Key moments

- HEICO Corporation reported significant financial growth in Q1 2025, including a 46% increase in net income.

- Both the Flight Support Group and the Electronic Technologies Group contributed significantly to the company’s success.

- HEICO’s management anticipates continued growth in fiscal 2025.

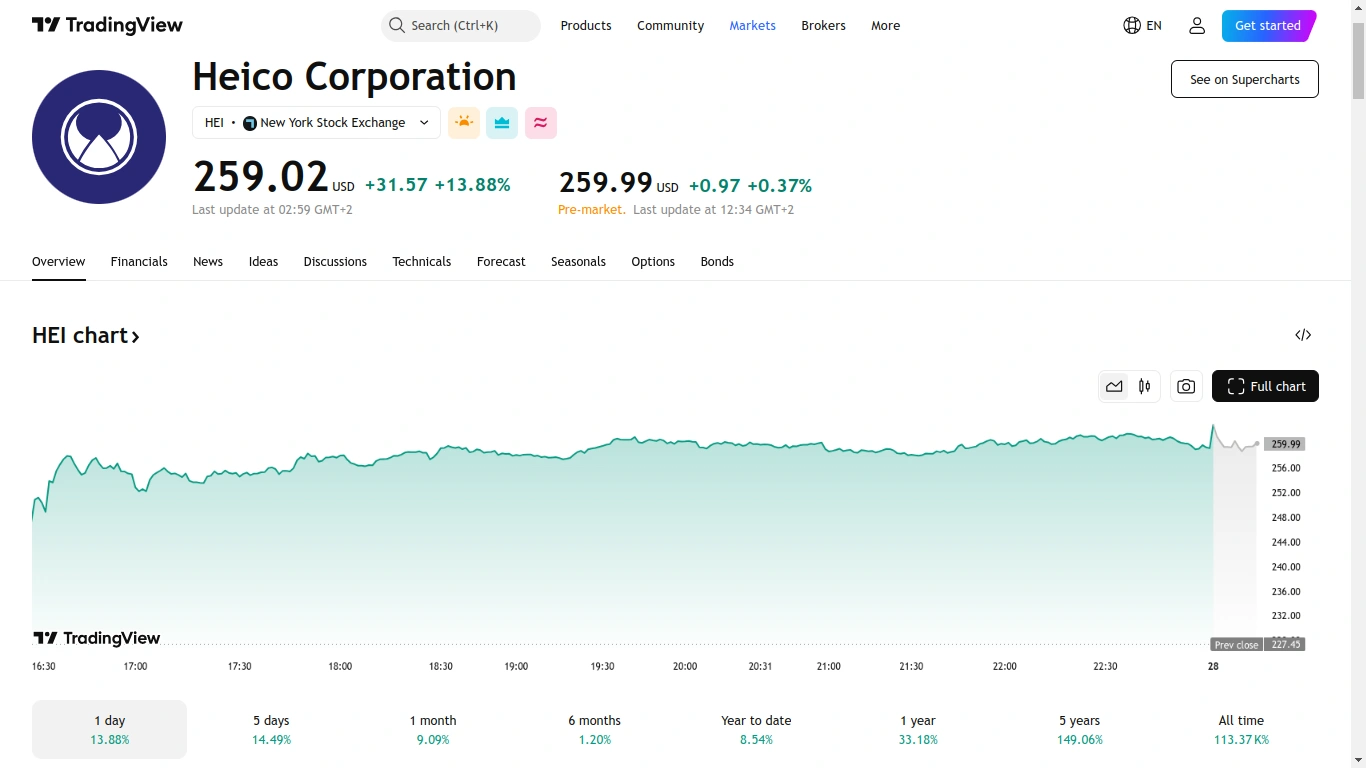

HEICO’s Stock Price Marks a 13.88% Jump After Company Reports Record Q1 Growth, Highlighting Net Income and Sales Surge

HEICO Corp. stock surpassed its 200-day moving average of $241.82, reaching $259.00, a 13.88% jump, following its Q1 earnings release. Investors received detailed information from HEICO Corporation regarding its recent performance.

HEICO Corporation, a major entity in aviation, defense, space, medical, telecommunications, and electronics, focuses on designing, manufacturing, servicing, and distributing specialized products and services. The firm operates via its Flight Support Group and Electronic Technologies Group, catering to a worldwide customer base including airlines, defense contractors, and medical equipment providers.

In its recent earnings statement, HEICO Corporation revealed record-high financial outcomes for fiscal 2025’s first quarter. Net income rose by 46% to $168.0 million, and net sales increased by 15% to $1,030.2 million. Operating income also experienced a 26% growth, reaching $226.8 million. These figures highlight HEICO’s strong performance and its strategic expansion efforts.

Key points from the report include a 22% increase in EBITDA to $273.9 million and an 82% rise in operating activities cash flow, totaling $203.0 million.

Both the Flight Support Group and Electronic Technologies Group contributed to the company’s success, with the former achieving an 18th straight quarter of net sales growth and the latter reporting a 38% increase in operating income. HEICO’s strategic purchases in fiscal 2024 and 2025 further strengthened its financial results.

HEICO’s leadership remains positive about ongoing growth in fiscal 2025. The company foresees consistent demand for its product lines, especially in the defense, space, and aerospace industries. By focusing on strategic purchases and internal expansion, HEICO seeks to boost shareholder value while keeping a solid financial foundation.