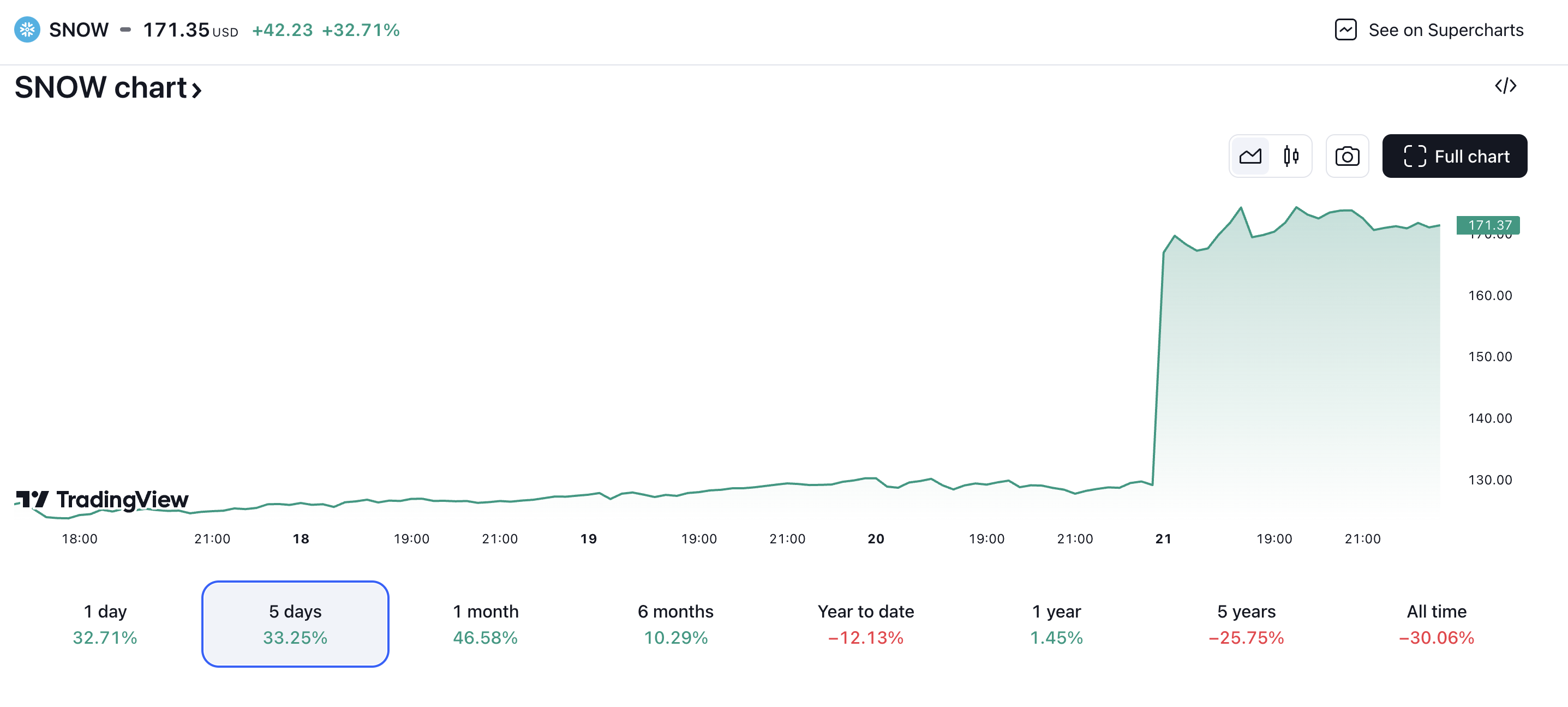

Snowflake Inc. (SNOW) shares surged over 30% on Thursday after the company reported a solid third quarter and raised its guidance for the full year. The stock’s impressive rally has caught the attention of analysts, who see further upside potential.

Goldman Sachs analyst Kash Rangan maintained a “buy” rating on Snowflake stock, citing its competitive position to capitalize on the shift of data and analytics to the cloud. Rangan’s $220 price target suggests a potential 30% upside from current levels.

Snowflake’s strong secular tailwinds, including cloud adoption, big data, AI/ML, and secure data sharing, are expected to drive sustainable revenue growth. The company’s partnership with Amazon-backed AI startup Anthropic and its plans to grow its business with the federal government also contributed to the stock’s rally.

While Snowflake’s loss widened in Q3, the company’s upbeat guidance and solid business model have analysts optimistic about its prospects. JPMorgan raised its price objective on SNOW, citing its exceptional alignment to secular trends and rapid revenue growth.

Snowflake offers exposure to the artificial intelligence market, which is forecast to grow at a compound annualized rate of over 28% through 2030. With its strong Q3 earnings and raised guidance, Snowflake stock is poised for continued gains ahead. Investors may want to consider buying any dip that may materialize in the coming weeks.