Key moments

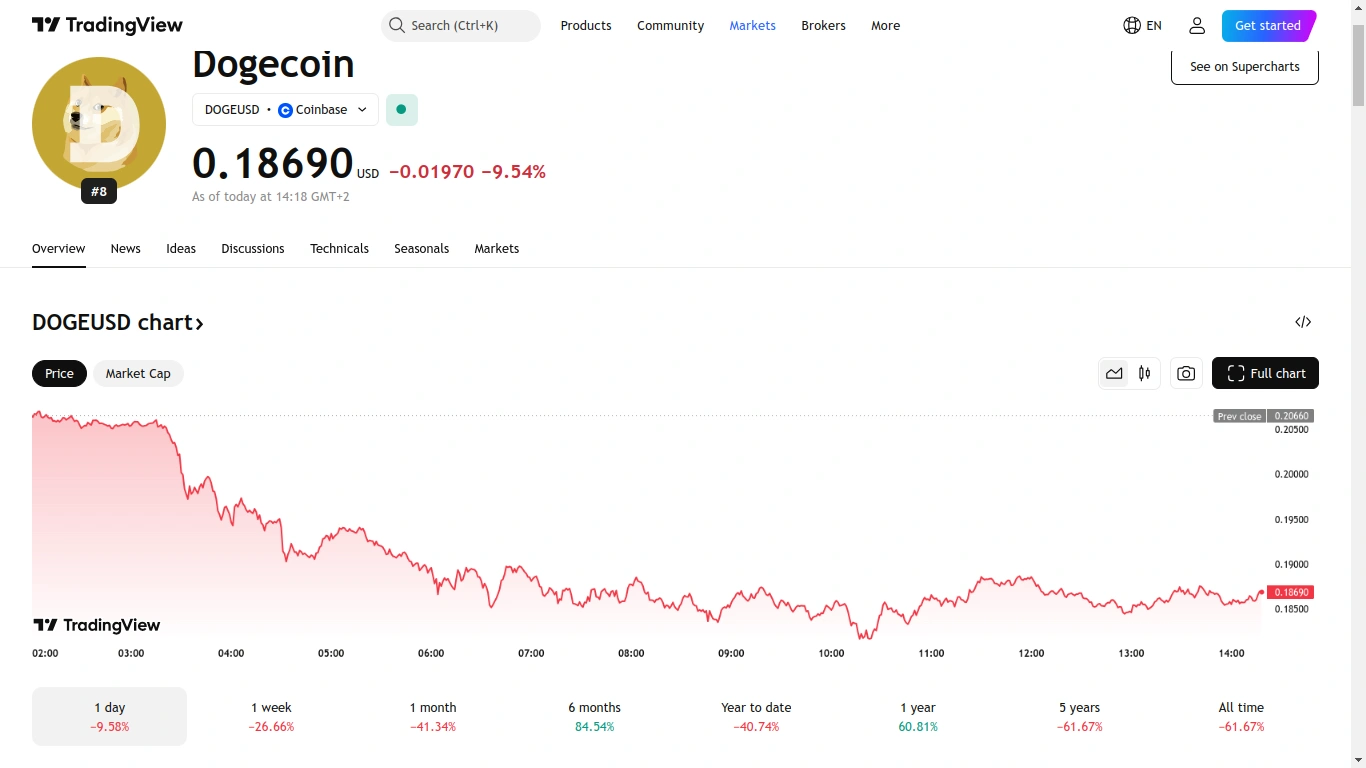

- Dogecoin’s price has experienced a significant decline, dropping over 60% from its peak in December.

- The cryptocurrency’s network activity has also plummeted, with active daily addresses decreasing by 95% from 2.4 million to 30,000.

- A shift in holder composition shows long-term holders decreasing by 2.67% and mid-term holders dropping by 11.81%, while short-term speculators increase by 107.45%.

Dogecoin and Fellow Cryptocurrencies Plunge, Dragging Down Overall Market Value

Dogecoin’s price has dropped significantly, over 60%, from its $0.4843 peak in December. The current price of $0.18 marked a 9.35% decline. Active daily addresses have also plummeted by 95%, from 2.4 million just three months prior to only 30,000 today. In just two months, its value has halved, falling from $0.4868 to $0.1977. This once-trending meme token, championed by Elon Musk, is experiencing significant instability.

On-chain data reveals that new Dogecoin addresses peaked at 2.4 million on November 21, 2024, after reaching 1.29 million earlier that month. However, this surge was short-lived. By February 23, 2025, new addresses had fallen to 30,000, a daily loss of 2.37 million. This drastic drop is comparable to a city of ten million shrinking to a town of 300,000.

Long-term holders (over one year) decreased by 2.67%, while mid-term holders (1-12 months) dropped by 11.81%. Conversely, short-term speculators increased by a dramatic 107.45%. This shift indicates a weakening of the coin’s fundamental support base, transforming the market into a speculative playground.

The mid-February price drop to $0.196 coincided with record low network activity. This simultaneous decline in price and user engagement forms a dangerous “death cross” pattern. Analyst Ali Martinez warns that without sustained user engagement, any price recovery will be unsustainable.