Key moments

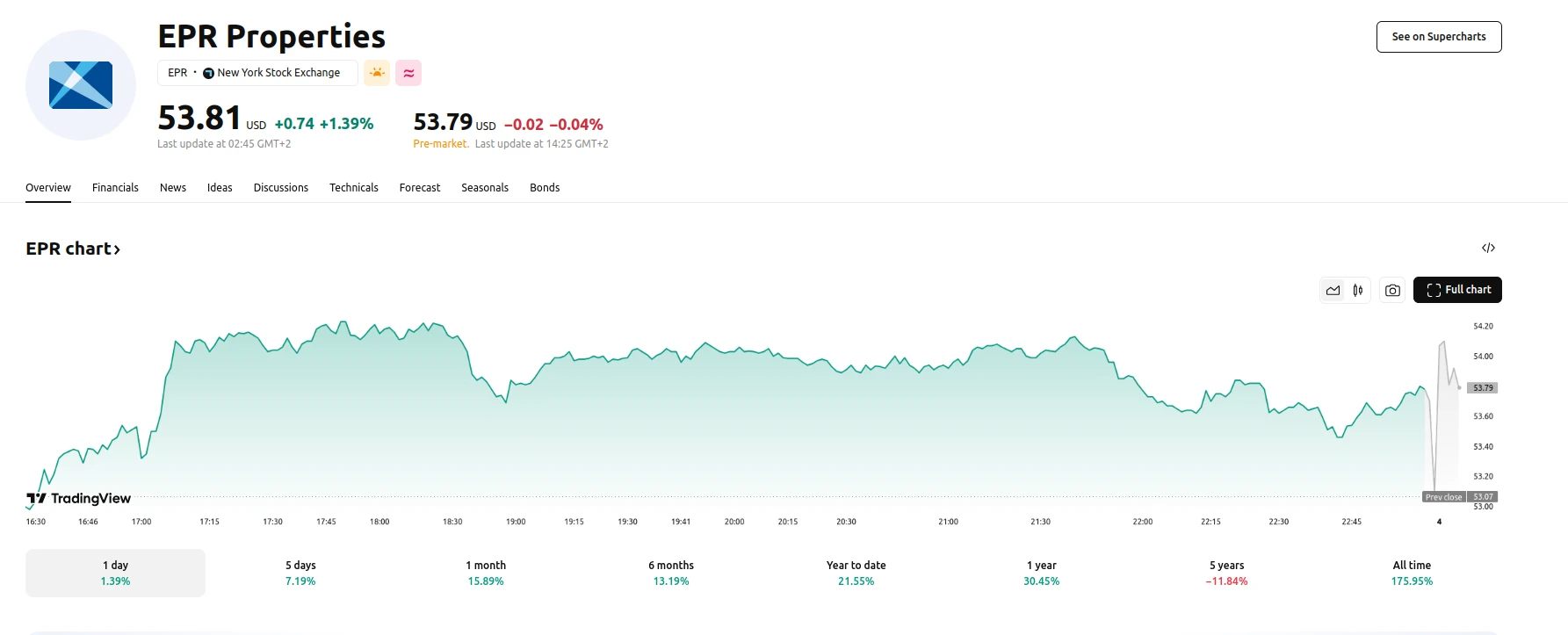

- EPR Properties Reaches 52-Week High, Signaling Market Confidence

- Strategic Growth Pause Amid High Interest Rates, Future Expansion Anticipated

- Company Maintains Strong Financial Performance, Supports Robust Dividend

EPR Properties Stock Sees Surge, Driven by Solid Performance and Promising Future Outlook

EPR Properties, a real estate investment trust (REIT) specializing in experiential properties, has recently achieved a new 52-week high, reflecting investor confidence in its robust business model and financial health. The company, which owns a diverse portfolio of entertainment-focused properties, including movie theaters, waterparks, and ski resorts, currently offers a compelling 6.5% dividend yield. This combination of income and growth potential positions EPR Properties as an attractive investment opportunity.

Despite the positive momentum, EPR Properties has adopted a cautious approach to expansion in recent years. The prevailing high-interest-rate environment has made it less financially viable to pursue aggressive acquisitions and developments. Consequently, the company has focused on maximizing the performance of its existing assets and maintaining a strong balance sheet. However, this strategic pause is viewed as temporary, with EPR Properties poised to resume its growth trajectory once market conditions become more favorable. The company has identified a substantial market opportunity, with potential acquisition targets exceeding $100 billion, particularly in the eat-and-play, ski resort, and attractions sectors.

EPR Properties’ recent financial results demonstrate its resilience and operational efficiency. In the fourth quarter of 2024, the company reported a 3% year-over-year increase in revenue, despite limited portfolio growth. Adjusted funds from operations (FFO), a key metric for REITs, rose by 5%, and the company also increased its monthly dividend rate by 3.5%. These strong financial indicators underscore EPR Properties’ ability to generate consistent cash flow and support its generous dividend payout. Looking ahead, the company’s 2025 guidance anticipates further FFO growth, reinforcing its financial stability and long-term prospects. With a reasonable valuation and significant growth potential, EPR Properties presents a compelling case for patient investors seeking both income and capital appreciation.