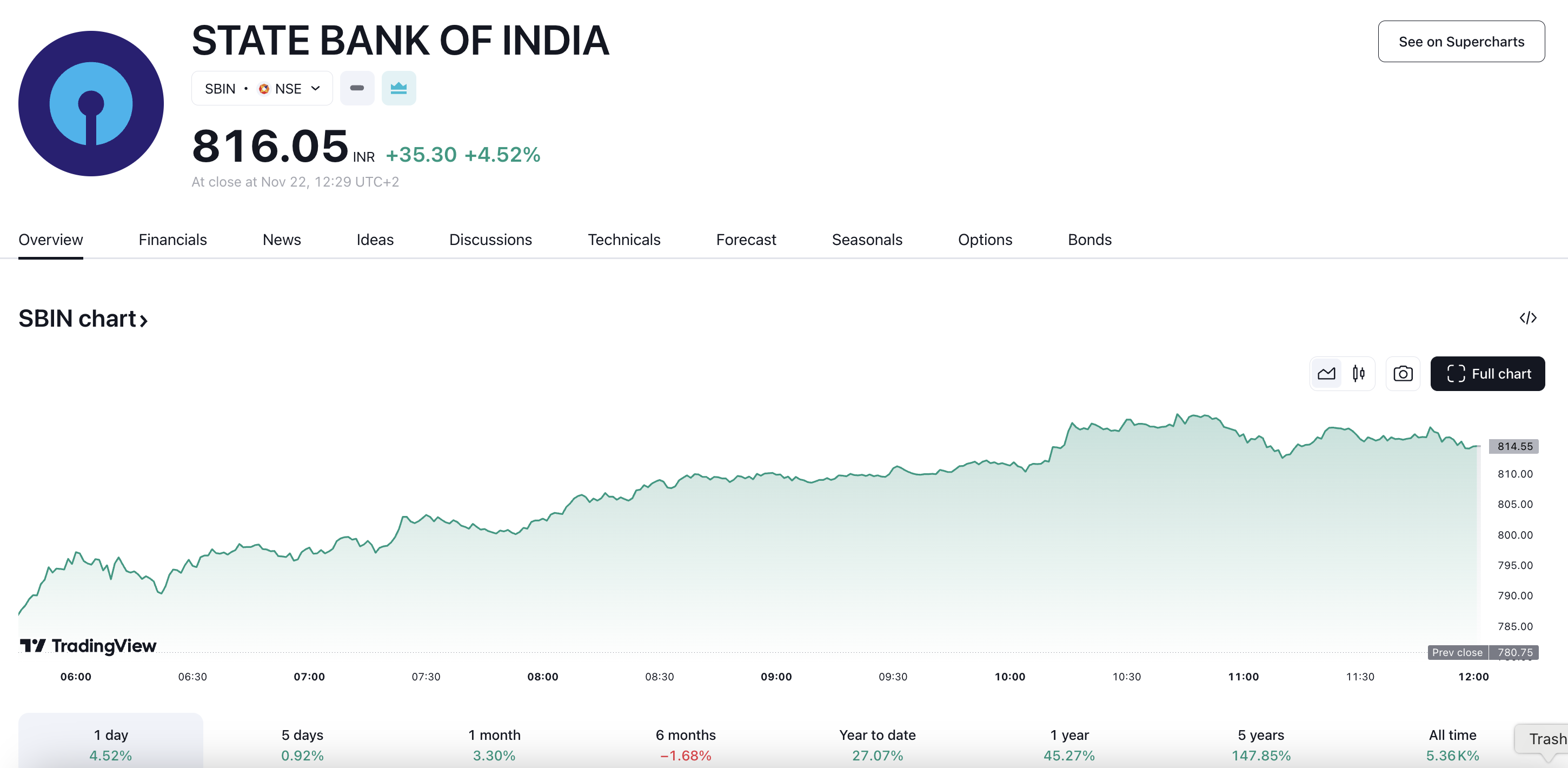

The State Bank of India (SBI) share price has experienced a significant boost, rising 4.52% to ₹816.05 on November 22, 2024. This upward trend is in contrast to its peers, with HDFC Bank and Axis Bank experiencing declines, while ICICI Bank and Kotak Mahindra Bank are seeing gains.

Technical Analysis

From a technical standpoint, SBI shares are trading above the 50-day simple moving average (SMA) but below the 5, 10, 20, and 100-day SMA. The stock has reached a high of ₹816.05 and a low of ₹784.3 during the day. Key resistance levels are at ₹799.38, ₹817.42, and ₹836.33, while key support levels are at ₹762.43, ₹743.52, and ₹725.48.

Volume and Trends

The volume traded on the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) for SBI has increased by 20.75% compared to the previous trading session. This surge in volume, combined with the positive price movement, suggests a sustainable uptrend.

Fundamental Analysis

SBI’s return on equity (ROE) stands at 17.34%, while its return on assets (ROA) is 1.07%. The current price-to-earnings (P/E) ratio is 9.74, and the price-to-book (P/B) ratio is 1.77.

Brokerage Firm’s Outlook

Jefferies, a brokerage firm, has expressed a bullish outlook on SBI shares, stating that the bank remains one of their top picks in the sector. SBI shares have a median 1-year forecasted upside of 17.99% with a target price of ₹955.00.

Market Performance

The benchmark indices, Nifty and Sensex, are up 1.16% and 1.11%, respectively. SBI’s market capitalization stands at ₹7,26,954.92 crore, with a 52-week high of ₹912 and a 52-week low of ₹555.15.